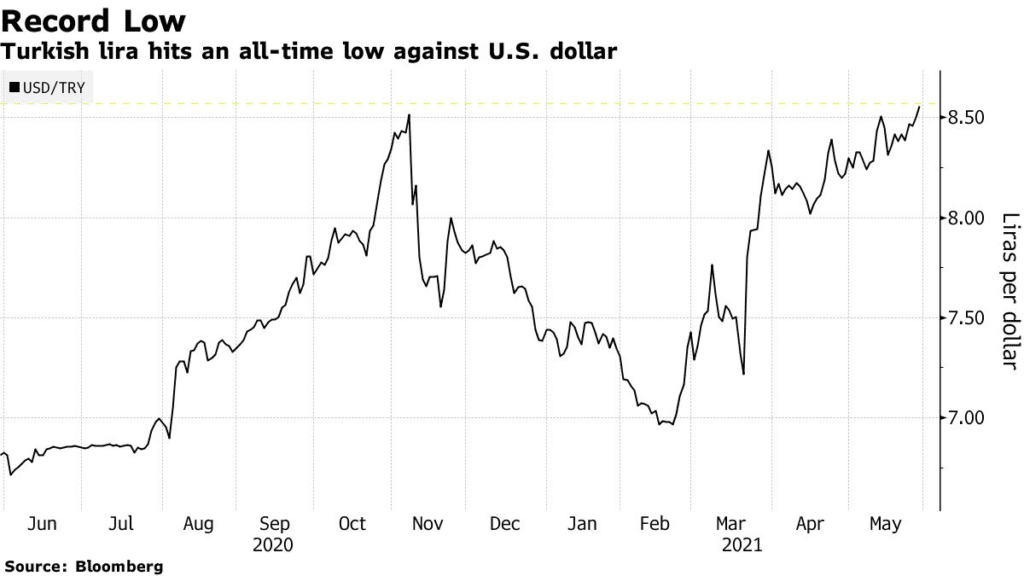

The Turkish Lira sank about 1.1% to trade at 8.5981 per dollar on rising concerns of loose monetary policy, according to Bloomberg. Investors grew worried of inflationary pressures on loose monetary policy pushing the currency to a record low.

Lira’s plunge was also fueled by large purchases of dollars on local accounts to settle foreign debt.

Turkey’s central bank maintained its benchmark rate at 19% citing price gains at the peak.

The Lira has now lost at least 13% in 3 months, the most in an emerging market that could open up opportunities for higher prices.

Turkey’s consumer inflation rose 17.14% in April, the seventh month of increase as energy prices surged higher.

Lira is exposed to changes in investor sentiment as real policy rate remains below 2%.

Turkey’s currency weaknesses come at a time Turkey faces geopolitical conflict with the NATO allies following Belarus’s forced landing of a plane.

Lira has been under pressure since the ouster of hawkish central bank governor Naci Agbal.

Lira is currently declining against the dollar. USDTRY is up 1.14%