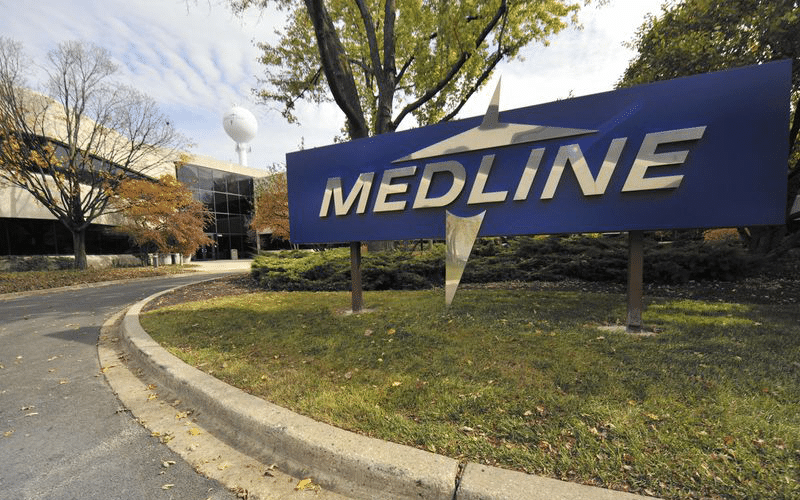

(WSJ) Three companies that include Blackstone Group Inc. have agreed to acquire Medline Industries Inc. The deal values the target at more than $30 billion.

Analysts see the acquisition of Medline as a sign of return of buy-out deals as private-equity firms look to invest resources in the recovering economies.

Buyout firms are estimated to have at least $1.6 trillion of cash that awaits deployment.

Large buyouts declined after several targets underperformed and filed for bankruptcy following the financial crisis.

The deal, which also included Carlyle Group Inc and Hellman & Friedman LLC, would be the biggest leveraged buyout transaction since the 2007-2008 financial crisis.

Mergers and acquisitions have become popular, with about $1.24 trillion deals executed this year, up at least four times from the same period last year.

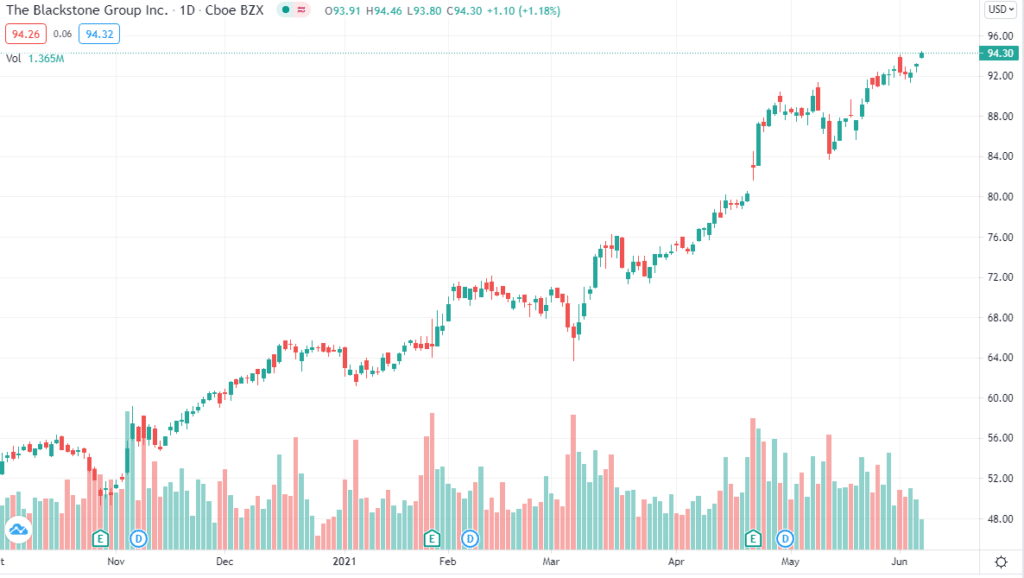

BX: NYSE is up 1.23%