(Bloomberg) London’s market watchdog is seeking to put an end to premium and standard listings to revive declining initial public offerings.

The regulator is reportedly seeking to create a single category for companies seeking to list in London. Creating a single category is seen as appropriate in attractive startups and increases London’s attractiveness in the post-Brexit era.

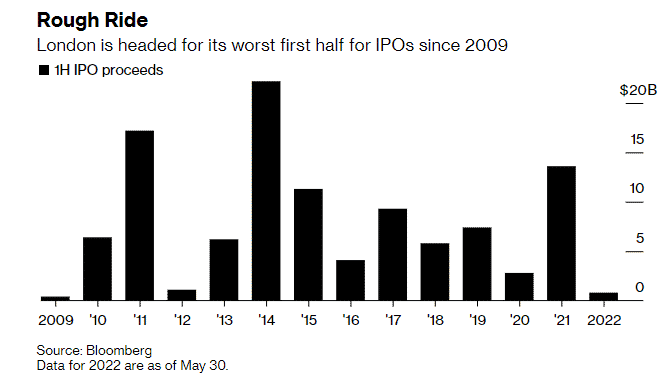

The move amid a declining IPO market in London. The market is set for its worst performance since 2009 in the first half of this year. Only 604 million pounds or $764 million has been raised so far this year.

The target comes after a proposed rule change that allowed founders to retain control of entities after listing failed to provide the anticipated boosts. Further headwinds have emerged from the decline in high-growth stocks in the high-interest environment.

Robin Walker, an IPO specialist at Equiniti Group Plc, says simplifying the process and eliminating some costs are insufficient. He says London competes with the US, Stockholm, and Amsterdam in attracting listings.

London is also seen losing IPO ground after the Brexit vote. Bourses in Sweden and Netherlands are closing the gap over the last years, while many British firms are lured by higher capital and more valuations overseas.

Susannah Streeter, a senior analyst at Hargreaves Lansdown Plc, says more work needs to be done to attract IPOs to London. She mentions the idea of shifting from the old-fashioned prospectuses and allowing more entry of retail investors into the IPO market.

FTSE 100 is up +0.21%.