NAGA’s social trading features, liquid markets, and a vast selection of financial assets position it as a top broker for FX, stocks, and cryptocurrencies. As a young broker, Naga has witnessed tremendous growth since its Initial Public Offering (IPO) in 2017. It’s now regulated by CySEC, which is a tier-1 regulator. Overall, Naga is a suitable broker for a social trader, whether novice or seasoned.

Pros

- Social and copy trading

- Free deposits

- Strict regulation

- NAGAX for crypto-fiat exchange

Cons

- Withdrawal fees

- No US investors

- Few educational materials

Naga is a German-based Fintech company founded in 2015 to offer its clients an all-inclusive financial ecosystem with the best market tools for trading. Its first success was in its IPO in 2017, where over 60,000 people subscribed to the platform. This public listing on the Frankfurt Stock Exchange (WKN: A161NR| ISIN: DE000A161NR7) skyrocketed its total token sale to over $50 million in a few short months.

Naga’s markets have over 950 financial instruments, including currency pairs, commodities, indices, and cryptocurrencies. Moreover, clients can buy and own real cryptocurrencies, which they can store in Naga’s crypto wallet, NAGAX.

The strict CySEC regulations keep the broker safe, as the clients and their funds are protected from any fraud. Also, client funds are segregated from the broker’s funds and banked separately for safety purposes.

Regulation

As a trusted broker, Naga has built its website in compliance with the laws of St. Vincent and the Grenadines as an operating subsidiary of the Naga Group. It’s registered under these laws as an International Business Company under Reg No. IBCN24501IBC2018.

The different Naga subsidiaries are registered in their respective jurisdictions with their specific locations and addresses.

The CySEC regulates and authorizes the NAGA Markets Europe Ltd in Cyprus under License No. 234/13.

Some regions are restricted from accessing NAGA services. These include countries like Canada, the USA, Israel, and Iran.

Account Types

Unlike other brokers that offer different accounts with different features, NAGA offers one trading account in multiple currencies. Currently, NAGA supports fiat base currencies and cryptocurrency accounts.

The trading accounts have the same features but have different base currencies. These base currencies are EUR, CHF, USD, PLN, and GBP.

The account features include:

- Trading instruments available — 950+

- Spreads — floating

- Maximum leverage — 1:1000

- Base currencies — EUR, CHF, USD, PLN, and GBP

- Minimum deposit — $250

- Social — copy trading

- Commission-free trading on crypto CFDs

- Cryptocurrency trading

- User referral bonuses

- Multiple platform access

- Real-time order execution

How to open a NAGA account

Registration on NAGA is straightforward. In only four simple steps, you’ll have a verified and funded account to start trading. These steps include:

Step 1. Go to NAGA’s official page, find a ‘Create an account’ button, and click on it. Follow through the process providing all the required information. At this point, you have access to a funded demo account, and you can start exploring the broker.

Step 2. NAGA will ask a few questions to know your experience level in trading. After answering the questions, you’ll be prompted to upload documents that verify your identity and address.

Step 3. Select a payment method that works well for you from the available list and fund your new NAGA account.

Step 4. Trade manually or auto-copy from successful investors and start making profits.

Fees and Commissions

NAGA’s fees are considerably low compared to other brokers at its level. Trading costs are divided into spreads, swap, margin requirement, commissions on ETFs and equities, and copy trading fees.

Spread

NAGA’s spread in different markets is not standard as it changes as the market conditions change. It’s referred to as floating spread. That means, only the spread within the trading environment is considered binding for the trade position.

Margin requirement

For some pairs, the margin is 5%, while for others, it’s 3.33%. The margin requirement can change as the market conditions change.

Copy-trading fees

It’s a fee applied when copy trading. After the position closes, a standard copy fee is applied and a variable copy fee. The amount varies on the results of the copied trade as follows.

- Up to $10 — $0.99 fixed amount and no extra variable copy fee.

- $10 or more — $0.99 fixed amount and a 5% variable copy fee from the profit.

Commissions on ETFs and equities

NAGA charges a commission of 0.20% on all trades on shares. Clients with VIP levels pay fewer commissions of 0.10%.

Swap

It’s a charge applied daily on all overnight positions. On Fridays, the charge is tripled to cover for the weekend.

