Cryptocurrencies have presented some intriguing avenues for the average Joe to build wealth or make a living. Mining and staking are incentives offered by many blockchains for users to confirm transactions and keep the networks secure.

Traditionally, mining has always been viewed as having the greatest barrier to entry due to the high-priced equipment and other operating costs. Conversely, staking is much more accessible.

The main takeaway we got was that mining could be more profitable in the long term, even though this depends on far more uncontrollable variables than staking.

Mining requires a significantly higher upfront investment, and it can take at least a year just to break even, meaning greater financial risk. Plus, it is also more time-consuming, needs some basic computer knowledge, and requires some constant physical effort.

On the other hand, you technically make money from day 1 when staking with less work, time, and monetary risk. Yet, the yields are not particularly impressive for the more established cryptocurrencies.

The typical costs of mining

The central cost for mining is understandably the hardware, which comes in three forms:

- CPU (central processing unit/your average computer)

- GPU (graphics processing unit/graphics card)

- ASICs (application-specific integrated circuits).

Very few coins are minable with CPUs because of the lower hash rates, which means tremendously reduced profits. Miners invest as much as possible into the most expensive machines (typically ASICs), producing astronomical hash rates.

Each block comes with a unique and complex hashing function that your mining device, along with other participants, will compute until a solution is found. A hash is a numerical function converting an arbitrary input into a fixed encrypted output. Hashes are measured per second in kilo, mega, giga, and tera form.

However, ASICs are pretty pricey, ranging from $1500 to $60 000, depending on the brand, hash rate, and other specs. The second cost to factor in mining is electricity.

Hence, many miners come from countries like China, where the power is some of the cheapest worldwide. The third charge is other possible overheads such as cooling the equipment, maintenance, internet, etc.

Lastly, because most mining is done collaboratively via mining pools, a fee is charged for the mining rewards, usually between 1-3%.

What does staking cost?

There are no additional associated costs other than setting aside a staking amount, varying from a few hundred to a few thousand dollars (depending on the project).

This distinction makes it particularly attractive because it is far less resource and power-intensive while achieving decentralization and security. Yet, certain coins might have higher staking minimums which exclude the general population, meaning it might be expensive for some.

Staking Rewards, a leading data provider for staking projects, suggests an average APY (annual percentage yield) of 16.19% across 260 digital assets. Therefore, you can start to earn daily interest immediately, meaning there is no breakeven point.

However, you may not be able to withdraw your holdings for a certain time or face some penalty for doing so. Unlike mining, no lock-up period exists since you earn new coins directly to your wallet for every mining day.

Comparing the hypothetical costs of mining and staking Litecoin

To get a better profitability comparison, let us imagine that person A spent $13 000 on mining equipment and person B instead staked the same amount through a staking program for a year.

It’s worth mentioning the following caveats as we are using averages for illustrative purposes since the figures will vary widely on a realistic case-by-case basis.

- We will use 5% APR to stake LTC for simplicity’s sake (it could be slightly less or more, but let’s round it off to 5%)

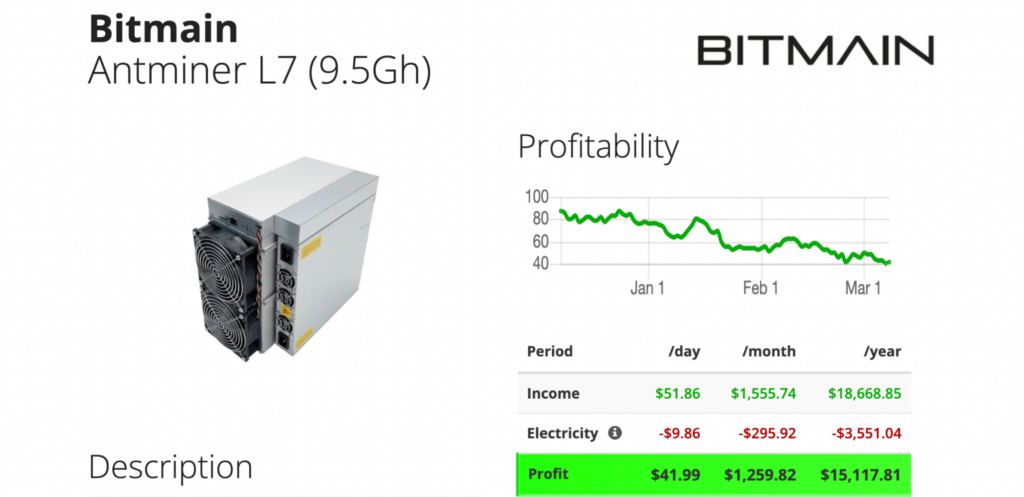

- We will assume that person A bought the ASIC device with the highest hash rate for Litecoin. According to the site ASIC Miner Value, the Bitmain Antminer L7 is the best device for mining LTC.

On average, you’d be looking to spend roughly $13 000 for purchase. This machine can produce 9.5 gigs of hashes per second and consumes 3425W of power. We’ll use the worldwide mean of $0.14 per kWh for electricity cost.

- We are using Litecoin for this example as it’s one of the most popular coins to mine and less competitive than the likes of Bitcoin and Ethereum.

- We won’t factor in mining pool fees to make things simpler. Moreover, we won’t consider other overheads that are harder to predict, but these would reasonably affect profitability.

- It’s impossible to consider mining difficulty because, on some days, you may mine more or less. Therefore, again, these are only rough estimates.

Based on approximate calculations from the site, you would profit $15117 after electricity costs in a year.

However, if we subtracted this amount from the initial $13 000, your actual gains are $2117. If you alternatively staked that same amount at 5% APY, you would make $650.

Therefore, hypothetically, mining turns out to be a winner in this case.

Curtain thoughts

Ultimately, although mining has a higher barrier to entry, this quality might be more appealing to those who can afford the hardware and have the effort to run this operation.

Objectively, mining may turn out to be more lucrative in the long run after you’ve recouped your costs. On some occasions, you might be lucky to mine more coins if the difficulty decreases. Plus, you could also sell your hardware.

Staking is profitable in the short term since there is no break-even point to reach. However, the APR is variable and will fluctuate here and there, meaning your earnings may flatten out after a while.

It’s fair to assume that neither method is significantly more lucrative than the other primarily because of price volatility risks. Even if you are consistently mining or staking, if the market value of the coins decreases, you’d still technically be at a loss.

Therefore, your decision between the two should consider upfront costs, how viable the respective project is, and whether it can produce higher income in the long term through natural price appreciation.