ICMarkets is one of the largest forex brokers in Australia, established in 2007 for all investors globally to trade on its cutting-edge trading platforms. It’s providing its clients with spreads from 0.0 pips. The company’s website is designed in a restrained style. The information is categorized to make it easier to find and get to know the company. The site has 12 languages, but those who want to read analytics, use a trader’s calculator or watch video lessons will first learn English.

Pros

- Low forex fees

- No deposit/withdrawal fee

- Highly customizable trading platforms

- Quick and seamless account opening

Cons

- No 2-step authentication for more security

- Few market products

- High CFD fees

The broker is owned and run by the Australia-based International Capital Markets Pty. It was founded in 2007 by a team of financial professionals whose aim was to provide a trading solution for both retail and institutional investors.

Over the years, IC Markets has grown to become a leading FX broker in Australia and Asia-Pacific. Its popularity is fueled by the high leverages and the low spreads it offers to its Australian clients.

Clients have at their disposal 64 currency pairs, 17 indices, 19 commodities, over 100 CFDs for stocks (ASX, Nasdaq, and NYSE exchanges), ten cryptocurrencies, as well as bonds. The minimum recommended deposit is $ 200.

The broker is well regulated by different bodies so that investors can trade on the platforms without worry. Overall, the broker is built on core values such as integrity, trust, and transparency, to boost its credibility in the financial sector.

Regulation

The broker received its first license in 2009 from the Australian Securities & Investments Commission (ASIC). As the broker extended services to other regions, it got more approvals and regulations from supervisory bodies in those regions.

Currently, the broker has the following regulations in different territories.

- It’s registered and supervised in Seychelles as Raw Trading Ltd by the Financial Services Authority of Seychelles under License number SD018. This registration authorizes the broker to conduct financial services business.

- In Australia, IC Markets is registered as International Capital Markets Pty Ltd by the Australian Securities & Investments Commission (ASIC) under license №335692.

- It’s registered in Cyprus as a limited corporation, supervised by the Cyprus Securities and Exchange Commission under License №362/18.

- In the Bahamas, the broker is registered and overlooked by the Securities Commission of the Bahamas under license №SIA-F214.

The broker also complies with other policies and procedures that guide the segregation of client funds and anti-laundering money. In addition, external audits are conducted regularly to ensure full compliance with all the regulations imposed on the broker.

Account Types

The broker provides three separate accounts with pricing models to suit all traders. They include the cTrader Raw Spread account, the Raw Spread account, and a Standard account. It also has an Islamic account for its Muslim investors.

cTrader Raw Spread account

- Trading tools available — 64+ currency pairs + 15 CFDs

- Trading Platform — cTrader

- Spread — from 0.0 pips

- Leverage — 1:500

- The commission per lot size — $3.0

- Base currencies — USD, GBP, CAD, CHF, AUD, SCG, EUR, NZD, JPY & HKD

- Minimum order size — 0.01

Raw Spread account

- Trading tools available — 64+ currency pairs + 15 CFDs

- Trading platform — MT4 & MT5

- Spread — from 0.0 pips

- Leverage — 1:500

- The commission per lot size — $3.5

- Base Currencies — USD, GBP, CAD, CHF, AUD, SCG, EUR, NZD, JPY & HKD

- Minimum order size — 0.01

Standard account

- Trading tools available — 64 currency pairs + 15 CFDs

- Trading Platform – MT

- Spread — from 0.6 pips

- Leverage — 1:500

- The commission per lot size — $0

- Base Currencies — USD, GBP, CAD, CHF, AUD, SCG, EUR, NZD, JPY & HKD

- Minimum order size — 0.01

How to open an IC markets account

On the broker’s official website, find the “start trading” icon. Click on it. Then, fill the form and provide all the required details. In the next step, choose the account type you want and the base currency.

IC Markets will ask you a few questions regarding your previous trading experience to get to know you. After that, upload the required documents to verify your account. You can now fund your account and trade.

Fees and Commissions

The three account types vary in the number of fees charged. For example, the cTrader Raw Spread account and the Raw Spread account are both commission-based accounts, while the Standard pays fees as spreads.

For commission-based accounts, a charge applies to any buying or selling activity on the market products. As a result, the spreads on these accounts are very narrow and go as low as 0.0 pips. On the other hand, a standard account has wider spreads starting from 0.6 pips but pays no commission.

If you consider the trading fee for FX, the charges will be like this. A standard account pays a fee equivalent to the spread + 1 pip. For example, if the spread is 0.2, then the charge will be 1.2 pips. Thus, the Raw Spread account pays a commission of $7 for a standard lot, and a cTrader account pays $3 per standard lot.

Other fees on the broker include:

- Currency conversion fee

- Stock borrow fee

- Charges for using platform tools like ZuluTrade

The broker doesn’t charge any fee for deposits, withdrawals, and inactivity.

Payment options

IC Markets allows many base currencies so that you can evade the conversion fees while depositing and withdrawing.

Deposit

You can deposit a minimum amount of $200. The broker will not charge you any deposit fees.

