NightVision EA is a trading system that is said to produce the best results on ECN accounts with low spread and commission. The EA’s strategy has been tested on real trading accounts. Furthermore, it can be utilized on a majority of the existing trading pairs and is featured by a few settings and simple installation. We evaluate the robot to see if it is the right solution for you.

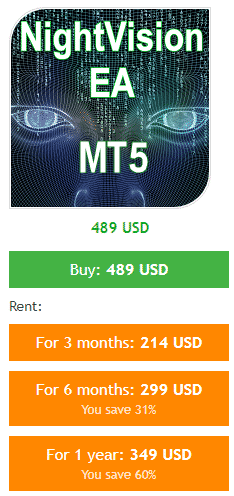

NightVision EA is very costly. A lifetime license is going for $489. The renting offers are expensive as well. To use the EA for 3 consecutive months, you will have to pay $214. The 6-months and 1 year options require you to part with $299 and $349, respectively.

NightVision EA trading strategy

The robot utilizes the night scalping strategy during the closing of the American trading session.

NightVision EA features

A list of the robot’s feature can be found be found below:

- The recommended FX broker is IC Markets.

- It does not utilize dangerous trading methods like the grid, martingale, arbitrage, etc.

- Each trade has its stop loss and take profit protecting your deposit.

- The system works on multiple currency pairs; GBPUSD, GBPCAD, USDCAD, GBPAUD, EURAUD, EURCAD, EURGBP, GBPCHF, EURUSD, USDCHF, NZDUSD, EURNZD, USDJPY, EURCHF, AUDJPY, and AUDNZD.

- It opens trades on Fridays.

- The EA can work on the MT4 or MT5 platform.

NightVision EA backtesting results

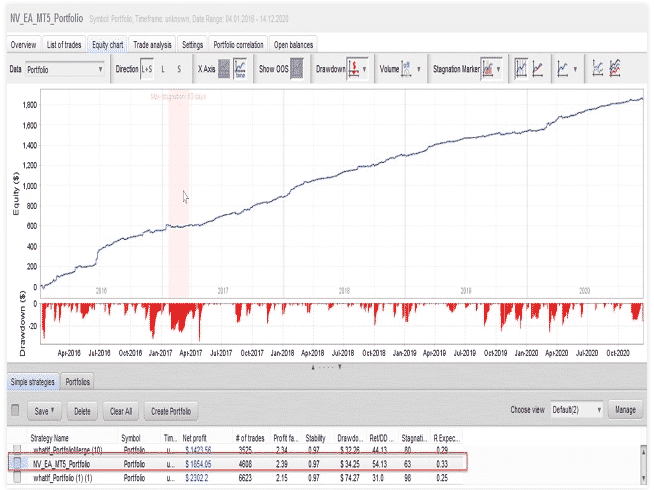

The developer does not showcase a detailed tester report. Rather, he provides us with a screenshot supposedly demonstrating the test chart. As you can see below, not many details are included. The EA was tested between April 2016 and October 2020 and generated a drawdown of 54.13% and a profit of $1854.06 after conducting 4608 trades. We don’t know the deposit amount used or the percentage of successful and unsuccessful trades. The win rates for long and short positions are not indicated either.