Other fees include:

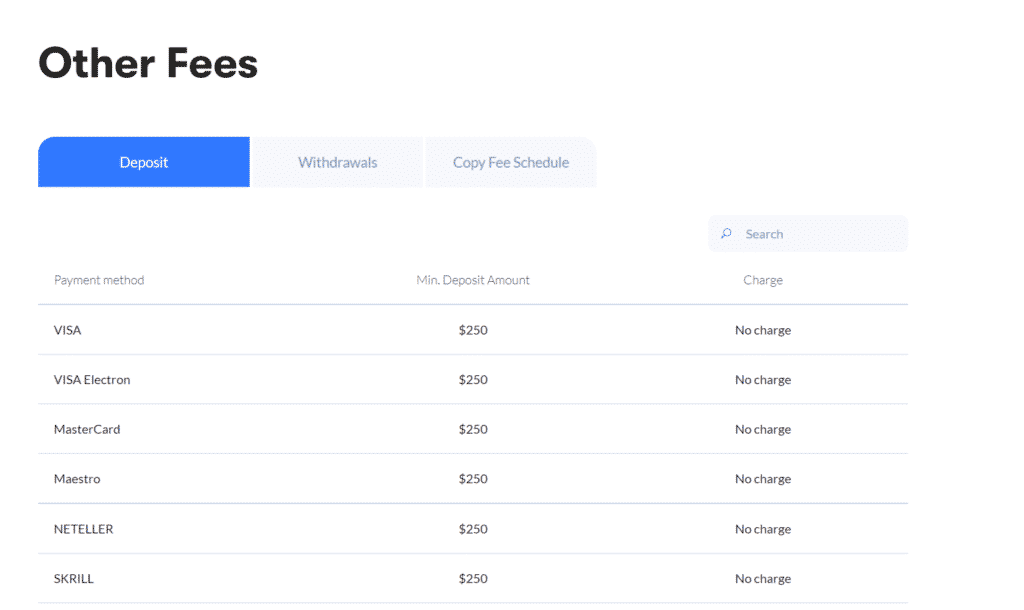

- Deposits — $0

- Withdrawals — for a minimum withdrawal amount of $50, the fee ranges from $0 to $5, depending on the client’s VIP level.

- Inactivity fee — $0

- Network fee — applied when sending cryptocurrencies. 0.99% when sending to a blockchain address and 1% when sending to an email address.

Payment options

NAGA accommodates a wide selection of payment methods so that investors can have an easy and safe experience while making deposits and withdrawals on NAGA.

Deposit

NAGA offers over 20 deposit methods, including Debit/Credit Cards, E-wallets, Wire Transfers, and cryptocurrencies. There are no deposit fees on all deposit methods, and the minimum deposit is $250.

Withdrawals

There are as many withdrawal methods as there are deposit methods. You can withdraw to any method as long as it works for you. However, there’s a requirement to verify the payment method, and so you can only withdraw to your verified method.

