Leon Cooperman saw it fit not to sell off some assets, perhaps because he anticipates the market to turn bullish. We looked at the latest developments of Omega’s holding in the previous part. Below, let’s look at some of the companies in which Omega Advisors reduced shareholding.

In Mr. Cooper Inc. (COOP)

Omega trimmed its shareholding to 4.245 million shares, down from 4.998 million shares at the end of 2020. The trimming, nonetheless, barely dented Omega Advisors’ share of the company, which remains almost level at 4.75%, and it still stands tall in its portfolio on the first position.

COOP’s stock performance has been positive year-to-date; the stock is up 14.34% year-to-date. Its EPS was positive in Q1 2021 at $5.92, increasing from $2.0 posted in the same quarter last year.

Perhaps Omega’s reservations with the stock arise because it has shed 4.57% in valuation since mid-March this year.

Another issue impacting Mr. Cooper’s financials is the late April 2021 incident where a system test resulted in an accidental issuance of mortgage payment drafts to consumers. The company clarified that the incident wasn’t a security breach and committed to reimbursing any victims. Sadly, Mr. Cooper will spend substantial funds to correct the error, especially in reimbursing fees.

This event is expected to shave off a sizable amount of funds from the company’s upcoming revenue numbers.

Trinity Industries, Inc. (TRN)

The hedge fund reduced the shareholding in the company by 28.87% to stand at 2.15 million shares from 3.02 million shares at the end of 2020. TRN now descends a few rungs in the Omega portfolio to position nine.

The last few months have been challenging for Trinity Industries if the latest financial figures are anything to go by. The company posted Q1 2021 EPS of $0.03, missing estimates by $0.02. Notably, the revenues declined 35.2% YoY to $398.8 million.

However, the stock has been on an upward trend and increased by 39.66% on March 31, 2021, from July 03, 2017. Operating income was down to $60.2 million versus the consensus estimate of $62 million.

Amazon.com, Inc. (AMZN)

Omega ended 2020 with 11,500 shares of Amazon.com. As of March 31, 2021, the shareholding was down 13.04% to 10,000 shares. The transaction earned Omega Advisors a little over $5.3 million in profits.

New Senior Investment Group Inc. (SNR)

Here is another target for stake-slashing by Omega Advisors. The hedge fund sold off 710,000 shares, bringing down its shareholding to 4.29 million shares. The transaction earned Omega an $830,000 profit. SNR has been struggling lately, with its revenue in Q1 2021 coming in at $78.7 million, an 8% drop.

Magnolia Oil & Gas Corporation (MGY)

Omega reduced its shareholding by 16.72% in the company to stand at 1.99 million shares. Cooperman based this decision on the Q4 2020 results since the EPS per share for FY 2020 reduced to a negative $0.727.

Table 1: Magnolia Oil & Gas Corporation (latest financials)

| Q4 2020 | Q4 2019 | FY 2020 | FY 2019 | |

| Total Revenue (millions) | $149.24 | $229.71 | $534.51 | $936.14 |

| Net Income (Loss) (millions) | $42.01 | $13.63 | ($1,868.98) | $85.01 |

| EPS Per Share | $0.16 | $0.05 | $(7.27) | $0.28 |

In Q1 2021, MGY posted $0.37 EPS, $0.08 above estimates. Revenue in the same quarter grew to $207.66 million, an increase of 14.5% year-on-year. Nevertheless, Leon Cooperman and his team saw fit to trim 400,402 shares.

Ocwen Financial Corporation (OCN)

Omega reduced its shareholding at OCN by 15.51% to stand at 1.99 million shares, bringing Cooperman’s share in the company to 8.55%.

The latest figures show that Ocwen Financial managed to generate $11.6 million in pre-tax income in Q1 2021, unlike the $87.3 million pre-tax loss made in Q1 2020.

Also, the company’s adjusted pre-tax income for the quarter came in at $6.6 million, making it the sixth quarter in a row that OCN recorded a positive adjusted pre-tax income figure. Despite the improvement, Omega’s decision-makers opted for shedding 136,376 shares.

Surgalign Holdings Inc. (SRGA)

Here is another target for partial divestment, where Omega sold off 759,049 shares, representing 39.76%. The new shareholding stands at 1.15 million shares.

Omega’s decision seems to have been informed by Surgalign’s poor financial run in Q1 2021; EPS came in at -$0.15, $0.03 lower than market estimates, and revenue came in at $23.29 million, a decline of 14.1% year-on-year.

Financial companies

- Navient Corp (NAVI) is another finance stock where the fund cut its stake by shedding 169,041 shares to 3.14 million shares worth over $44 million.

- Gamco Investors Inc (NYSE: GBL) is an investment advisor. Omega sold off all its stake in the company. Another finance company where the fund sold off its stake in Associated Capital Group Inc (NYSE: AC).