NightVision EA live trading results

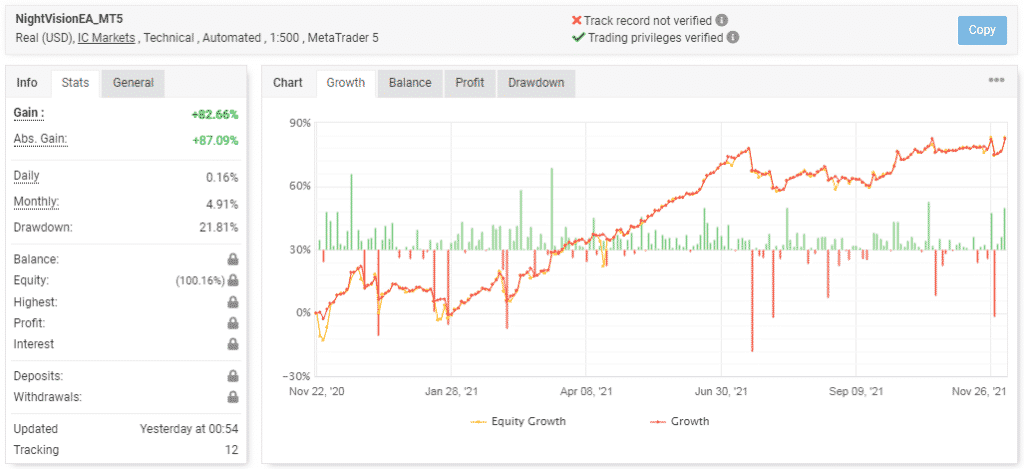

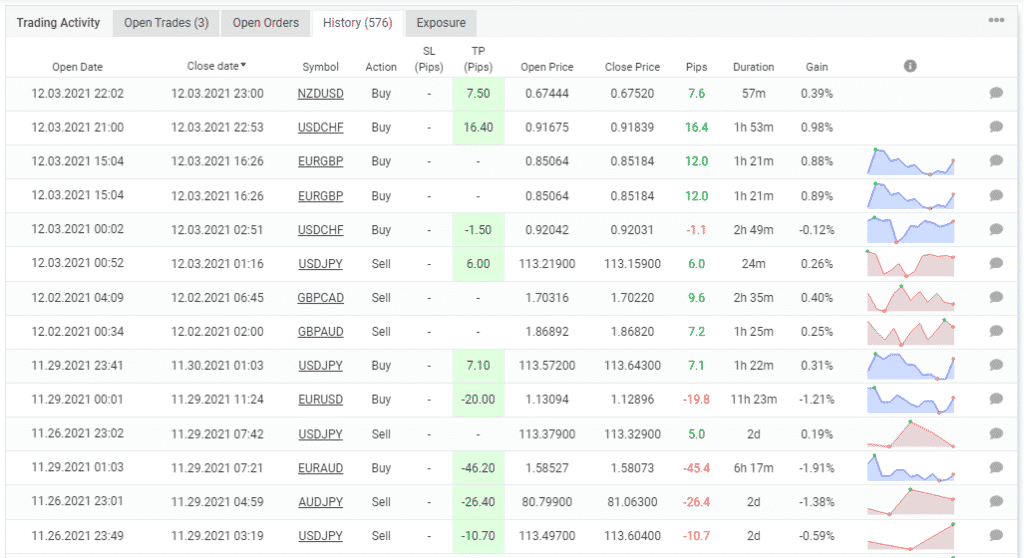

The good news is that there are live trading results for the system on Myfxbook, but still, the vendor is not open enough. He keeps most of the data hidden, probably because it gives the robot a bad picture.

NightVision EA is currently managing a real USD account under IC Markets. The trading activities started on November 22, 2020. Since then, the EA has been making a monthly profit of 4.91% on average. The drawdown rate (21.81%) generated so far is way higher. So we have a bad risk/reward ratio of 4:1. This is dangerous because, at this rate, the account’s value will deteriorate.

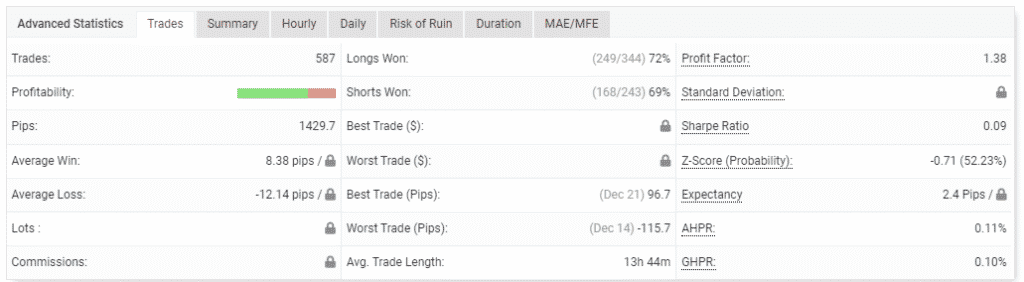

The number of trades completed is 587, and from the profit factor (1.38), we can see that not many orders are successful. This means that the number of losses made is much higher. So, it is not surprising that a high average loss (-12.14 pips) is recorded compared to the average win (8.38 pips).

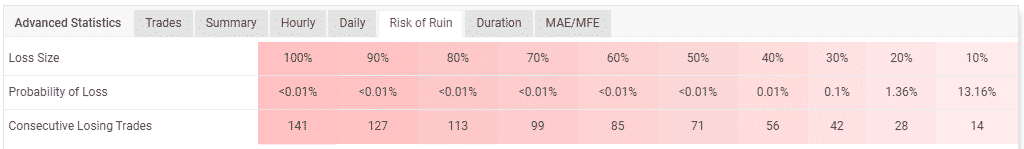

This account is at high risk of having a margin call, thanks to the robot’s risky trading activities.

The EA has suffered some significant losses, and they might as well have rendered the profits made (which are low) useless. On some occasions, the robot placed some grids of orders. TP and SL features are present.

NightVision EA reputation

A developer called Alexander Kalinkin is the brains behind this system. He is from Russia and also the creator of another system — Lucky Price Action. Alexander has zero reputation in Forex. Based on his portfolio, he may be starting out his career as a developer for Forex robots. Therefore, he may take a while to create a solid reputation for himself in this market.

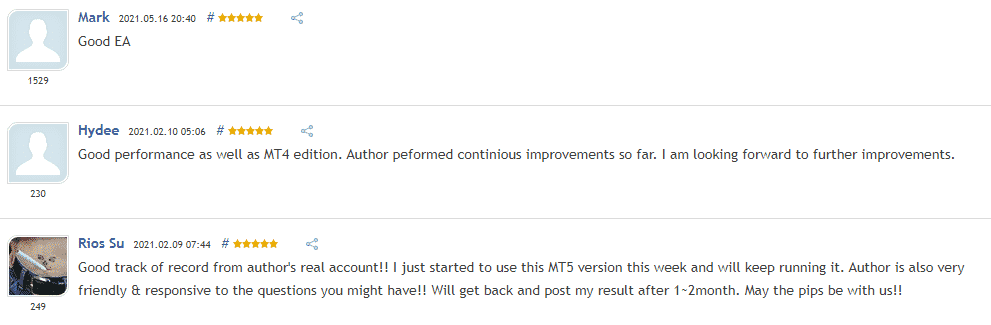

There are only 4 reviews for NightVision on the mql5 platform. As is always the case of most testimonials on this site, all are positive. The EA is said to have a good track record from the author’s real account. However, the results on Myfxbook say otherwise.

NightVision EA review summary

- Strategy – 3/10

- Functionality & Features – 4/10

- Trading Results – 3/10

- Reliability – 4/10

- Pricing – 2/10

The EA’s high risk of ruin is enough to tell you that its strategy can mess your account big time. We suspect that the grid approach is used, and this can decimate your capital. The profitability of the system is too low and can hardly cover losses resulting from the dangerous approach. Based on these findings, we don’t think this robot can get you far in trading.