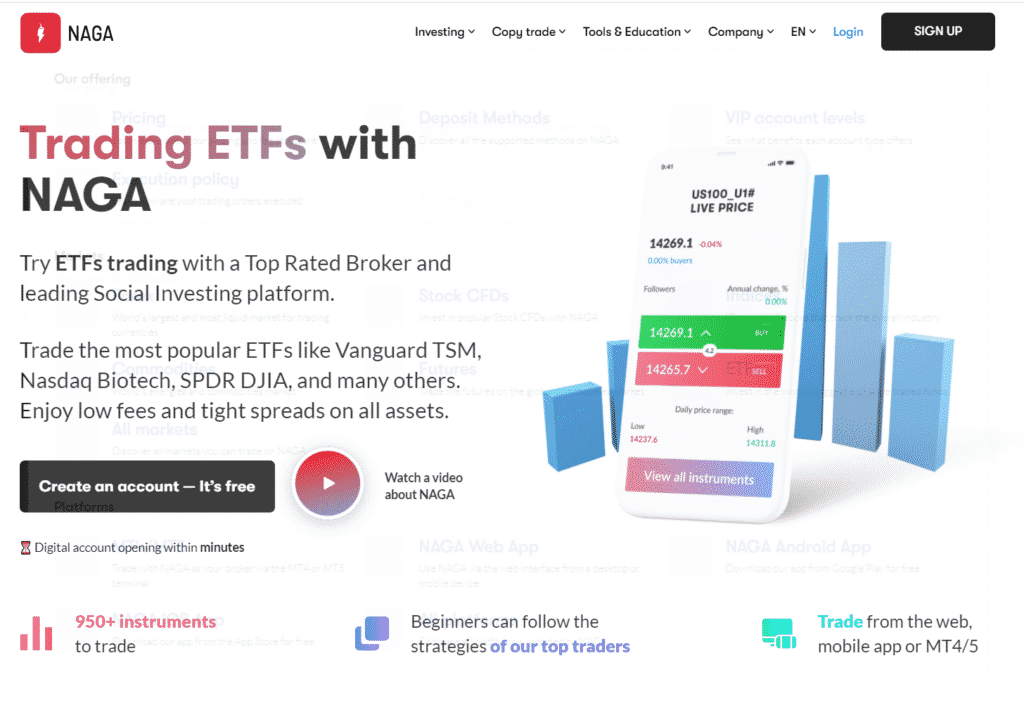

Available Markets

NAGA’s markets have over 950 trading assets, including FX pairs, CFDs on stocks, real stocks, commodities, indices, futures, cryptocurrencies, and ETFs.

Forex

NAGA offers its clients a large market to trade forex. It has all the major and minor pairs and most of the exotic pairs. The spreads start as low as 0.4 pips on EUR/USD.

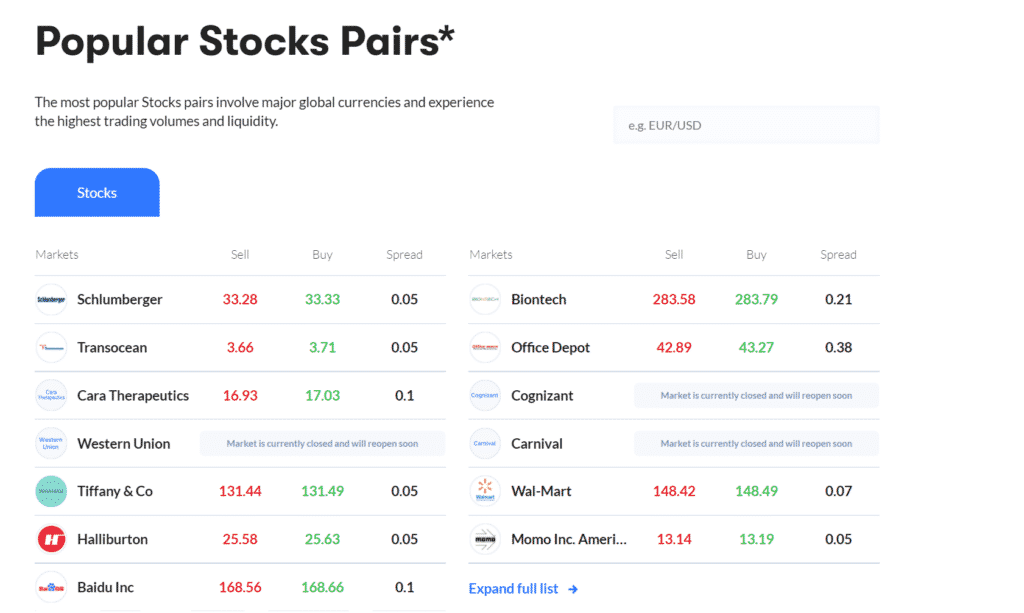

CFDs on Stocks

There are 400+ stocks from significant countries like Germany, the USA, and the UK. The spread starts from as low as 0.05 pips.

Real stocks

Investors in real stocks enjoy zero commissions and no hidden fees on all their investments.

