(Bloomberg) The Turkish lira fell up to 3.1% against the dollar on Thursday, breaching the psychological barrier of 15 as sentiment was dampened by projected further rate reduction by the central bank.

Investors are expecting that Turkey’s central bank will cut its one-week repo rate by another 100 points to a low 14% amid rising inflation, which hit 21.3% in November.

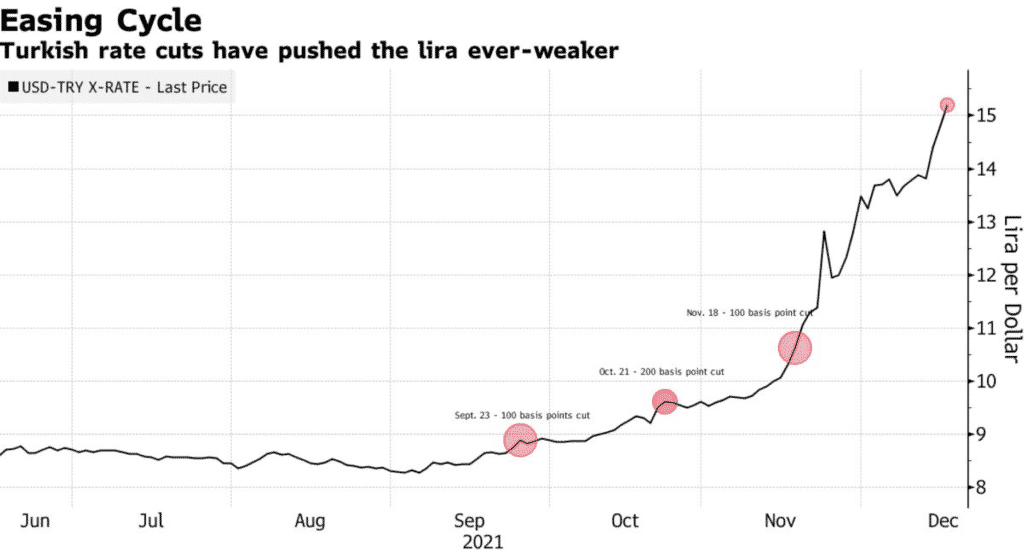

Turkey’s central bank officials have so far reduced the key rate by 400 basis points since September, with President Recep Tayyip Erdogan expecting the moves to create jobs and support the economy.

The Lira has fallen more than 40% since the central bank initiated rate reduction, making it the worst performer in the emerging world.

Lira reacts. USDTRY is up +2.56%.