- GBPUSD powers through 1.3900 on dollar weakness

- AUDNZD under pressure amid RBA tapering concerns

- Gold bounce back gathers pace after dovish FED remarks

- Bitcoin is on an eight-day winning streak

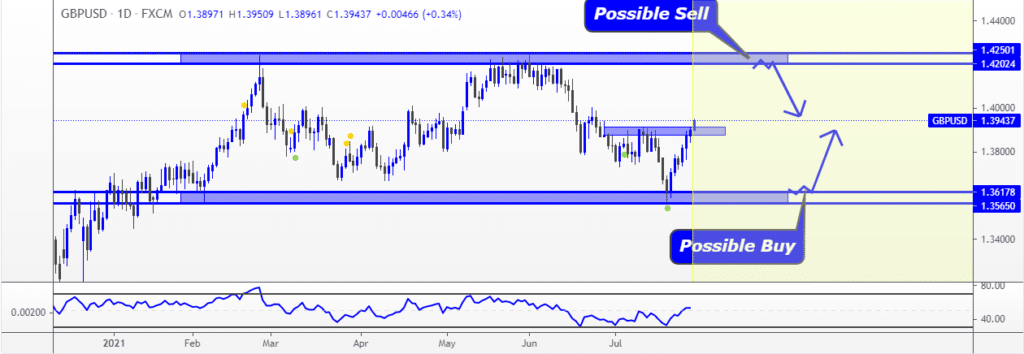

The GBPUSD bounce back from five-month lows received a boost from Federal Reserve Chair Jerome Powell, downplaying the need for higher interest rates for now. The dovish remarks sent the dollar lower against the majors, consequently driving the cable higher.

After plunging to 1.3571 last week, GBPUSD has turned bullish, taking out the 1.3900 level following the FED remarks.

With the upward momentum building up, the pair could make a run for the 1.4000 critical resistance levels.

In addition to the dovish FED remarks, the British pound is also strengthening across the board amid waning concerns about the Delta variant. Neil Ferguson, UK’s top epidemiologist, stating that the end of the pandemic is just months away, has all but continued to fuel support on the sterling.

A declining trend in Delta variant infections across the UK has also alleviated initial concerns about lockdowns that could have hurt the ongoing economic recovery. However, it is the emergence of some fresh selling on the US dollar that is fuelling deep buying on the GBPUSD pair.

AUDNZD bounce back stalls

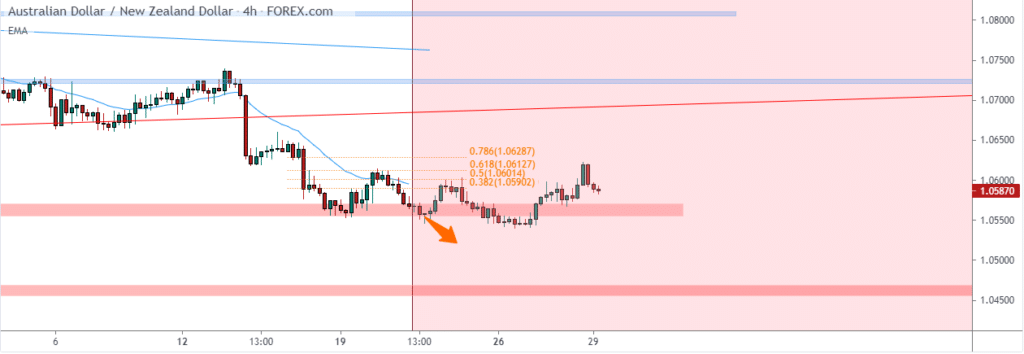

The Australian dollar, on the other hand, remains under pressure against the New Zealand dollar. The AUDNZD pair has since plunged to five months lows from where it is trying to bounce back. The sell-off in the pair has been necessitated by growing concerns about the impact of the Delta variant on the Australian economy.

After bouncing off eight months’ lows of 1.0511 AUDNZD appears to have hit strong resistance near the 1.0608 levels. Bulls are finding the going tough, with bears likely to push the pair lower.

Weighing heavily on the AUD against the New Zealand dollar is growing talk that the Reserve Bank of Australia will push back on its plan to taper bond buying. Prolonged lockdowns due to the COVID-19 situation have left the central bank with no option but to keep the loose monetary policy intact.

Gold rally gathers pace

In the commodities market, gold hit its highest level in more than a week in the aftermath of the US Federal Reserve not providing a clear timeline on when it will start tapering. XAUUSD has since rallied to the $1818 level ahead of a key resistance near the $1826 level.

Dovish remarks by the FED chair Powell have sent the dollar lower to one-week lows against the major, all but benefiting the XAUUSD. With the FED chair insisting that the job market still has some ground to cover, the likelihood of tapering and higher interest rates is unclear, a stalemate that should continue to benefit the precious metal on sending the greenback lower.

US indices bounce back

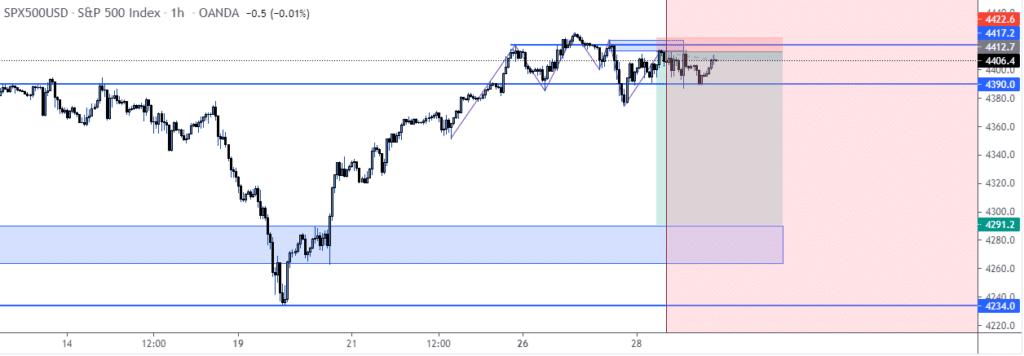

All the major U.S. indices edged higher in the wake of the dovish remarks by the Federal Reserve. The comments all but alleviated initial concerns that the FED will hike interest rates. The markets react negatively to higher interest rates as they tend to push borrowing costs higher.

The S&P 500 reversed declines following the FED report as the Dow also cut its declines and the NASDAQ edged higher.

A string of impressive second-quarter results have all but continued to fuel investor interest in equities helping support the recent rallies in the indices. With the economy doing well amid higher inflation and the ever-escalating Delta variant situation, equities look set to continue edging higher.

Bitcoin on the front foot

Bitcoin is on course for one of the longest winning streaks in the cryptocurrency market as a recovery from lows of $29,000 continues to gather pace. BTCUSD was up by more than 7% on Wednesday, touching highs of $40,900.

BTCUSD has since climbed for eight straight days after bears pushed it below the $30,000 barrier. With the current momentum looking strong, the pair could make a run for the $45,000 level. The recent bull run has been fuelled by positive remarks from Elon Musk and Ark Investment Management. Talk that Amazon could also be planning to get involved in the sector has also continued to fuel the buying spree.