Nadex, also known as North American Derivatives Exchange, is the leading US-regulated exchange in North America, offering binary options and spread trading on a wide variety of global markets. Based in Chicago, Nadex is part of the North American IG Group (IGG) unit, an FTSE 250 global financial services firm. As of October 2020, Nadex market capitalization stood at $3.75 billion.

The firm is regulated by the Commodity Futures Trading Commission (CFTC), and member funds are held in segregated accounts in central US banks ensuring guaranteed security.

Pros

- Open to US residents

- Offers a wide range of markets and positions

- Offers $10,000 practice funds upon sign up

- Serve individual and business traders

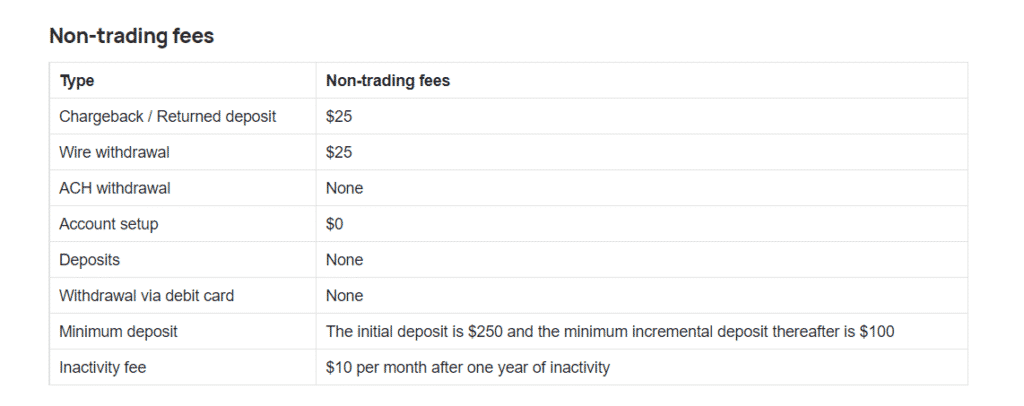

- Deposits are free of charge

- Debit card withdrawal is free

- ACH withdrawal is free

- No charge if position closes out-of-the-money

Cons

- A minimum first deposit is $250

- Traders are limited to trading on derivatives only

- Traditional securities such as stocks and ETFs have not supported

- $25 fee for wire withdrawal and returned deposits

- Settlement fee of $1 per contract if position ends in-the-money

Headquartered in Chicago, Illinois, in the US, Nadex, formerly known as HedgeStreet, was founded in 2004 by John Nafeh as an electronic marketplace that offers retail traders opportunities to trade in derivatives. Throughout the years, the Nadex platform has been the go-to place for traders looking for the best trade options and spreads on the most heavily traded forex, commodities, and stock indices markets.

Regulation

Nadex is a US CFTC-regulated exchange. It prides itself as one of few binary options providers designated as Designated Contract Market and Derivative Clearing Organization.

For context, the CFTC is a US government agency that oversees futures, options, and swaps trading. Its mission is to protect traders and the public from fraud, manipulation, abuse, and systemic risk. This guarantees traders based in the US and outside the country the security and freedom to trade without fear and knowledge that their funds are safe.

It can be quite risky to trade on binary options that are not properly registered and regulated. You will notice that some of these providers are based outside the US and therefore operate outside US law and, in some instances, may hold member funds in various types of offshore accounts. This in itself disqualifies them from legally offering binary options to retail customers in the United States.

Pros

- Its operations are tightly regulated by CFTC.

- Perfect binary options trading platform for traders based in the US.

Cons

- The tight CFTC rules and regulations might serve as a stumbling block for users based outside the US.

Account Types

The broker offers a variety of accounts designed with each user in mind – the accounts are tailor-made to suit your specific needs. Generally, the broker offers only two standard account types, but each one comes with a myriad of investment options and opportunities.

Business account

Alongside its standard accounts, the broker offers businesses, corporations, LLCs, partnerships, and trusts equal yet exciting opportunities to trade in binary options and spreads with limited risk.

However, these entities must be registered in the US to operate a business account on the brokers platform. They are, therefore, required to provide the following documents for verification purposes during the account opening:

- Proof that the entity is legally registered in the US.