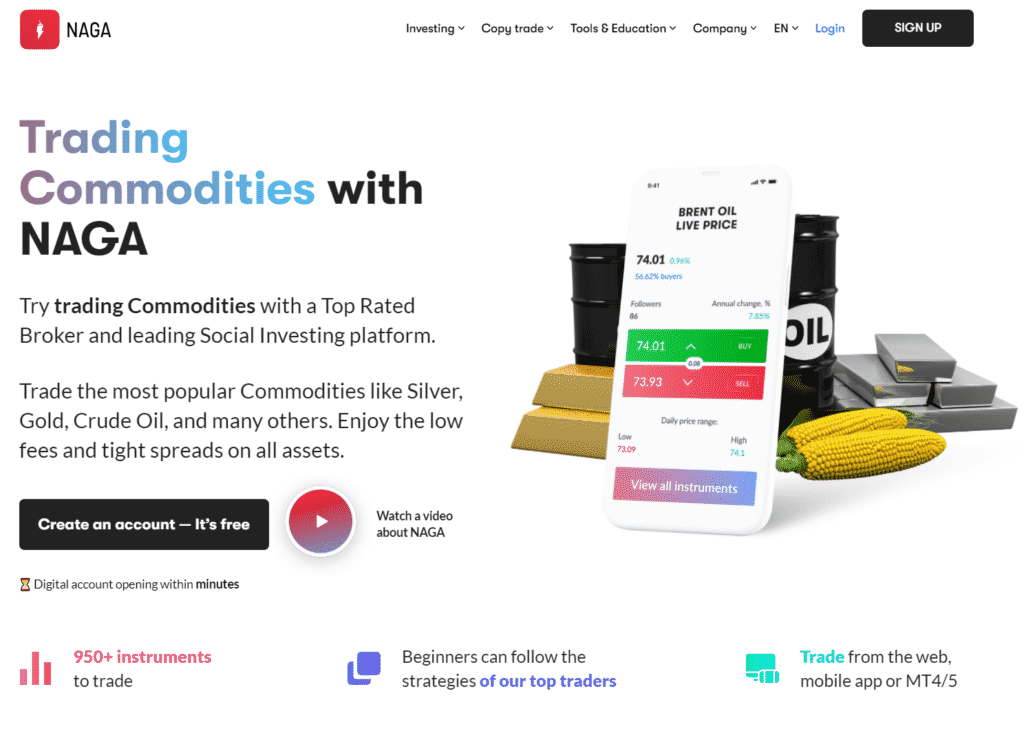

Commodities

You can trade popular commodities like natural gas, coffee, wheat, corn, etc., from all around the world. The spreads on commodities start as low as 0.0 pips.

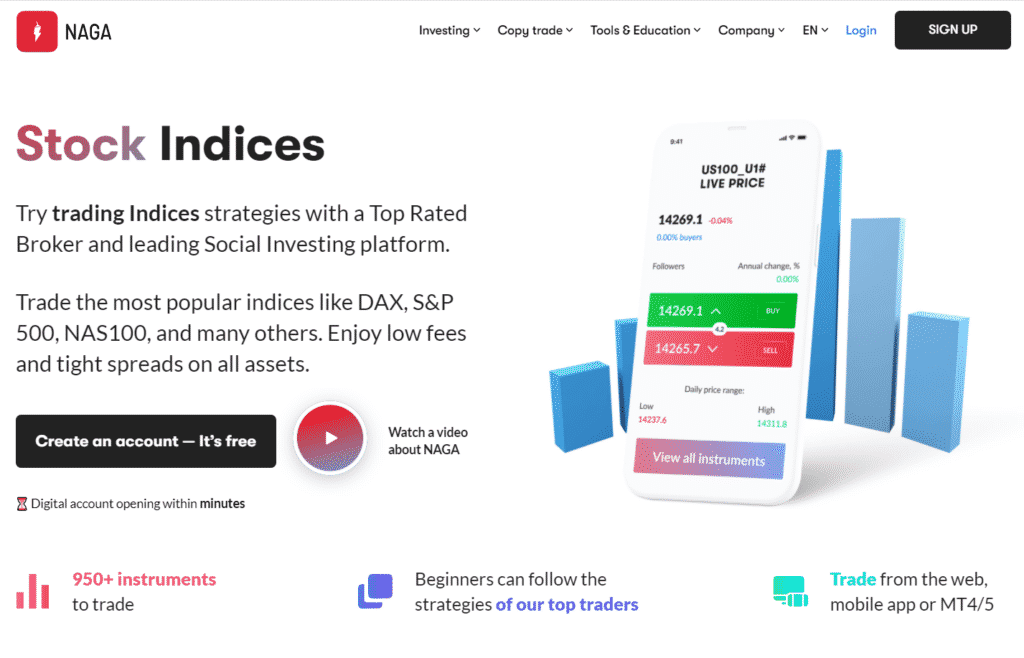

Indices

You’ll find popular indices like SPX 500, UK100, NAS100, and many others on NAGA. The spread on indices starts from 0.0 pips.

