After several years of bearish performance, especially between 2015 and 2019, the Nigerian equities market sustained the turnaround which commenced in the 2020s this year to close 2024 norward.

Following the oil price crash in 2015 and the ensuing recession in 2016, the 2020s ushered in a period of unprecedented growth for Nigeria’s stock market.

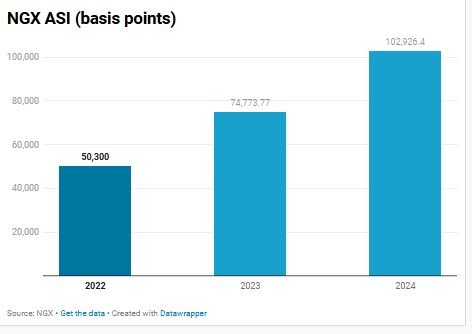

However, since 2020, the NGX All-Share Index (ASI) has delivered a stellar return of 283.45 per cent, climbing from 26,842.07 basis points at the end of 2019 to 102,926.40 basis points as of December 2024. The index closed 2024 with an impressive annual growth of 37.65per cent.

In terms of market capitalisation, it closed at N62.763 trillion as of December 31, 2024, about N21.8 trillion increase over N40.917 trillion it closed 2023.

The depreciation of the naira, driven by macroeconomic reforms by the Central Bank of Nigeria (CBN) and the federal government, significantly boosted the performance of the stock market. Also, foreign capital inflow has steadily increased, rising from a low of 4 per cent in mid-2023 to an average of 16 per cent by November 2024.

Additionally, high-profile listings energised trading activities on the exchange, providing investors with a broader range of blue-chip stocks. Notable entries include Geregu Power Plc, Transcorp Power Plc, Aradel Holdings, and BUA Foods Plc.

These listings have propelled the market capitalisation from N12.79 trillion at the end of 2019 to N62.76 trillion as of December 2024, representing a meteoric increase of N49.97 trillion.

Meanwhile, major stakeholders have applauded the management of the NGX Group for providing the enabling environment for players to thrive.

Speaking at the Closing Gong Ceremony marking the end of 2024 trading activities, NGX’s Chief Executive Officer, Mr. Jude Chiemeka, represented by the Head of Trading and Products, Mr. Abimbola Babalola, commended key stakeholders, including the stockbroking community represented by the Chartered Institute of Stockbrokers (CIS) and the Association of Securities Dealing Houses of Nigeria (ASHON).

“The year 2024 witnessed significant activity in the secondary market, a testament to the efforts of our trading license holders. Complementary macroeconomic fundamentals were instrumental, and we appreciate the impactful policymaking by the CBN and the Federal Ministry of Finance. We also commend the Securities and Exchange Commission for its effective oversight, especially during the smooth banking recapitalization process,” he said.

CIS President and Chairman of Council, Mr. Oluropo Dada, and ASHON Chairman, Mr. Sam Onukwue, represented by the 2nd Vice Chairman, Mrs. Ify Rita Ejezie, emphasized the pivotal role of stockbrokers in driving capital market growth. They reiterated their commitment to advocating for policies that enhance market development.

GMD/CEO of Nigerian Exchange Group, Mr. Temi Popoola reflected on the market’s resilience and growth trajectory: “Nigeria’s capital market has proven itself as a hub of resilience and innovation, consistently offering valuable opportunities for investors. The strong performance of our blue-chip companies over the past decade has been a key driver of returns, even amid challenging economic cycles. Inflationary pressures have made equities an attractive hedge, and strategic new listings have significantly boosted market activity.”

He further highlighted the transformative impact of policy reforms: “Macroeconomic shifts, particularly in the oil and gas sectors and currency devaluation, have been transformative. These changes, coupled with the liberalization of exchange rates, have enhanced operational efficiency and contributed to the robust performance of listed companies. As we approach 2025, we remain optimistic that continued reforms and a stable macroeconomic environment will sustain growth, boost liquidity, enhance investor confidence, and deliver long-term value for all market participants.”

In the same vein, capital market said the stock market performance in 2024 is on the backdrop of mixed corporate earnings by listed companies, federal government’s reforms in the foreign exchange market and fuel subsidy removal.

Analysts at Cordros Research in a report titled, “Nigeria in 2025. Reform to Recovery: Navigating the Rebound,” stated that the financial market in 2024 has been a story of “two unequal halves”.

“In the first half, the domestic equities market surpassed previous highs, hitting the 100,000- point mark for the first time, as elation about reforms remained rife amongst investors. In the second half, fixed income yields hit unprecedented levels, moving in tandem with the MPC’s aggressive stance and, thus, reinstating investors’ belief in the rate transmission mechanism,” the report stated.

On his part, the Vice President, Highcap Securities Limited, Mr. David Adnori stated that investors are trading based on sentiment.

He stated that the emergence of President Bola Tinubu further energised the stock market since market participants have hope in his ability to rejig the economy and implement economy-friendly policies.

Adnori, however, was optimistic that the stock may maintained its positive momentum in H2 2024, on the backdrop of banking sector recapitalisation and expected 2024 corporate earnings by most especially the banks listed on the Exchange.

Speaking, Investment Banker & Stockbroker, Mr. Tajudeen Olayinka stated that the N21.03 trillion market capitalisation gain in 2024 tells us the presence of huge liquid funds in the hands of institutional investors who currently dominate activities in the stock market.

“It also holds the fact that the future is brighter for some of the listed companies, hence, investors 5are positioning their portfolios for that brighter future. This is also the reason the market remains resilient in spite of the high interest rate regime,” he said.

On 2025 outlook, Cordros Research said, ” We expect a bullish start to 2025E, driven by investors positioning for 2024FY results and dividend declarations, particularly in the banking sector. Ultimately, certain factors primarily will determine how the market shapes up in 2025. The primary factors include the trajectory of economic growth, direction of monetary policy and impact on fixed income yields, and corporate earnings performances. Furthermore, we also discuss the relative attractiveness of the overall market compared to peers, which we believe may drive better FPI net flows.

“Macroeconomic headwinds to challenge corporate earnings: In 2025E, we project the Nigerian economy to record modest growth of 3.87per cent (Cordros estimate), driven by incremental oil production from new fields and improved security conditions. Non-oil sectors, notably telecommunications and financial services, are expected to underpin GDP growth, with telecoms expected to recover from recent setbacks and financial services extending their 2024 performance.

“While these dynamics may provide a foundation for revenue growth and profitability, they are insufficient to offset significant macroeconomic headwinds. Persisting currency pressure remains the most critical challenge, exacerbating operational inefficiencies and inflating costs for corporates, particularly companies in the manufacturing sector, which are more reliant on imported inputs as well as foreign currency-denominated obligations.”

They added, “This dynamic threatens to erode margins, especially as companies grapple with a constrained consumer environment marked by weakened purchasing power and rising inflation. Consequently, we anticipate considerable strain on corporate earnings across most non-financial sectors. However, we expect the banking sector to emerge as a relative outperformer given strong capital buffer, an elevated yield environment that spurs net interest income, and historical resilience in volatile macroeconomic conditions. Conversely, consumer goods, utilities, and oil and gas sectors may struggle to navigate the compounded pressures of currency volatility, rising costs, and constrained consumer spending.”