- Documentation regarding the entity set-up and ownership.

- Nadex certification for your entity type.

- They may also need to provide additional documents specific to your entity type.

- Once a business account application is approved, the entity will need to obtain a legal entity identifier (“LEI”) commonly known as a Global Markets Entity Identifier (“GMEI”) at a fee.

Standard individual account

Nadex accounts are very much similar in how they operate; in fact, the only real difference between the two types of accounts is the requirements when opening each account.

But what makes the broker stand out is that they provide international clients the same safety and security as they do for US clients. International traders can use Nadex’s products and services knowing that their funds will be secure.

Islamic account

Islamic account options are not offered on the Nadex platform. And so, Muslim traders who follow Sharia law wouldn’t be able to open an Islamic account on the platform.

An Islamic account means a Muslim client has an additional swap-free option without being charged during overnight positions of swaps or rollover interests.

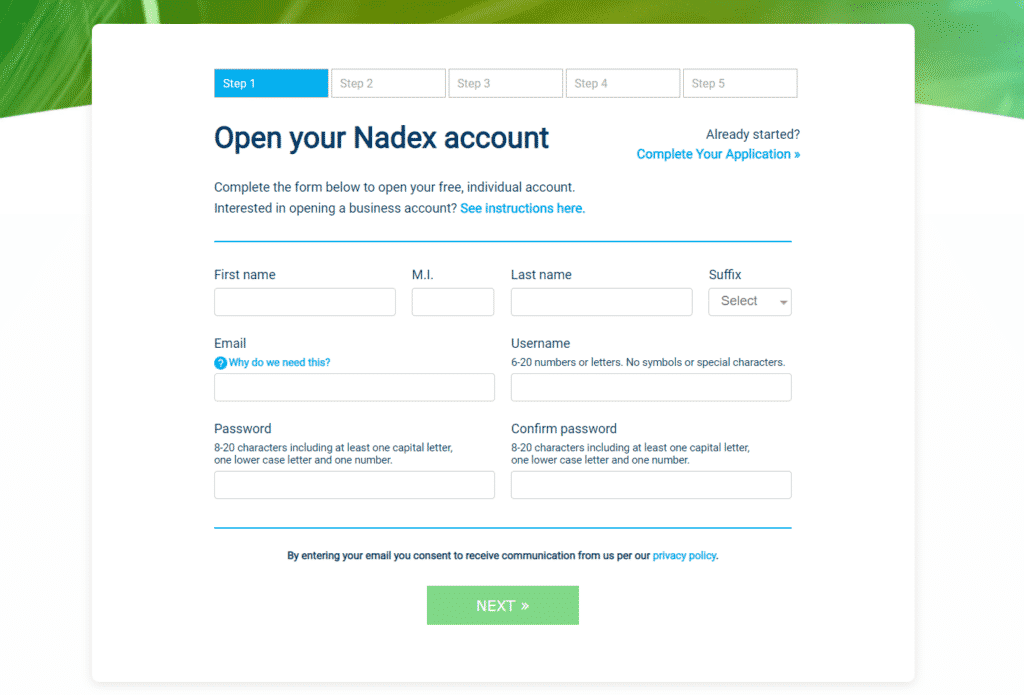

How to open a Nadex account?

The min. initial deposit to open a live trading account is $250, and the min. incremental deposit is $100.

Step 1. Click the “open account” button on the official website.

Step 2. Provide your personal details for verification.

Step 3. Once you have logged into your trading account, choose from one of the three trading products: binary options, call spreads, knockouts.

Step 4. Select one of the market classes, and choose an expiration option underneath one of the markets.

Step 5. Start trading.

