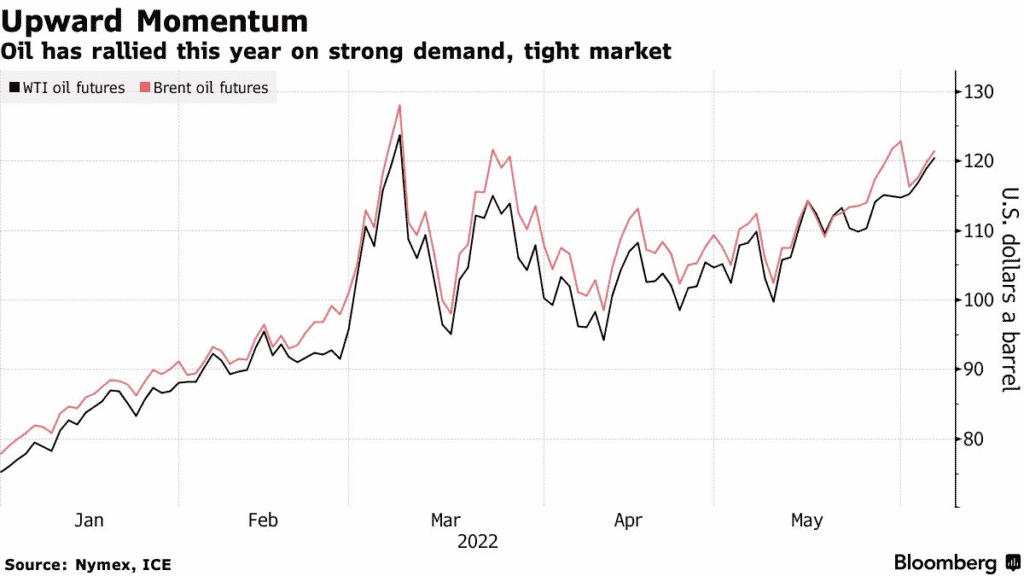

(Bloomberg) The West Texas Intermediate oil rose to almost $120 a barrel on Monday after Saudi Arabia surprised markets with higher-than-expected crude price increases.

Saudi Arabia increased the price of its key Arab Light crude grade for its consumers in Asia by $2.10 a barrel from June to $6.50. The market was projecting a lower $1.50 hike.

Aramco also hiked prices for Mediterranean regions and northwest Europe.

The price hikes have been interpreted as a signal for demand confidence. China, the world’s leading crude importer, is already emerging from virus lockdowns, with demand set to follow.

Chen Shuxian, an analyst with Cinda Securities Co. in Shanghai, says the peak oil demand season has arrived. He says the summer driving period across Europe and the US will drive consumption, besides China’s reopening.

The latest development comes days after OPEC+ agreed to increase output to 648,000 barrels a day in July and August, an increase of 50% from the previous hikes.

CL1! is up +0.31%.