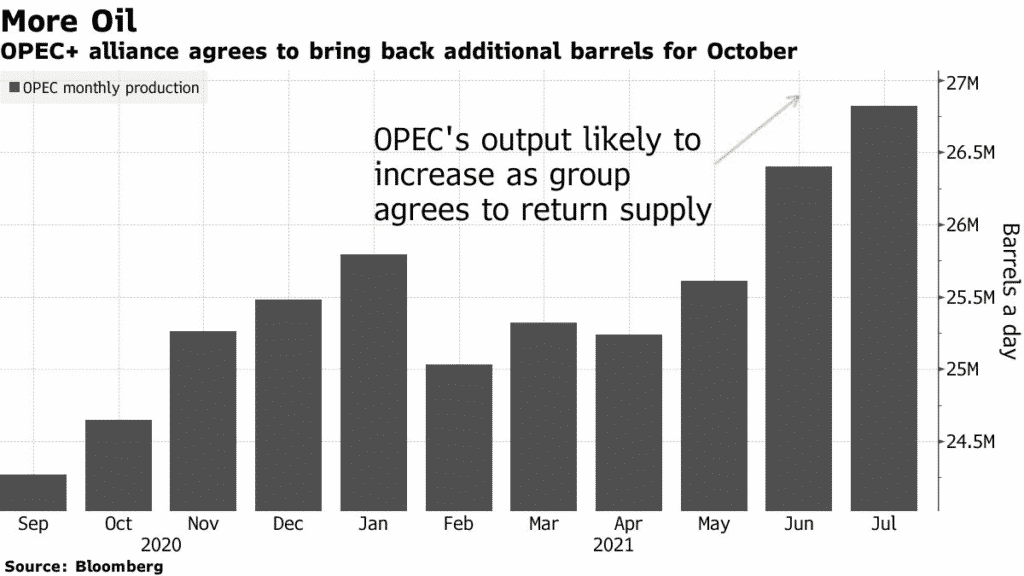

(Bloomberg) Brent crude hit the ceiling near $72 as investors took time to digest OPEC+ plan to boost output by 400,000 barrels a day from October.

The pause in oil prices happened as investors tried to gauge whether the market had sufficient capacity to absorb additional output.

OPEC+ news comes as the US faces contraction in crude inventories amid the outbreak of Hurricane Ida that disrupted oil infrastructure.

Oil has risen about 40% in 2021 as demand crawled back from the pandemic lows, with the OPEC+ output increase expected to weigh on prices.

Analysts still say oil prices could go higher by year-end, with the rise in the price of natural gas and Hurricane Ida seen to fuel crude demand in the winter.

CL1! is up +0.63%