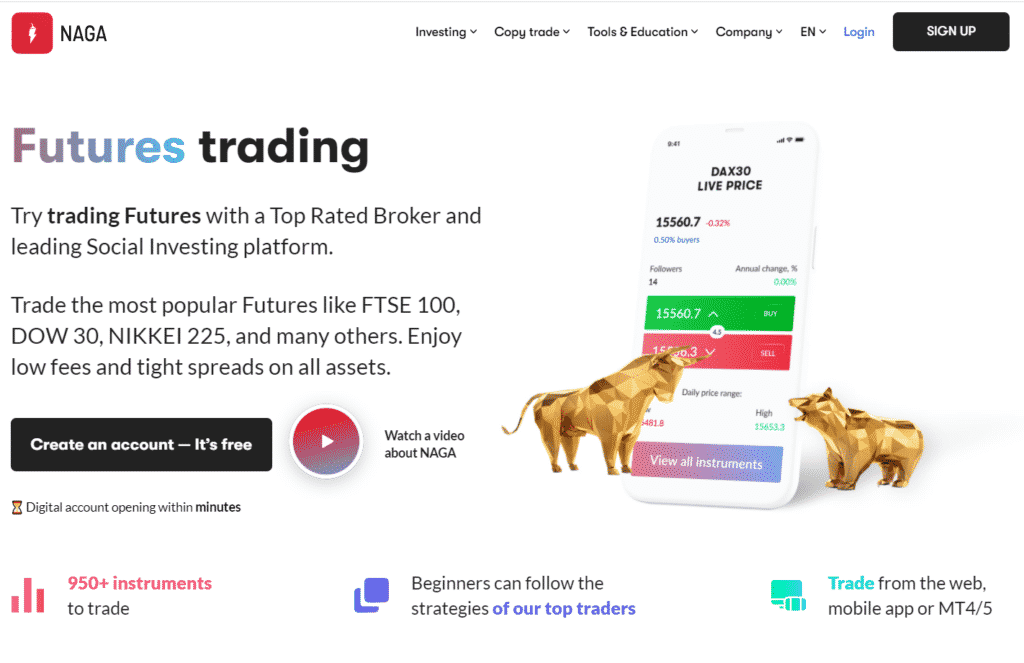

Futures

You can speculate the future prices of indices and commodities as futures CFDs on NAGA. Spreads on futures start from 1.0 pips.

ETFs

You can trade ETF CFDs on over 500 instruments on NAGA’s markets. Their spreads start from 0.05 pips.

