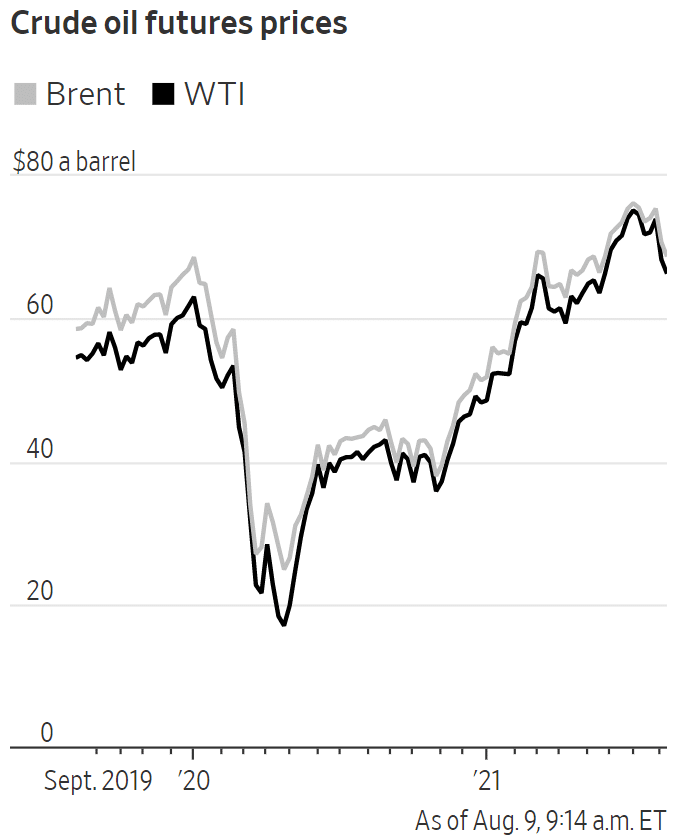

(WSJ) Oil futures fell as much as 4% on Monday following renewed concerns of demand outlook in the global market as restrictions to tame the spread of the Delta variant increased.

The global benchmark, Brent crude oil, plunged by 4% to $67.87 a barrel as the West Texas Intermediate fell by 4.3% to trade at $65.38 a barrel.

The rising Delta covid variant raised alarms in China and other countries in East Asia, with Beijing authorities expecting to cancel large-scale exhibitions to tame the spread.

China, which ranks as the world’s biggest buyer of oil, saw its imports drop in July from June, raising worries of demand outlook.

Analysts say lower oil and commodity prices could delay central banks’ policy easing as they are viewed as key drivers of inflation.

Analysts still say the oil market is experiencing supply and demand imbalances, and a major drop in prices is unlikely, although caution around the next stage of Covid-19 recovery and possible output increase by OPEC! is weighing on prices.

CL1! Is down -3.88%.