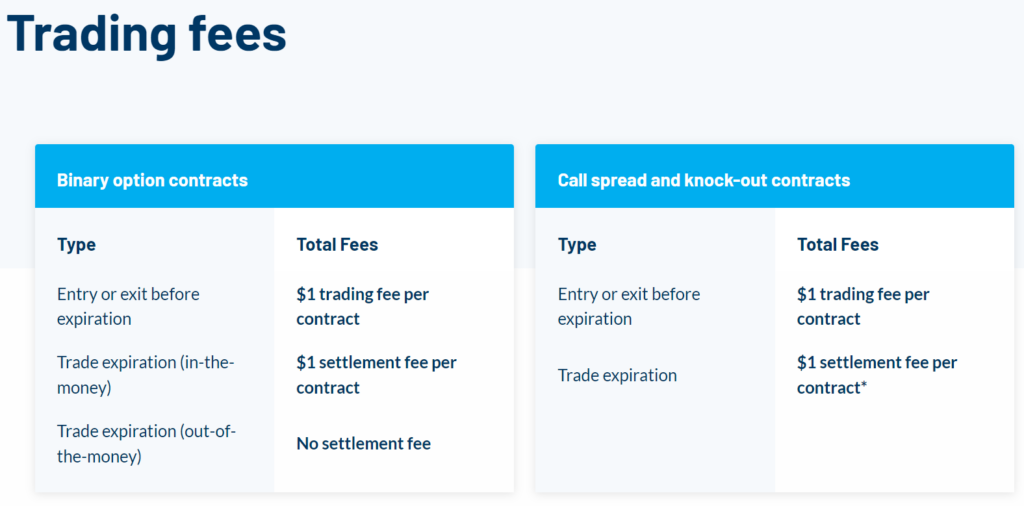

Fees and Commissions

The broker offers a broad range of fees and transaction costs to all its customers. The charges are pretty reasonable and are applied on a case-by-case basis. For instance, a $1 fee will be charged per contract if the position ends in the money and the contract fee waived if the position ends out-of-the-money. This flexibility allows its customers to capitalize on their returns.

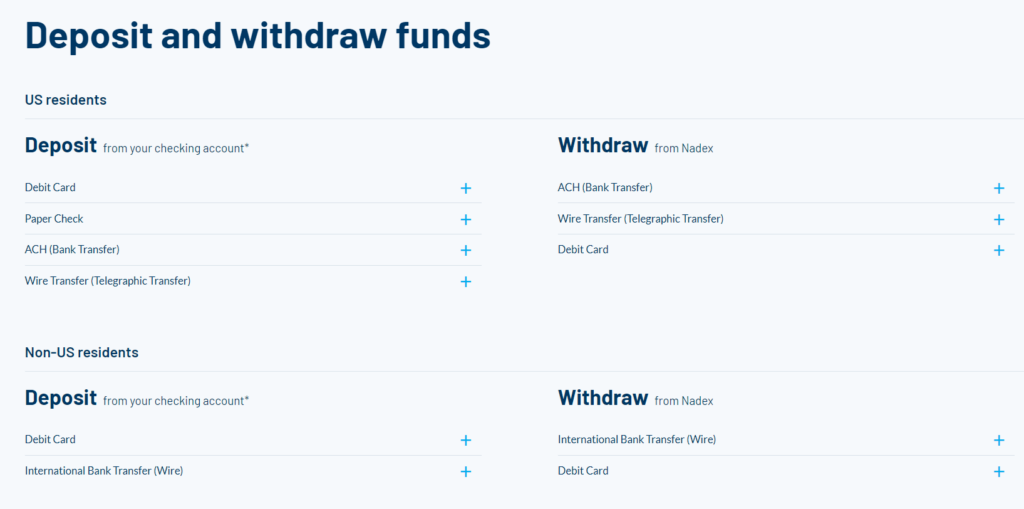

Payment options

Nadex payment options include:

- Debit card

- Wire transfer (telegraphic transfer)

- ACH (bank transfer)

- Paper check

- Wire transfer (telegraphic transfer)

Pros

- Deposits are free of charge

Cons

- There is a $25.00 processing fee for international bank transfer withdrawals

Available Markets

Clients can trade on various products and markets on Nadex with a wide range of contracts available based on forex, stock indices, commodities, and economic events. The broker also offers its customers opportunities to speculate on these markets without owning the underlying asset, using the binary option, call spread, and knockout contracts.

Nadex’s trading experience is heavily simplified. The platform is designed with the average and even the avid trader in mind. Customers can also manage risk better by observing different types of outcomes in one go.

