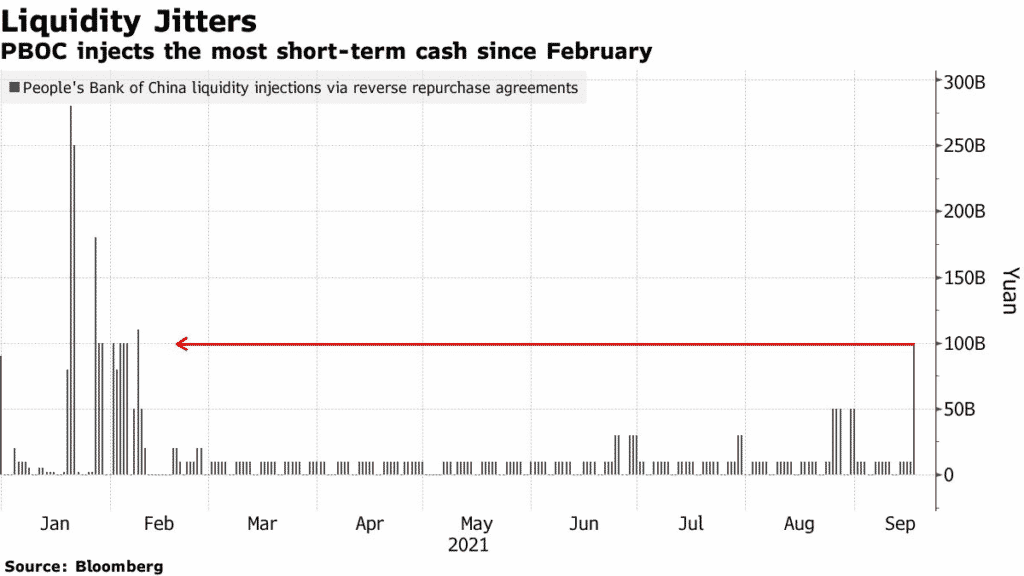

(Bloomberg) The People’s Bank of China injected 90 billion yuan or $14 billion on Friday in the banking system to address the funding crisis and the Evergrande debt problem.

Fig: PBOC’s Liquidity Injections

The amount, which is the highest since February, comprises 50 billion yuan in seven-day reverse repos and 50 billion in 14-day contracts. A sum of 10 billion yuan is due on Friday.

It is the first time Chinese authorities are putting more than 10-billion-yuan worth of short-term liquidity in the sector.

Analysts have stated that the Evergrande Group’s debt crises will largely affect China’s growth, even as the authorities move carefully to avoid asset bubbles in its cash boost.

PBOC’S move did not push down the money market rates. The seven-day repo rose 12% to 2.39%, the highest point since July.

CSI 300 is up +1%, USDCNY is down -0.08%