(Bloomberg) Discussions of the housing bubble burst are back after the craze for home ownership saw global property prices jump at the fastest rate since 2006.

Low-cost mortgage, desire for more space in post-pandemic era, and migration to regional locations by remote workers have been cited as behind the property market craze.

Annual prices have now risen by double digits, with some analysts warning of frothy markets that have flashed bubble warnings witnessed before the financial crisis.

Analysts say there are risks for the individual and society in the property craze, warning that big mortgages are bound to be defaulted if interest rates rise.

There are also concerns that spending on high priced property could reduce individuals’ disposable incomes and make them retire in debt.

For younger individuals and those with lower disposable income, the uptick in prices means difficulty in buying property that could widen the intergenerational gap.

Concerned regulators project the bullish market to cool down and have dismissed claims of a potential crash saying the boom is caused by decade-long higher lending standards and low rates.

Regulators say property activity is driven by owner-occupiers, rather than investors, which reduces the risk of seizure should prices drop.

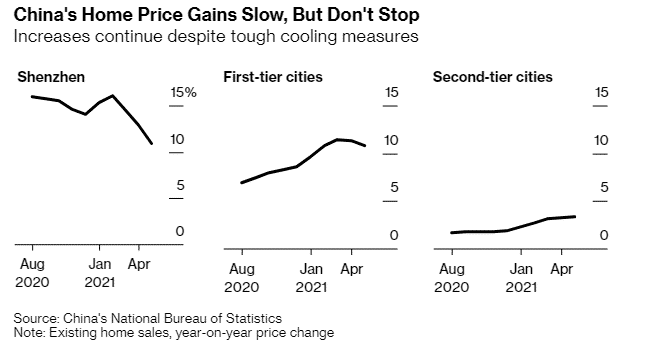

US home prices rose the most in 30 years in April while in China, existing home prices in top-tier cities were up by 10.8% in the year to May as gains were recorded across the globe.