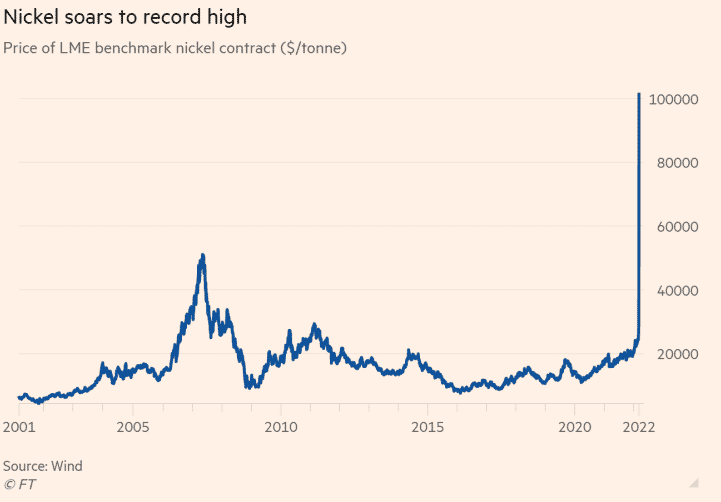

(FT) The London Metal Exchange banned trading in nickel contracts on Tuesday as prices rose past $100,000 per ton.

The price rally follows moves by the market to cover short positions after Western countries continued imposing sanctions against Russia, threatening supply.

LME says it took the decision to create orderly market grounds, even as buyers scrambled for the metal that is used to make stainless steel and electric vehicle batteries.

LME has promised to actively plan for the reopening of the nickel trading, saying it will announce the mechanics very soon. The exchange says it will make arrangements to tackle the pending deliveries.

Prices of Nickel have quadrupled in the past week even as the escalating curbs threaten supply for the already low-inventory metal. The price of the metal rose by more than 70% on Monday.

Russia supplies around 10% of the world’s nickel. Russia’s Nornickel also dubs as the world’s largest supplier of battery-grade nickel, with around 15% to 20% of the total supply.

NICKEL1! is up +5.97%.