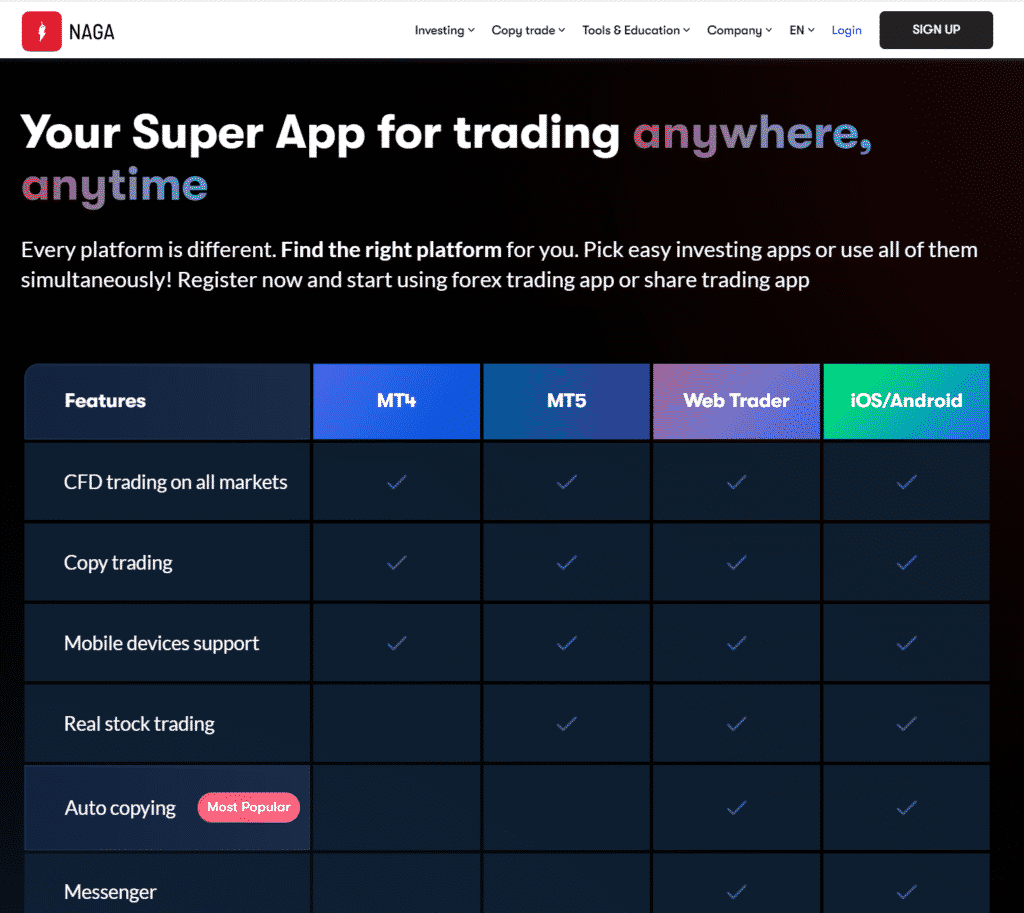

Trading Platforms

NAGA has a proprietary trading platform, MT4, and MT5. Their features are shown below.

Proprietary web trading app

- 950+ financial instruments

- Real stock trading

- Copy-trading

- CFD trading on all markets

- Auto copying features

- Trading signals

- Supported on mobile devices

- View the leaderboard

Proprietary mobile app (Android & IOS)

- 950+ financial instruments

- Real stock trading

- Copy Trading

- CFD trading on all markets

- Auto copying features

- Trading Signals

- Supported on Mobile devices

- View the Leaderboard

Meta Trader 4

- Customizable interface

- Copy-trading

- Three order execution types

- Four pending order types

- 31 graphing objects

- 30 technical indicators

- Supported on mobile devices

- CFD trading on all markets

Meta Trader 5

- 38 technical indicators

- Transfer funds between accounts

- 44 graphing objects

- Four order execution types

- Six pending orders

- Copy-trading

- Supported on mobile devices

- CFD trading on all markets

- Real stock trading

Features

- Copy-trading – NAGA clients can copy from the experts and increase their chances of winning more trade positions.

- Referral bonuses – every client that refers new users gets many bonuses from NAGA.

- Newsfeed – it shows the latest updates on the platform and how different markets are performing.

- An all-in-one trading calculator helps determine the currency conversions, the required margin, swaps, and pips of the preferred asset.

- Economic calendar – it keeps track of the market and events likely to move the market. It also shows when the events are scheduled to plan your moves in the market at that time.

- NAGA crypto wallet has an in-built exchange, charts for tracking your portfolio, and low transaction fees for smooth crypto trading.

- Price alerts – the volatility price alerts are sent to the email or as an app notification so that you don’t miss out on any opportunity to trade.

- NAGAX – it’s a crypto-fiat exchange platform offering low commissions and social-copy trading opportunities.