The broker offers a range of markets to its clientele, all in one account:

- Forex

- Indices

- Commodities

- Events markets

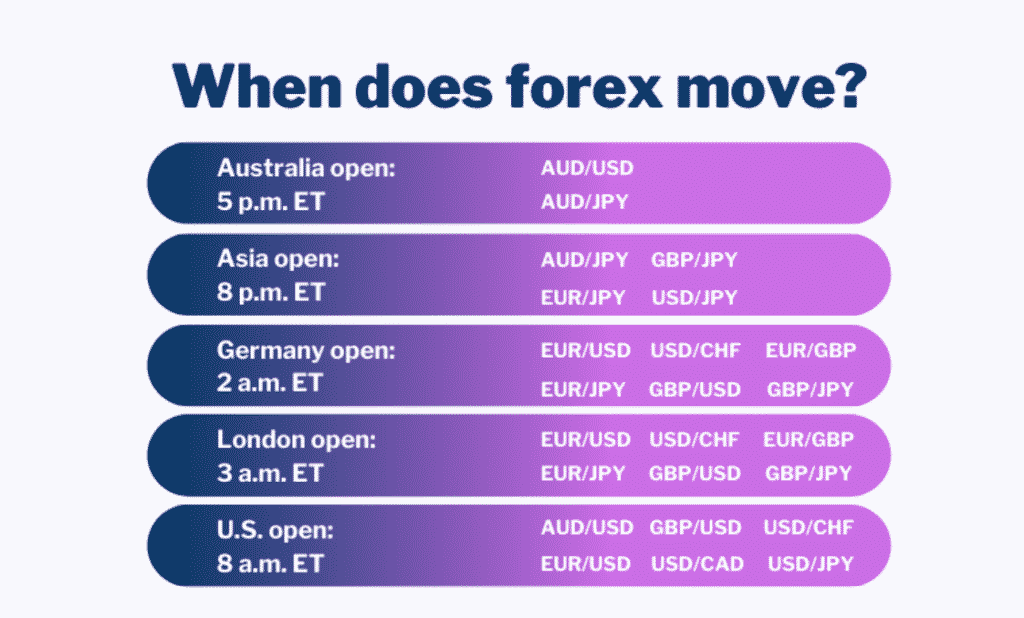

Forex trading

FX trading is simply buying one currency and selling another. The broker offers its customers the opportunity to access this massive market with an estimated $3-5 trillion dollars traded daily.

- Currencies are always quoted in pairs, with a base and quote currency.

- When looking at a chart of currency pairs, it will reflect the movement of the base currency relative to the second named or quote currency.

- It is always assumed that the base currency is worth one. So if EUR/USD = 1.11, this means there are 1.11 USD to 1 EUR.

- Currencies are traded in pairs too. You can see them listed on the Nadex platform in the format of base currency and quote currency. If you see the strike EUR/USD > 1.1080, the pricing will reflect the market-perceived probability that one euro is worth more than 1.1080 USD at expiration. If you agree it will be worth more, you buy. If you disagree, it will be worth more, you sell.

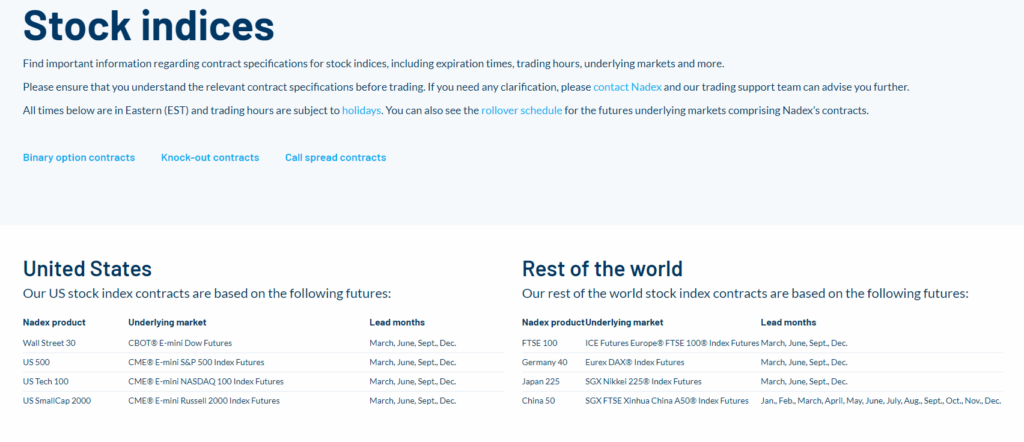

Stock indices

Nadex members can speculate on some of the world’s most significant stock market indices, from the S&P 500 or the NASDAQ 100 to the NYSE. Stock market indices measure the value of a section of the stock market’s value via a weighted average of selected stocks from particular companies preselected from a specific industry or market sector.