The accepted deposit methods are:

- Credit/debit cards

- PayPal

- Bank Wire Transfer

- Skrill

- Union Pay

- Bpay

- Neteller

The different methods, especially the e-wallets, vary for other countries, as some offer services in select countries or regions. So, as you make your deposit, choose a way that is available in your country.

Withdrawals

On IC Markets, you can only withdraw to the method you used to deposit your funds. For example, if you deposited via Skrill, then you can only withdraw to Skrill. You won’t pay any fee to withdraw.

Available Markets

The broker offers a robust selection of market products for its clients. They include FX, commodities, indices, bonds, cryptocurrencies, stocks, and futures.

Forex

The FX market has over 65 currency pairs and remains open 24/5. It offers the tightest spreads, fast trade execution, and high leverages of 1:500 to increase market efficiency and profitability.

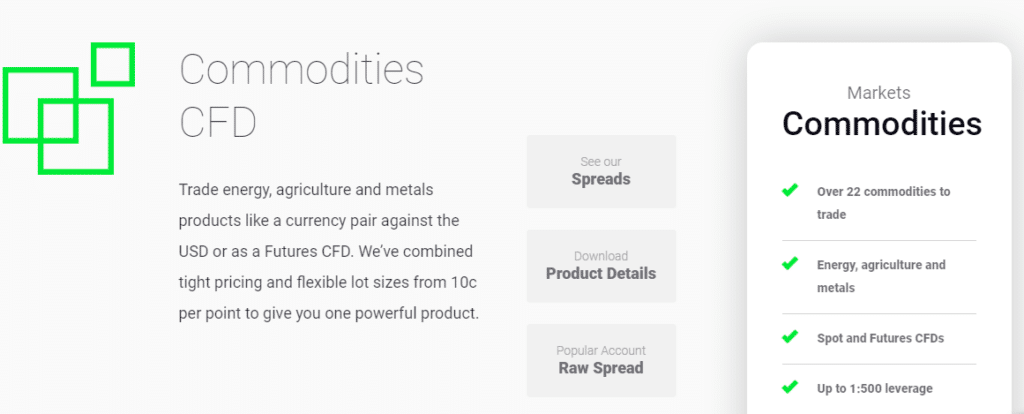

Commodities

There are 19+ commodities to trade on the IC Markets. They include energy products like crude oil, metals like gold and silver, and agricultural products like cocoa and sugar. They pair with the USD and trade at a leverage of 1:500.

Indices

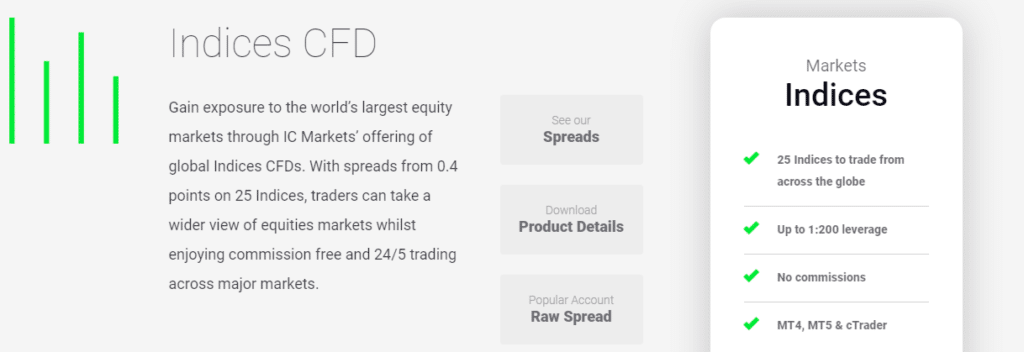

You’ll find 23+ indices in IC Markets, including the popular Australia S&P 200 Index and the UK FTSE 100 Index. The leverage for indices goes up to 1:200 on all trading platforms on IC Markets.

Bonds

IC Markets offers about six bonds on the Meta Trader platforms at a leverage of 1:200. Predict the economic future for governments as you trade short and long positions on the bonds CFDs.

Crypto

Trade over ten popular cryptocurrencies on IC Markets. The supported cryptocurrencies include Bitcoin, Litecoin, Ethereum, Bitcoin Cash, Ripple, Dash, Emercoin, Namecoin, EOS, and Peercoin. The leveraging is 1:5 for the crypto CFDs.

Stocks

There are 120+ stocks on IC Markets, executed exclusively on the MT5 platform. The popular stocks include Apple, Facebook, and BHP Billiton.