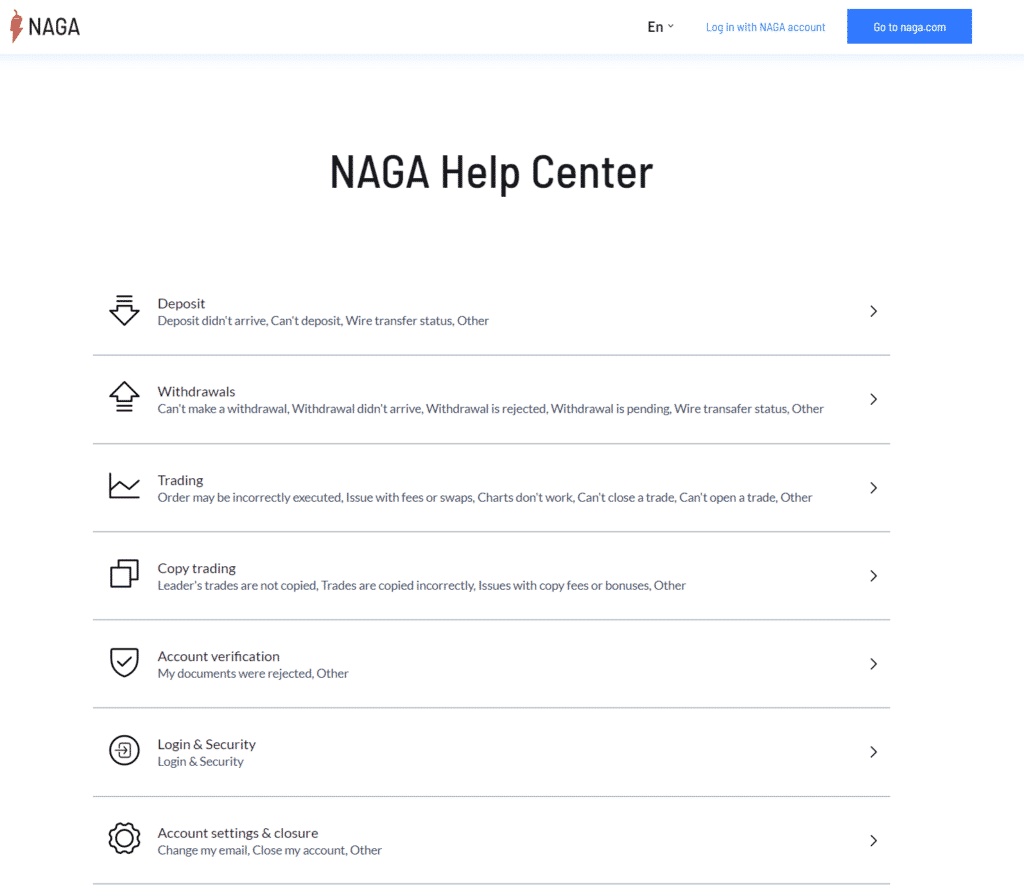

Education

NAGA has invested in educating its clients as it has resources like webinars, e-books, video tutorials, educational articles, and a help center.

- Webinars – NAGA organizes educational webinars several days a week to teach its clients the different aspects of the platform.

- E-books – professors and the most successful traders write the NAGA Academy e-books on the NAGA broker

- Educational articles – they are found in the News and Analysis section. The articles address different questions one would have while trading on NAGA.

- Video tutorials – the videos are in different categories like Technical analysis, auto-invest, community, etc., to allow the clients to find what they are looking for on the broker easily.

- Help center – NAGA’s help center has many articles where you can get answers to your questions. Also, you can contact the support team from there in case you get stuck.

Customer Support

NAGA offers two ways to contact its support team. The first is through email, and the other is through webchat. On the NAGA’s support page, you’ll notice a small message icon at the bottom corner which provides the web chat space. The reply comes in less than five minutes.

To send an email, click on the ‘contact support’ button, and you’ll be redirected to your email, where you can compose and send the email. You’re likely to get a response to your email within the day.

Also, on the help center page, you can scroll through the articles available there and find an answer to your queries.

Review Summary

NAGA is a globally recognized social and copy trading platform suitable for all levels of traders. You can easily grow your trading portfolio by automatically copying trades from successful traders on the platform.

The NAGA Exchange (NAGAX) platform allows cryptocurrency traders to buy and sell their cryptocurrency safely. They can also store their crypto conveniently in a NAGA cryptocurrency wallet.

On the downside, NAGA has few educational materials, especially the articles and videos available on the site. It also charges high withdrawal fees on all the withdrawal methods.