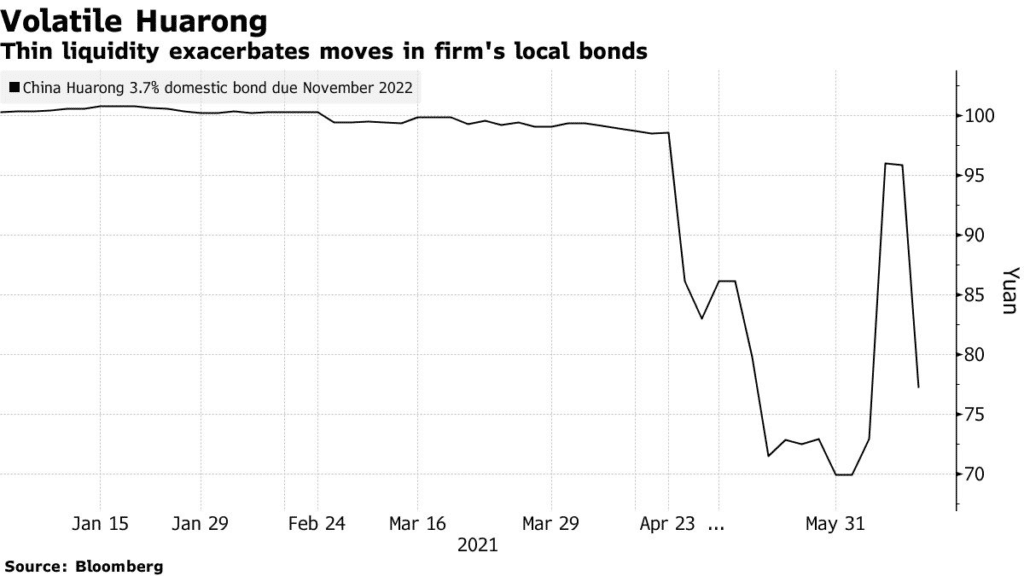

(Bloomberg) Wide spreads and low trading volume have been reported on China Huarong Asset Management Co. onshore bonds. On Tuesday 11 a.m. traders failed to agree on the price of a bad-debt asset manager, as no bids for the bonds were placed.

The bond offers now range between the price of 70 Yuan and 80 Yuan, with some managers reported posting lower bids of about 50 Yuan amid depressed demand.

The high spreads are making it challenging for bondholders to sell large positions and potential investors taking a significant position in the bonds.

The limited trading on the onshore bonds is said to have made it difficult to value them even as investors continue to see high risk in them.

High volatilities are also likely when trades are made due to the low liquidity.

Huarong has not given sufficient clarity on the steps it will take to address the debt issues.

2799: HK sheds -1.92%.