Huckster is an expert advisor that uses artificial intelligence for identifying accurate entries and exits. It is a fully automated FX robot compatible with the MT5 platform. The ATS uses an algorithmic strategy to ensure profitable results. As per the author, the system is designed to mimic the trades of a professional trader. It works on multiple currencies and timeframes and can provide a good risk-reward ratio, according to the developer.

You can purchase this FX EA for $499. The author mentions that the price will soon increase to $999. A free demo is present for the system. There are no other details present on the features you get with the package. No money-back guarantee is present, which makes us suspicious about the reliability of the product. When compared to the price of competitor systems, we find the pricing is expensive.

Huckster trading strategy

According to the explanation provided by the author, the system works based on artificial intelligence. Before opening a position, the EA meticulously assesses the market conditions on three timeframes namely daily, H4, and H1. While the author states that the ATS does not use risky approaches like the grid, Martingale, etc. he does not provide a proper explanation of the strategy used.

Huckster features

Important features of the expert advisor that make it competitive as per the developer are:

- It uses artificial intelligence to identify accurate trades

- A smart news filter helps to protect the capital

- The FX robot is not broker sensitive and hence can be used on any broker

- It is suitable for use in prop firms such as MFF, FTMO, etc.

- The FX robot uses custom-made trend and volume indicators as additional tools

- This ATS works on EURUSD and the EUR minor pairs, namely EURGBP, EURNZD, EURCAD, EURCHF, EURAUD, and EURJPY

- The H1 timeframe is recommended by the author

- A hedge account is needed for the proper functioning of the FX EA

Huckster backtesting results

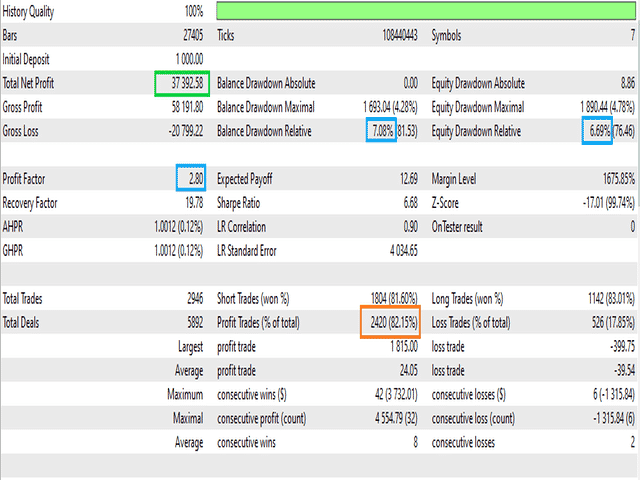

A backtesting result is present for the FX robot on the MQL5 site. Here is a screenshot of the result:

From the above stats, we can see the EA had generated a total net profit of $37,392.58 for an initial deposit of $1000. A total of 2946 trades were executed with a profitability of 82% and a profit factor of 2.80. The maximum drawdown was 4.28%. From the results, it is clear that the drawdown is low, indicating a low-risk strategy. The profits are high, indicating good performance.

Huckster live trading results

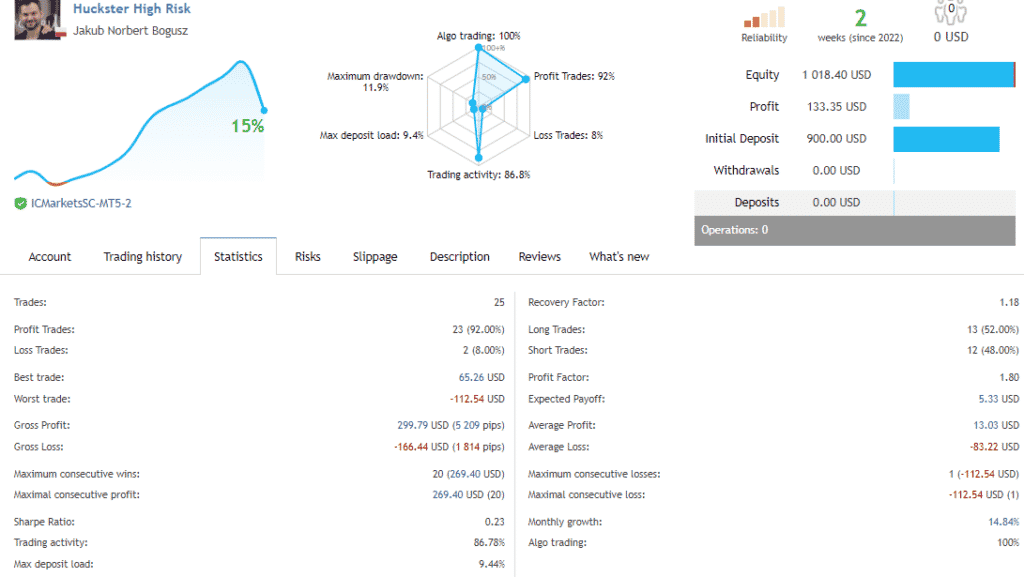

A real live USD account is present for the FX robot on the MQL5 site. Here is a screenshot of the trading stats and growth curve:

From the above stats, we can see the account shows 14.84% growth for an initial deposit of $900. For the account that started on June 6, 2022, the number of trades executed is 25 with a profitability of 92% and a profit factor of 1.80. The maximum drawdown for the account is 11.9%. From the low drawdown, it is clear that the strategy used is not risky. Similar results were seen in the backtesting results. However, since the sample is very small, the results may be random and prevent us from making a proper evaluation.

Huckster reputation

Jakub Norbert Bogusz is the author of this FX robot. He is based in Poland and has experience in developing MT4 and MT5 EAs and indicators since 2014. He also has Python coding experience. He has created 6 products and 5 signals. For this FX EA, he claims that it has been designed after several years of trading and the input of experienced professionals based in Warsaw, Poland. To contact the developer, you need to use the private messaging option on the MQL5 site as the author does not provide other communication methods.

There are 14 reviews for the MT5 version with a rating of 4.69/5. Although most of the reviews are positive, we could not find third-party (Forexpeacearmy, Trustpilot, etc.) verified feedback to confirm the authenticity of the testimonials.

Huckster review summary

- Strategy – 4/10

- Functionality & Features – 4/10

- Trading Results – 3/10

- Reliability – 4/10

- Pricing – 4/10

Huckster is an expert advisor using algorithmic trading and artificial intelligence for accurate entries and exits. The developer provides a backtesting report and real trading results for the FX EA. While the backtesting report shows a low-risk approach and decent profits, the small sample size in the real trading results makes it difficult to analyze the system. Other drawbacks we identified in the ATS include the expensive pricing, lack of strategy explanation, and the absence of a money-back guarantee.