Prices of China’s industrial commodities dropped on Thursday following the government’s warning on market crackdown, according to Reuters. Steelmaking ingredients including iron ore and coking coal as well as steel products shed at least 5%.

China’s crackdown aims to stop escalating material prices which are hampering economic revival

Traders offloaded supplies, placing bets that the crackdown will lead to drawback in metals.

China aims to restore commodity supply and demand control to address high prices and weed out behavior that drive up costs.

Senior economist Wood Mackenzie says measures such as imposition of state reserve will help balance supply and demand.

A ANZ analyst believes that steps to tame steel production and exports might not aid in containing price as falling iron ore inventories emulate strong underlying basis.

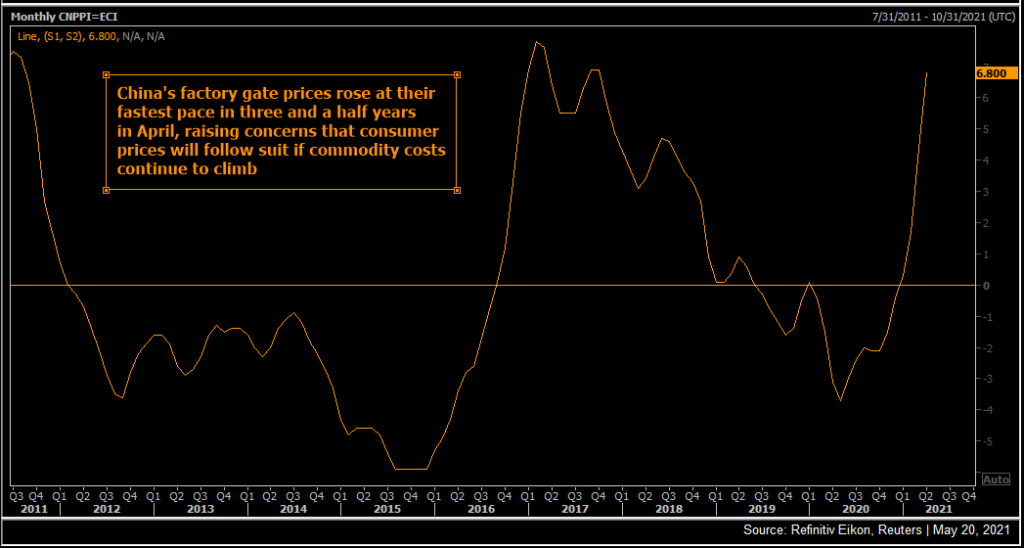

Factory gate prices rose last month at the fastest pace in more than three years raising inflationary concerns in the commodity market.

Major commodities are currently declining. HG1! is down 0.29%, STEEL is down 4.19%, FEF1! Is down 0.31%