Avi Hooper, Invesco Ltd.’s senior portfolio manager, sees unsustainable yields on Canadian bonds, according to Bloomberg. Hooper says the bonds have risen too far and too quick, failing to match the reality of the Canadian economic recovery.

Canada’s 5-year benchmark bond has jumped higher and has the biggest nominal yields compared to peers.

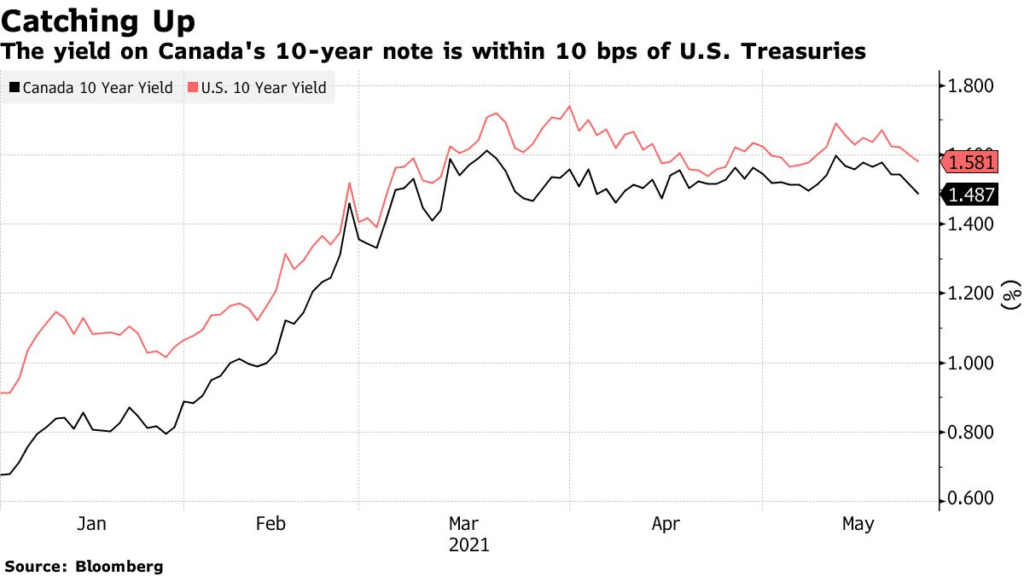

10-year note yields have more than doubled this year, to marginally below 1.5% as of Tuesday, to remain within 10 basis points of U.S Treasuries.

The yield’s rise in Canadian bonds happened amid rising commodity prices and higher inflation.

Canada has been slow to match peers such as the U.K and U.S in Covid vaccinations raising concerns over economic recovery.

Hooper says expectations by the Canadian central bank of an increase in interest rate next year are premature.

Canada 10-year bond yield is currently 1.458%.