- US dollar strengthens, firms at 16-month highs.

- EURUSD slides below 1.1300 amid dollar strength.

- AUDUSD struggling for direction after sliding to one-year lows.

- Oil prices bounce following OPEC supply cut talk.

- Cryptocurrencies are in recovery mode.

Indecisiveness is the central theme at the start of the Friday trading session, with market participants deploying a calmer tone ahead of the release of the US job report for November. Nonetheless, the US dollar remains elevated at 16-month highs, the dollar index having powered and found support above the 96.00 handle.

The dollar strength ahead of the Non-Farm Payroll report has been reinforced by the hawkish stance from the Federal Reserve chairman Jerome Powell. The chair hinting at accelerated asset purchases has only gone to fuel bids on the greenback. Bets are already rising. The US central bank could hike interest rates as early as June of next year.

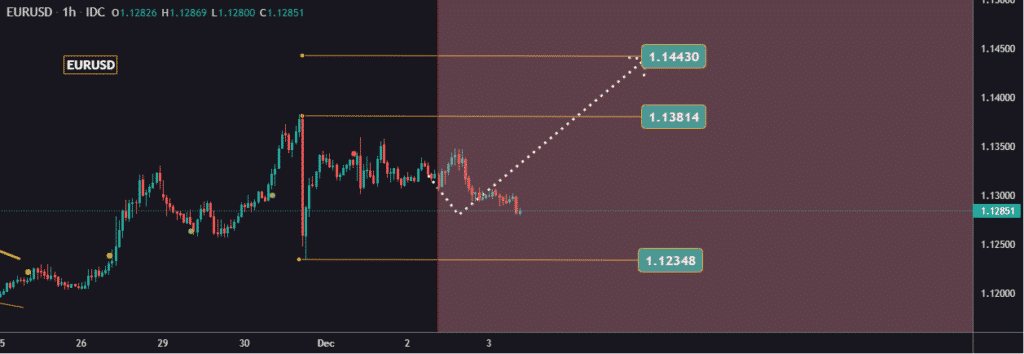

EURUSD below 1.1300

The renewed dollar strength could explain why EURUSD is under immense pressure, having tanked below the 1.1300 level ahead of the European trading session. The currency pair is struggling for direction amid a lack of catalyst from the EU.

A sell-off followed by a close below the 1.1300 level leaves the EURUSD susceptible to a slide to the 1.1250 level, seen as the next support level. A breach of the support level would leave the pair vulnerable to a slide back to 17-month lows of 1.1185.

On the flip side, a bounce-back followed by a close above the 1.1300 mark could attract bids on the pair after the recent bounce back. To the upside, EURUSD faces strong resistance near the 1.1370 level, where it’s been rejected in the recent past.

The Euro sentiments have received a significant boost on the unemployment rate easing in November, favoring European Central Bank hawks. Looking ahead, the focus is on a speech by the ECB president Christine Lagarde and Eurozone Retail sales data, which could trigger volatility. However, the NFP report during the New York session is likely to influence extreme price action activity.

AUDUSD under pressure

Meanwhile, AUDUSD remains pressured at one-year lows as risk sentiment soured in Asia on Friday morning. The pair is clinging for support near the 0.7070 level as fears over the spread of the Omicron variant continue to send traders into safe havens.

A close below the 0.7060 level could trigger renewed sell-off that could see AUDUSD tanking to the 0.6970 mark, the next key support level. The 4-hour chart already hints at further sell-off as the pair continues to trade below bearish moving averages.

In addition to Omicron concerns, AUDUSD’s bearish momentum continues to be fuelled by disappointing economic data out of China. The latest is the drop in Chinese Caixin Services PMI to 52.1 in November versus 53.8 registered in October.

Oil prices bounce back

In the commodity market, oil prices edged higher on Friday morning but remained below the pivotal 80 a barrel level. US West Texas Intermediate was up 1.8% to $67.69 as Brent crude rose 1.7% to $70.86 a barrel.

The spike in oil prices follows remarks by OPEC that it is open to reviewing supply additions at its next meeting should the Omicron variant dent demand. However, oil prices are still on course for the sixth week of losses.

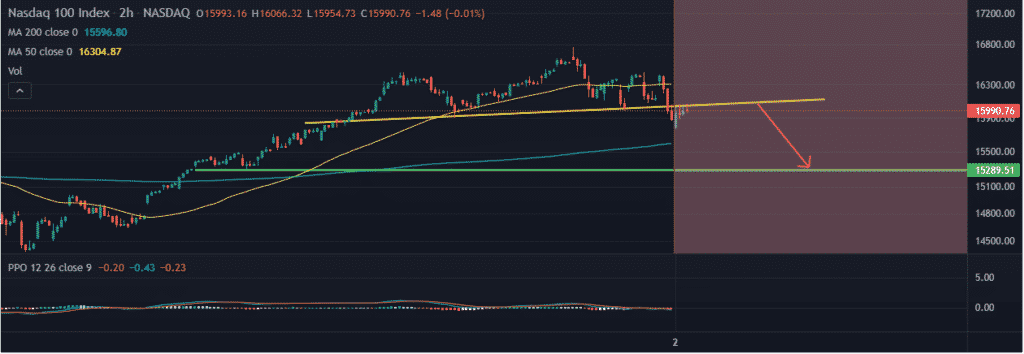

US indices recovery

US benchmark indices snapped two days of losses to edge higher on Thursday in the equity markets. The Dow Jones Industrial Average jumped 1.8% to 34,639, as the S&P 500 jumped 1.4% to 4,577. Tech heavy Nasdaq was up 0.8% to 15,381.

However, the indices are poised to remain flat for the week as caution grips the market amid the spiraling Omicron variant concerns. The US has already started ramping up measures to try and tame its spread.

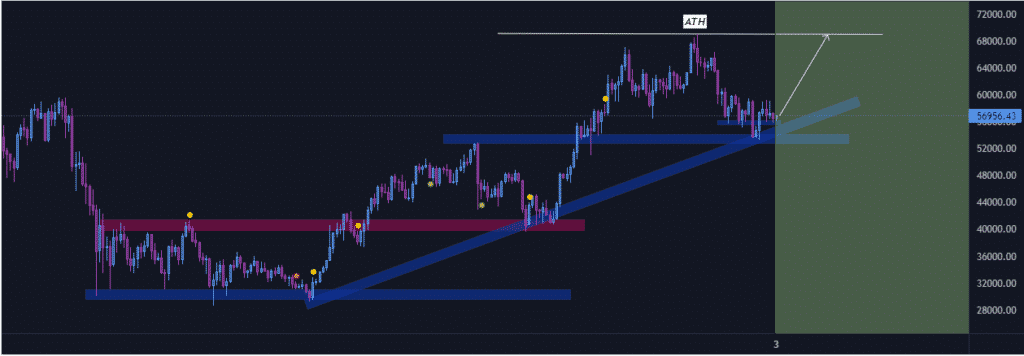

Bitcoin and Ethereum bounce back

Bitcoin and Ethereum are in recovery mode after two days of losses in the cryptocurrency market. BTCUSD has powered to session highs of $56,900 and faces strong resistance at the $57,330 level.

ETHUSD, on the other hand, appears to have found support at the $4,478 level, having powered to highs of $4,590. A breakout above the $4,600 could pave the way for the crypto to make a run for record highs of $4,860.