Futures

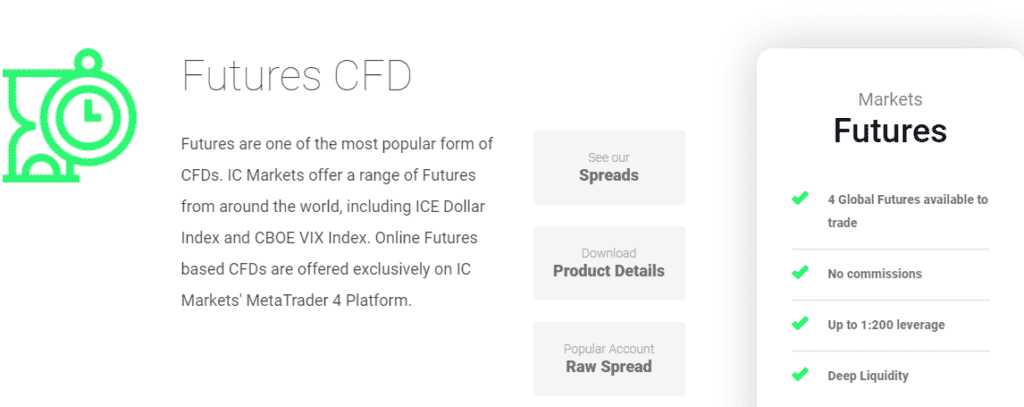

IC Markets has four futures available for trade as CFDs on the MT4 and MT5 platforms. Future CFDs are leveraged at 1:200, and the markets remain open for 24 hours on the five business days.

Trading Platforms

IC Markets allows market accessibility in three trading platforms: MT4, MT5, and cTrader. These platforms are all accessible on the web, desktop, and mobile platforms for convenience.

| MT4 & 5 on the web platform | MT4 & 5 on the mobile app platform | MT4 & 5 on the desktop platform |

| The MT Web Trader has many features to increase its trading efficiency: One-click trade execution No order or trade restrictions Trade micro lots of 0.01 Multiple order types Level II pricing Raw spreads Advanced charting tools and technical analysis Leverage – 1:500 | The MT4 and MT5 platforms on the mobile app allow traders to access the markets on the go. The features include: Real-time CFD and forex quotes Multiple order types Different order execution modes Over 30 popular technical indicators Three chart types: Japanese candlesticks, bars, line charts Interactive charts (real-time) with zoom and scroll Trading history available ZuluTrade for copy trading Price action and pattern | The features include: One-click trade execution No order or trade restrictions Trade micro lots of 0.01 Multiple order types Level II pricing Raw spreads Advanced charting tools and technical analysis Leverage — 1:500 Personalized trader dashboard |

cTrader Trading Platform

The cTrader is available on the web and mobile platforms. These platforms have features that ease trading for the investor. It supports different languages like English, Russian, German, Greek, Italian, Arabic, Polish, Korean, French, Portuguese, Turkish, Spanish, Vietnamese, Hungarian, and Japanese.

| WebTrader | Mobile app |

| The features include: No order or trade restrictions Trade micro lots of 0.01 Multiple order types Level II pricing Raw spreads Advanced analysis tools Leverage — 1:500 Ultra-Low latency execution No dealing desk intervention 16 indices | The features include: Spreads from 0.0 pips Raw Pricing Single-tap order execution Create a favorite list of symbols and rates Fast execution View trading history View and modify pending orders Total balance, margin, and P&L information |

Features

The broker has many features and add-ons that boost one’s trading experience. Some of them include:

- The daily market commentary — shows the latest news on the FX market daily.

- Trading central — checks the frequently used tools and provides you with relevant trading ideas.

- Auto-chartist — it is an auto-trading tool with accuracy and high-speed capabilities for efficient trading.

- Economic Calendar — serious traders use this feature to plan their trading and avoid losses.

- Newsfeed — it shows market news and other sentiments from sources like ForexLive.

- Social sentiment-currency pairs — it helps gauge the trader’s mood and readiness to risk their portfolios.

- Copy-trading — the mobile app supports copy trading tools like ZuluTrade.

Education

IC Markets has organized a complete 101 series, which covers the following topics:

- FX trading 101

- Trading psychology 101

- Fundamental analysis 101

- Trading plan 101

- Technical analysis 101

- Risk management 101

It also has a demo trading account for practice. Platform tutorial videos come in handy in explaining how the platform works.

The broker has archived client webinars and an investor dictionary that investors can use to learn their craft. All these materials are accessible in the education section on the site.

Customer Support

You can access customer service through a live chat on the platform, phone support, and email support. The phone support is fast and reliable. You get connected to a representative in about a minute, and your questions are answered without a rush.

The customer service responds to the emails within 24 hours. They are suitable for questions that require lengthy explanations and illustrations. The support team ensures that your questions are thoroughly answered.

The live chat takes about 10 minutes to get a reply from a representative. This is relatively slow, considering that a live chat should get instant responses.

There’s also a comprehensive FAQ segment that answers most questions. Be sure to check the section before contacting support, and you may get help there.

Review Summary

IC Markets is a suitable FX and CFD broker for all traders. The wide range of market products allows you to trade on your preferred CFDs and scoop profits from the market. Take advantage of the demo account to practice before trading on the live account. The many features on the platforms will make trading easier for you.

On the other hand, the broker lacks extra account protection like 2-step login verification. Also, trading CFDs is risky, so there is a possibility of making losses if proper risk management actions are not taken.