(Bloomberg) JPMorgan strategists say small cap stocks and cyclicals are attractive buys after the recent dip, pointing out that they have already priced for an unlikely economic recession.

Led by strategist Marko Kolanovic, the strategists say the recent sell-off on small stocks and cyclicals is overdone, opening a buy on the dip.

Kolanovic has dismissed investor concerns over Fed’s policy tightening, saying such fears are misplaced. The analysts project an above-trend economic growth and corporate earnings amid the central bank’s rate hike.

The strategist says the equity market could see a reversal of systemic outflows and a rise in buyback activity amid the jitters of hike policy by the Fed.

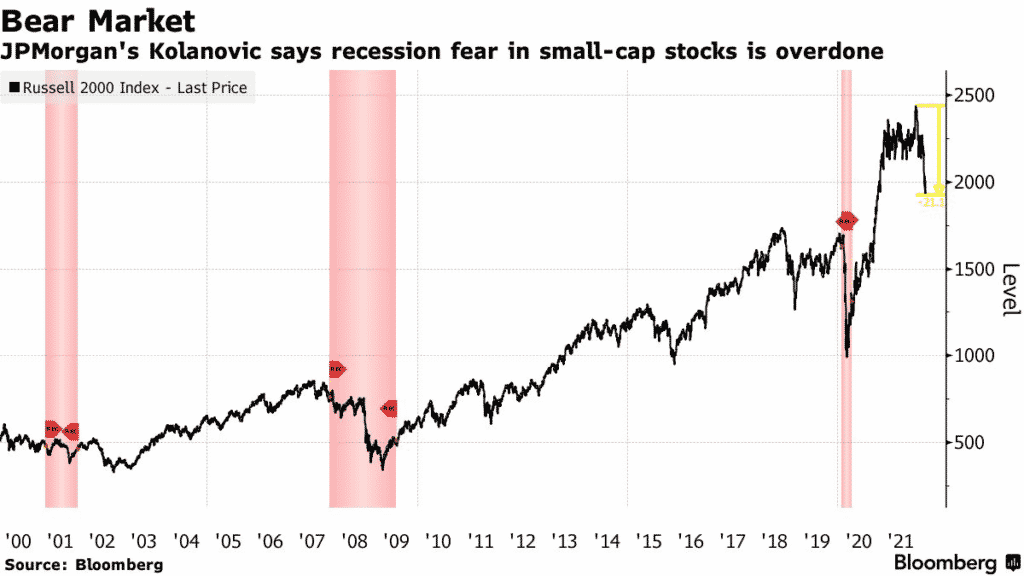

Russel 2000 dropped last week due to fears of policy tightening by the Fed, taking losses to 20% from the peak, before recovering some losses since Friday.

Russell 2000 Index is currently up +3.05%.