With binary options, traders can take positions in these markets (speculate if the NASDAQ 100 will rise or fall) without taking ownership of the underlying market.

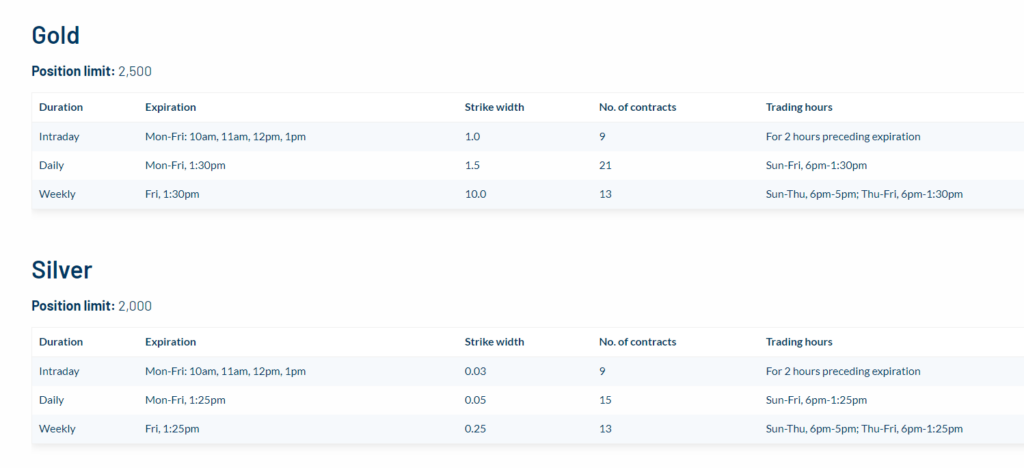

Commodities

The broker allows its customers to participate in the largest precious markets trading in the world. Using binary options trades, traders can take positions on different precious metals such as gold and silver and speculate on the crude oil market.

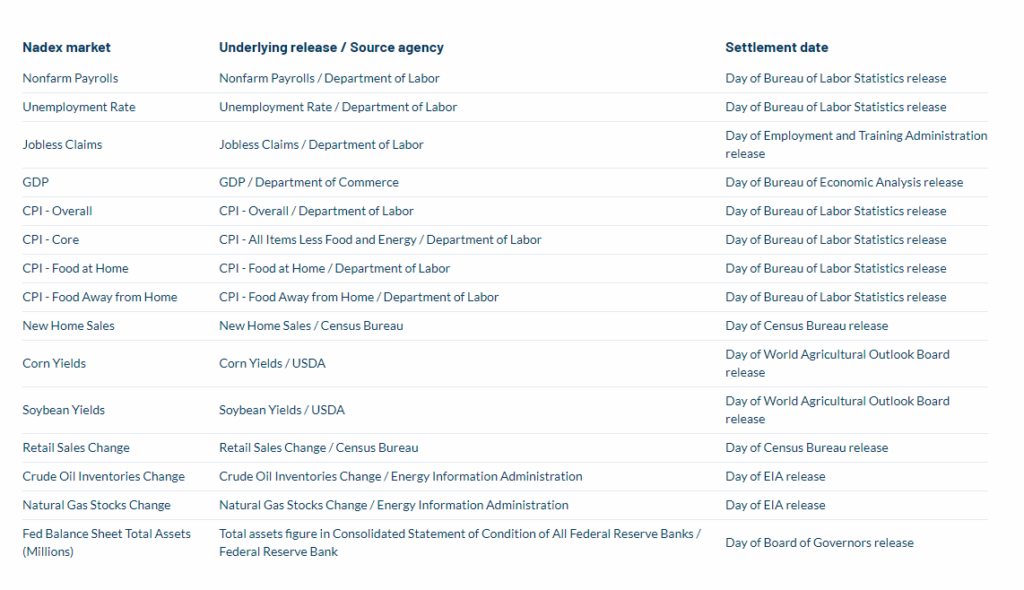

Economic events

Economic events provide valuable insights into a country’s financial health. Through Nadex, customers can trade on current economic events by predicting figures and making forecasts.

