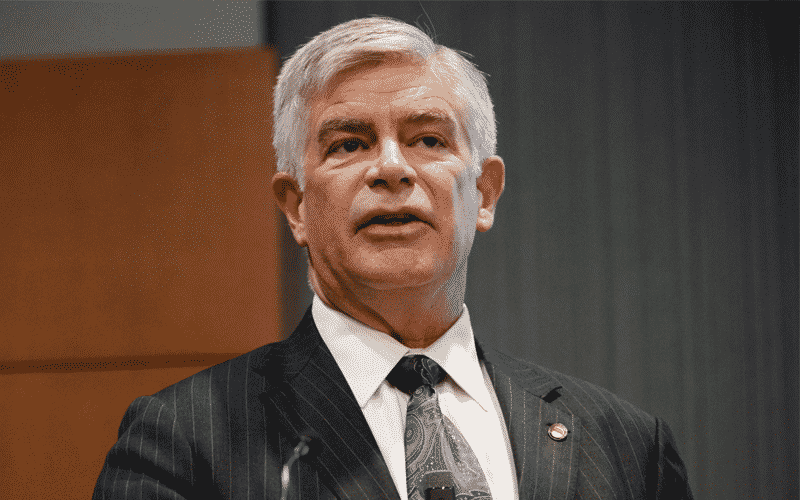

(Philadelphia Fed) Philadelphia Federal Reserve President Patrick T. Harker believes the central bank should slowly and methodically taper $120 billion in bond purchases.

Harker says he sees a “cautious optimism” in the economy, with consumers moving in tandem with Covid-19 waves.

The Philadelphia Fed chief believes the economic recovery in the latest Covid-19 wave could be more long-lasting than in the past. He says more than a half of the population is now fully vaccinated, raising optimism.

Harker still sees persisted headwinds such as labor shortages, supply chain constraints, and fresh Covid-19 outbreaks.

The Philadelphia Fed chief believes the bond purchases were necessary to keep markets out of the pandemic crisis. Still, the economy is now struggling with supply issues, and asset buys are not doing much to help.

Harker expects the US to post a 6.5% growth in 2021 before moderating to 3.5% in 2022 and 2.5% in 2023. He expects inflation at around 4% in 2021 and slightly above 2% in 2022, and at 2% in 2023.

SPY is up +0.42%, DXY is up +0.56%.