Mood EA is a Forex expert advisor that was launched on 13th December 2020. It is up for sale on the MQL5 website, and according to the vendor, it can successfully detect the market sentiment. Since many vendors make these kinds of claims, it is up to us to analyze its performance metrics, thus determining its profitability.

The current price of this Forex robot is $199, which is slightly lower than the market average price for EAs. You can download a free demo version of the system if you wish to test its performance using virtual money. Unfortunately, the vendor does not offer a money-back guarantee for this EA.

Mood EA trading strategy

This EA is based on a momentum indicator, which is a leading indicator. For making its entries, it utilizes the overbought or oversold conditions of the indicators to catch the trader sentiment. The vendor has not elaborated further on the strategy. We don’t know how exactly the indicator is utilized for detecting the sentiment. Also, we don’t know the conditions based on which the EA finalizes its entry.

Mood EA features

You can use Mood EA to trade in currency pairs like EUR/AUD, EUR/CAD, EUR/USD, EUR/JPY, GBP/AUD, XAU/USD, and GBP/CAD. From the EA setting, you can modify several parameters to suit your trading style. You can enter the starting lot size or enable the money management functionality to allow for automatic calculation of trading lot size.

Mood EA has a hedging feature that you can enable manually. This allows the robot to trade in both directions. When disabled, it only trades in a single direction. The EA also has a drawdown reduction algorithm. You can select from which order the algorithm is activated as well as the percentage of profit.

Traders can also choose the maximum lot, maximum spread, trailing stop distance, take profit in terms of pips, as well as the lot multiplier. Support manual orders is another important setting of Mood EA. When it is disabled, the EA will not support the entry of manual orders.

Mood EA backtesting results

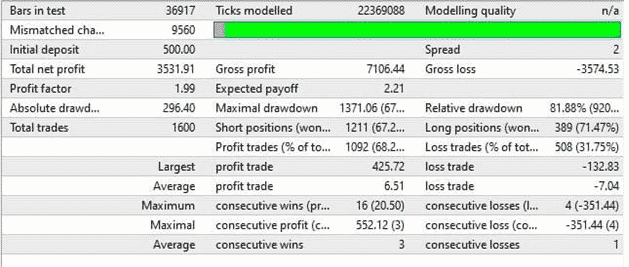

Here we have the backtesting results for Mood EA. This test was conducted with an initial deposit of $500. The EA placed a total of 1600 trades during the testing period, winning 1092 among them. This means it had a win rate of 68.25%. At the end of the test, it had managed to generate a profit of $3531.91.

There were 16 maximum consecutive wins and 4 maximum consecutive losses during the backtest. While the profit factor was quite decent at 1.99, the relative drawdown was extremely high at 81.88%. This indicates a risky trading strategy that can leave your account vulnerable to large losses.

Mood EA live trading results

On the MQL5 product page, the vendor has shared a link for real-time trading results. However, it seems they have deleted the trading account as it does not exist on the website anymore. We searched multiple websites like Myfxbook, FXBlue, and FXStat, but were unable to find any verified trading accounts for this expert advisor.

Without verified trading results, it is impossible for us to assess the profitability of the system. We cannot compare the live performance metrics with that of the backtest to see how the robot fares in the current market scenario.

Mood EA reputation

The developer behind Mood EA is a Russian national by the name of Vasiliy Strukov. They have shared the link to their official website https//forexstrukov.ru/ on the MQL5 profile; however, it seems the domain has expired. We don’t have any background information on this person and we don’t know anything about the team they work with. According to their MQL5 profile, the developer has two years of experience.

We couldn’t find any user reviews for this expert advisor on websites like Trustpilot, Myfxbook, Forexpeacearmy, and Quora. This shows that Mood EA does not have too many regular users. While there are some reviews on the MQL5 product page, we have no way to verify their authenticity.

Mood EA review summary

- Strategy – 6/10

- Functionality & Features – 5/10

- Trading Results – 4/10

- Reliability – 5/10

- Pricing – 6/10

While Mood EA is available at an affordable price, it is not supported by verified trading results. The vendor has not clearly explained the trading strategy, but it seems to be a risky one since the EA exhibited a high drawdown during the backtest.