Cooperman maintains a stake in a few high-value tech stocks

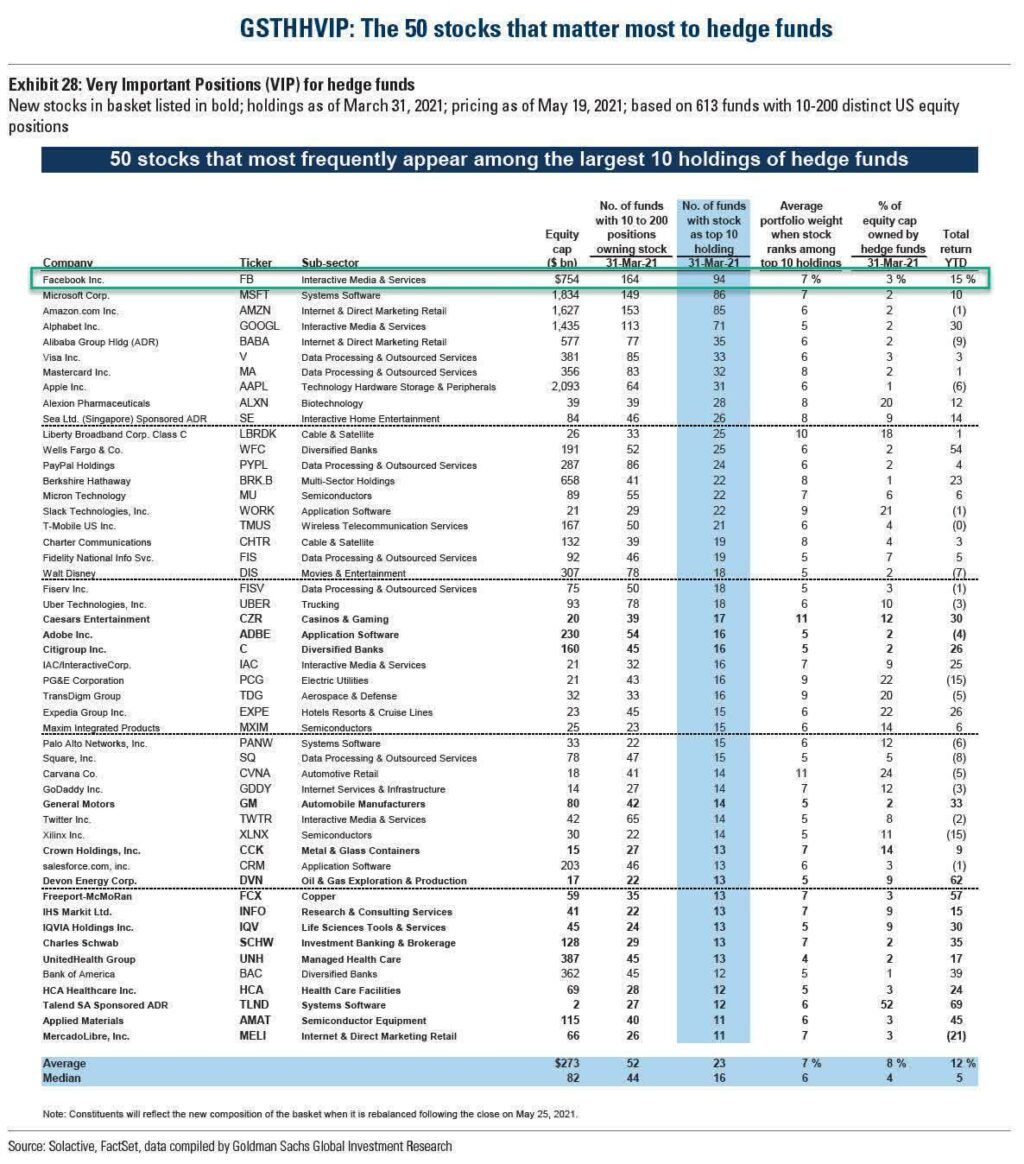

Omega might have shed off just 1,500 AMZN shares, but the likelihood of a further sell-off is high. This is because Amazon.com Inc. is falling out of favor for several hedge funds, as the Goldman Sachs Investment Research team found.

According to the team’s list of stocks in high demand by hedge funds, dubbed Goldman Sachs’ Hedge Fund VIP List, AMZN, Alphabet Inc. (GOOGL), and Microsoft Corporation (MSFT) miss out on the top 10 holdings of prominent hedge funds.

Nevertheless, Amazon remains an essential asset for the hedge fund; the stock is among the top 20 Omega Advisors’ investments and makes up 1.93% of its portfolio.

On the other hand, Alphabet Inc. (GOOGL) is the second largest of Omega’s investments. It makes up 7.72% of the hedge fund’s portfolio. Omega holds 60,000 shares of Alphabet Inc., which it acquired in mid-2015. Since then, the value of shares has increased by 322.26% as of May 21, 2021.

Microsoft Corporation (NASDAQ: MSFT) is another of Omega’s essential investments, which sits at position 10 in the list of assets. Omega Advisors has 245,705 MSFT shares whose valuation amounts to $57.9 million or 3.61% of the entire portfolio. The stock’s return on investment (ROI) was 451.56% as of May 21, 2021.

Conclusion

If there is one mandatory take-home from Cooperman’s investing strategy, it is portfolio diversification. A closer look at Omega Advisors’ portfolio exposes interests in various companies drawn from a myriad of sectors.

It is worth noting that Omega initially had a strong interest in the energy sector, but this is changing. Now, the hedge fund is pivoting to finance and tech stocks.

Additionally, Cooperman strives to keep the share of the hedge fund’s portfolio for each asset low. For instance, Mr. Cooper Inc. is the hedge fund’s most valuable asset, yet it consists only 9.21% of the portfolio. In short, Mr. Cooperman is willing to take risks, but he hedges them by spreading his funds as thin as possible.

To the beginning: Part I.