Some of these economic events include:

- Payrolls report

- Weekly jobless claims

- Unemployment rate

- GDP estimates

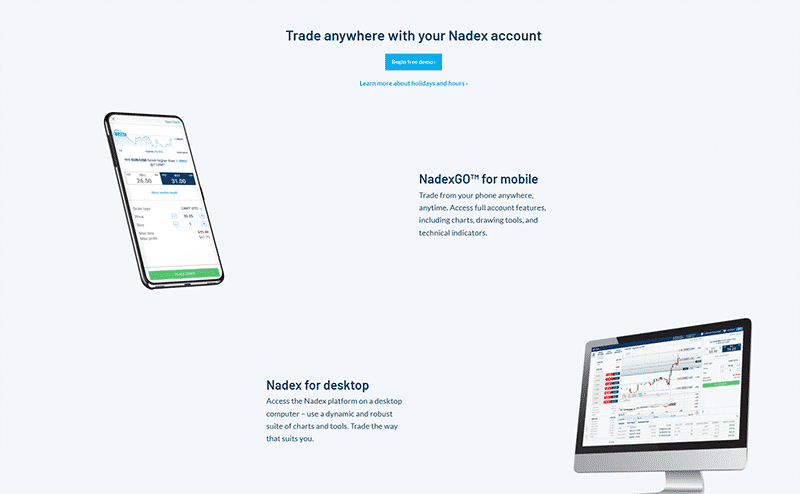

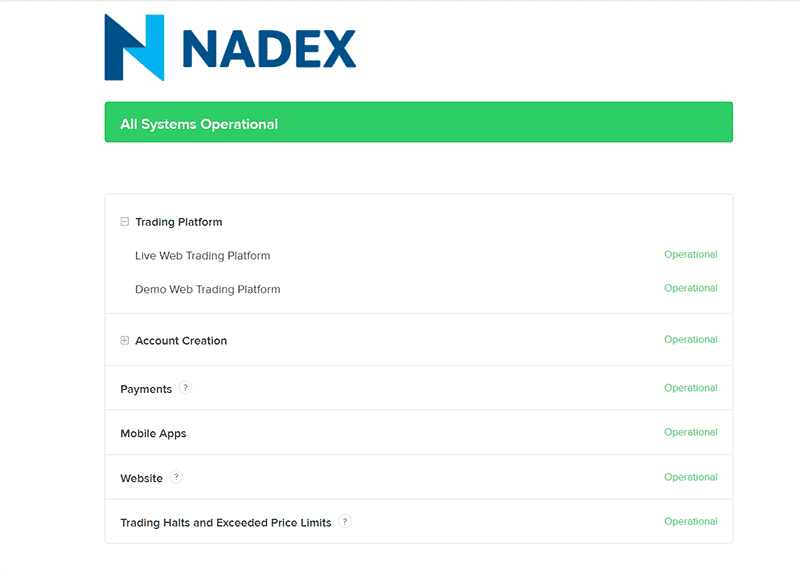

Trading Platforms

Nadex web trading platform integrates Apex investing tools and the Apex scanner, making trading spreads and binary options all the merrier for traders. Apex affirms that its binary and spread scanners, designed by real traders for traders, have more intuitive user interfaces for new and veteran traders alike.

