Cryptocurrencies and equities are understandably quite different from each other. However, they share one commonality: market capitalization (or market cap). Any seasoned investor wants to know how valuable stock is compared to another, just as any crypto investor does with digital currencies.

Market cap is one popular metric offering analysts a snapshot of an asset’s dominance. This statistic changes quite frequently as coin increases or decreases in price.

However, it’s a simple method and quick reference point for discerning the market value of a cryptocurrency. Market cap can allow investors to categorize digital assets in different risk brackets and assess the expected volatility and stability level for each.

Needless to say, it’s only the foundation of intelligent investment decisions, but it’s often a good place to start. So, let’s explore more about this concept and how it’s significant in cryptocurrencies.

What is the market cap in cryptocurrencies?

Market capitalization refers to a simple formula that takes the current price of a digital asset and multiplies it by its circulating supply. The former denotes the number of publicly available coins presently being traded in the markets.

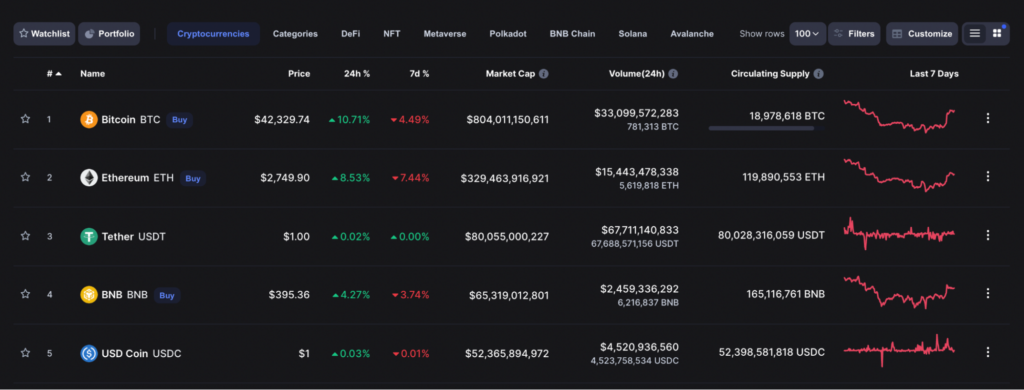

For instance, a coin worth $1 with a circulating supply of 5 million would have a market cap of $5 million. Below is a list of the top 5 most valuable cryptocurrencies presently on CoinMarketCap, the leading crypto data aggregator.

Other popular resources also include CryptoSlate and CoinGecko. CoinMarketCap currently approximates the entire crypto market as being worth an incredible $1.85 trillion, a testament to the astounding growth of this asset class.

So, what’s the point of knowing a coin’s market cap, you may ask? This simple metric is a comparative value measure rather than looking only at the price. For instance, yearn.finance is presently worth $20 268, while DOGE is valued at a much lower $0.12.

However, Dogecoin is technically more valuable than the former because of a higher cap where it’s ranked #13 compared to #92 for yearn.finance. Ultimately, the market cap shows us that the size of the pie is more paramount instead of the price of each slice.

Therefore, a coin that is priced less expensively may not necessarily be less in-demand than a more expensive coin. Market cap is also helpful in quantifying the level of risk, volatility, and other factors pertaining to a particular token, which we’ll cover next.

The different market cap categories

Aside from value comparisons, using these prescribed categories may help with diversification. For instance, an investor may split their total investment by allocating 50% to large-capped coins, 25% to mid-capped coins, and 25% to small-capped coins.

Without the market cap, one wouldn’t have a quantifiable method of allocation. Furthermore, understanding the market cap can help you know where a coin is likely to be traded.

For example, many small-capped tokens are rarely listed on centralized exchanges since they are still relatively new.

Large market cap

These are coins with a market value above $10 billion. These include the likes of Bitcoin, Ethereum, Cardano, Binance Coin, Terra, etc.

Projects of this scope are characterized by relatively low competition, longevity in existence, first-mover advantage or dominance, steady growth, substantial user bases, and decent volatility.

Furthermore, because they boast high trading volume, they are less susceptible to slippage and price manipulation, making them quite liquid. Thus, from an investment perspective, they are relatively ‘safe’ or conservative bets in the long term.

However, most of these cryptocurrencies have somewhat plateaued in value and are less likely to produce the tremendous gains they once did when they were still smaller in value.

Mid-market cap

Cryptocurrencies in this range boast a market cap between $1 billion to $10 billion. Examples of such coins include Cronos, Litecoin, Chainlink, Uniswap, and countless others.

Mid-capped coins share many of the qualities possessed by large-capped coins, albeit to a lesser extent. So, they may be considered a medium risk by and large.

However, these cryptocurrencies still possess a greater growth potential and are understandably less risky than small-capped coins.

Small market cap

Only 81 coins are currently in the mid or large-cap range, leaving the rest of the thousands in the small-cap bracket. These are coins with a market value of less than $1 billion, comprising the likes of NEM, Theta Fuel, Celsius, Compound, Holo, and many others down the list.

Such cryptocurrencies are distinguished by lower trading volumes, higher volatility and tend to operate in niche markets or have distinct value propositions. As you go down the rabbit hole, small-capped coins are easier to manipulate in price (by having a thinner order book due to the diminished trading volume).

Many of these cryptos are listed on lesser-known exchanges, and you can only trade some on decentralized exchanges. Therefore, they are the riskiest of the bunch.

Yet, these coins can grow explosively in value over time due to being relatively new or exciting compared to their established counterparts.

Misconceptions about the market cap in cryptocurrencies

Ultimately, the market cap is, of course, not the be-all and end-all for evaluating any cryptocurrency. Therefore, it’s a concept whose importance continues to be debated among die-hard crypto enthusiasts to this day.

We generally have two misconceptions, the first of which deals with money inflow. Let’s consider an earlier scene where we presented an example of calculating market cap.

If the price shot from $1 to $1.20, this would increase the market cap to $6 million (from $5 million). However, this event wouldn’t represent a real investment of $1 million.

This brings us to the second problem: the market cap is technically dependent on price and not the inherent value of a coin.

As is often the case with cryptocurrencies, a price increase tends to be driven by sentiment and not always by changing fundamentals. Therefore, even if the market cap has gone up, it doesn’t necessarily mean that the asset has gained real distinguishable value.

Curtain thoughts

Like any analytical factor in cryptocurrencies, ‘everything in moderation.’ As outlined in the previous sections, the market cap does have its place for comparative or categoric purposes.

However, it may be overused in sensationalist headlines within online media. Ultimately, the market cap cannot account for how truly valuable a cryptocurrency is. You can only get answers to this question by conducting a thorough fundamental analysis.

In doing so, you should have a fair assessment of whether a cryptocurrency is undervalued or overvalued.