- BTCUSD struggling to power through $40,000

- Japanese yen shrugs off dollar strength

- British pound pilling pressure on euro

- Oil prices rising amid high demand in the US

Bitcoin’s upward momentum is facing strong resistance near the $40,000 level. After powering through the critical level early in the week, BTCUSD has pulled lower. However, the flagship cryptocurrency is looking increasingly bullish amid improving underlying fundamentals.

BTCUSD rallying and finding support above the $40,000 will affirm the emerging uptrend after the recent sell-off to six-month lows.

On the flip side, failure to take out the $40,000 level could trigger renewed sell-off that could see the pair plunging back to the $35,000 level.

The recent jump to six-week highs has come amid heightened speculation that Amazon may be planning to venture into the cryptocurrency space. In the recent past, there has been a talk that the e-commerce giant could start accepting BTC payments.

Elon Musk reiterated that he and his rocket company SpaceX still hold some Bitcoins despite concerns about environmental impact have only gone to fuel the buying spree sending BTCUSD higher. Additionally, the buying spree has been supported by Musk, insisting that Tesla could accept Bitcoin payment if the process of mining it is less reliant on fossil fuels.

The string of good news is the latest catalyst fuelling the buying spree in other overall cryptocurrency markets.

USDJPY edges lower

In the forex market, the Japanese yen is gaining ground against the US dollar despite the lingering COVID-19 situation in Japan. USDJPY has since plunged to one-week lows following FED chair dovish remarks on Wednesday.

The pair has since plunged to the 109.49 level amid renewed selling pressure on the USD. Immediate support on the renewed sell-off is seen at the 109.20 level.

A breach of the 109.20 support could open the door for bears to push the pair back to the 109.00 level.

The FED remaining cautious about tapering has only gone to fuel sell-off on the greenback across the board. That said, the yen could continue to strengthen as traders shrug off the escalating COVID-19 situation in Tokyo, where cases of new infections are rising significantly.

EURGBP at three-month lows

A resilient British pound against the major continues to pile pressure on the EURGBP, which has since dropped to three-month lows. The pair is trading near a key support level at 0.8511 and looking susceptible to dropping to the 0.8470 level.

The pound continues to strengthen against the euro amid a declining trend in Delta variant infections in the UK. However, the euro is also holding a firm supported by impressive economic releases from the Eurozone.

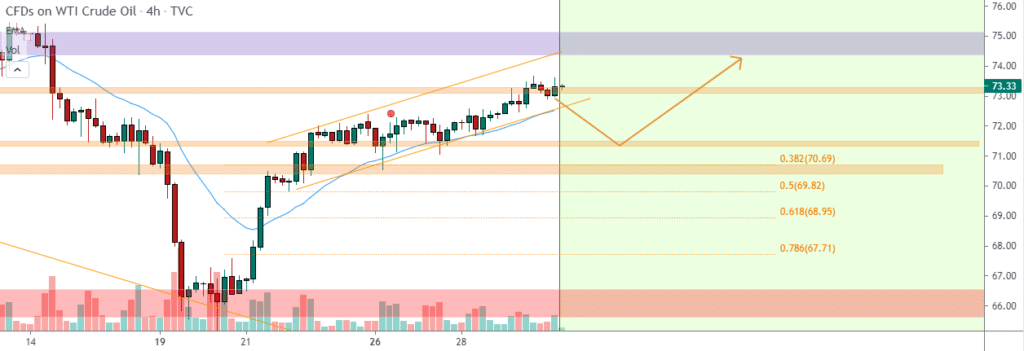

Oil prices bounce back

Oil prices continue to edge higher in the commodity markets, supported by demand growing faster than supply. Oil prices are poised to end the week on a high with gains of up to 2%. Brent oil is trading near the $75 a barrel level. US oil prices have found support above the $70 barrel level on rallying to $73.24 a barrel.

Tight crude supplies compounded by strong fuel demand in the US is the catalyst fuelling the spike in oil price. Data from the US Energy Information Administration indicate that crude stocks at Cushing are at their lowest level since January.

However, the rising number of COVID-19 cases in the US, Asia, and some parts of Europe is the biggest headwind that could weigh on sentiments in the oil markets.

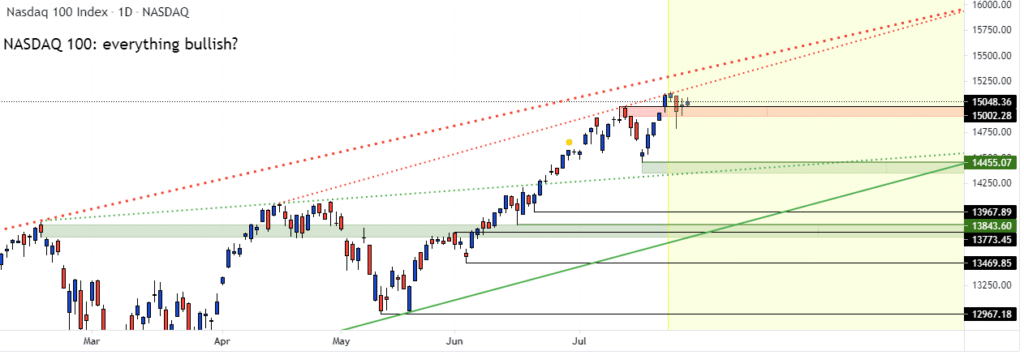

US indices at record highs

US equity indices are poised to end the month near all-time highs after racing higher on Thursday as impressive GDP data erased concerns about inflation and Federal Reserve scaling back on monetary policy.

The S&P 500 touched record highs as the NASDAQ retreated following a disappointing earnings report from Amazon. Facebook also pulled lower after issuing a cautious outlook, all but pilling pressure on the tech-laden indices. However, sentiments in the equity market remain positive after GDP data showed that consumer spending is strong.