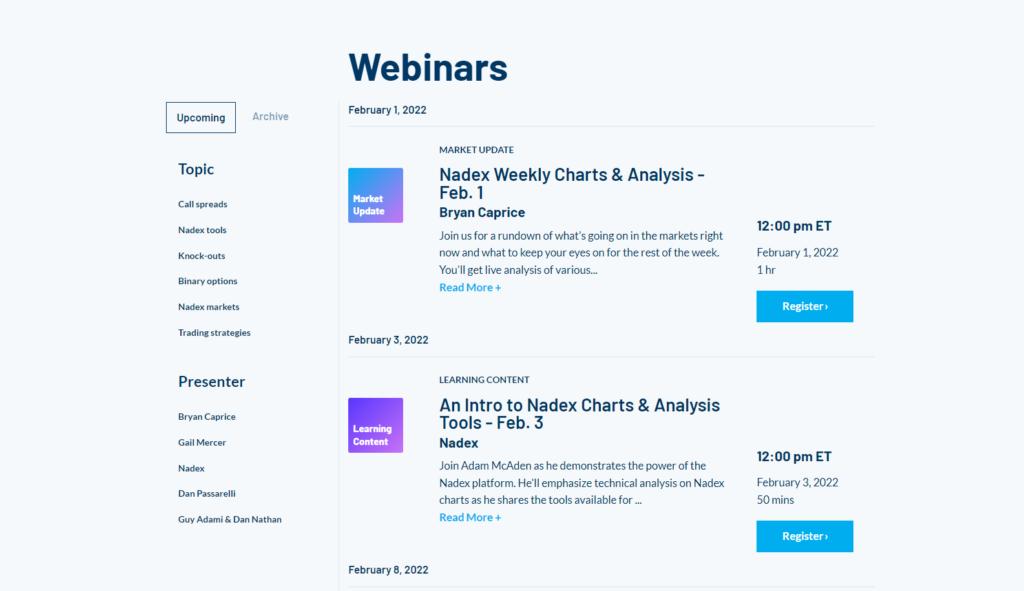

Education

The broker offers comprehensive training resources to all its members through its website. These resources range from live webinars to bootcamps and weekly market updates. Members can gain information on trading binary options through their website by practicing with a demo account before getting their feet wet with a real trading account.

The detailed analysis of available products and trading concepts gives newbies the required knowledge to understand how trading options and spreads work and how they can quickly get started.

Their tutorials also cover fundamental and technical analyses of the market and strategies to apply when trading in different market scenarios.

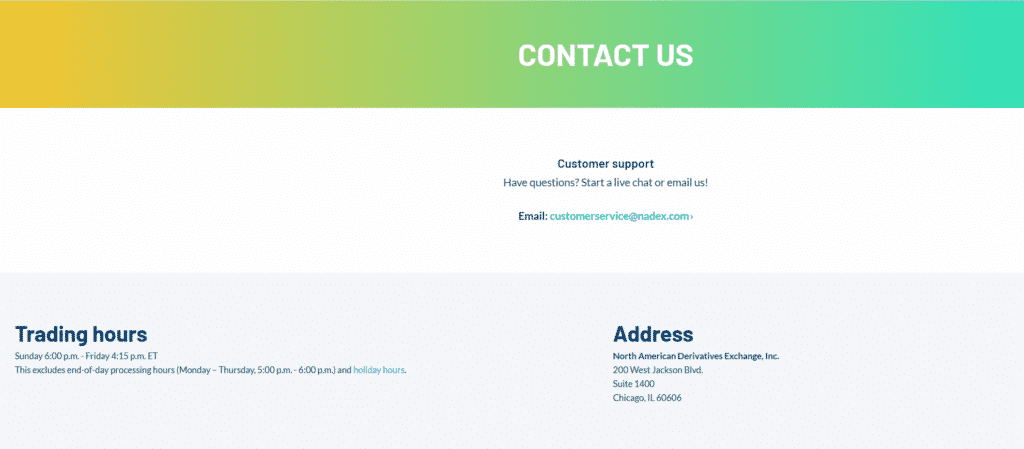

Customer Support

Nadex customer support is quite reliable and easily accessible to both existing and new customers through live chats or email. Nadex members can reach support either by phone or by email ([email protected]) any time from 3:00 p.m. ET Sunday through 5:00 p.m. ET Friday. Prospective customers can speak with a Nadex account specialist from 7:00 a.m. – 8:00 p.m. ET Monday through Thursday and 7:00 a.m. – 4:15 p.m. ET Friday.

Review Summary

In conclusion, the broker provides some of the most competitive positions to trade in binary options, call spreads, and knockouts in various global markets. Brokers customers can trade in forex, indices, commodities, and economic events all through a single account. They can do this while going through a mobile application or on their personal computers through the desktop app.