Hippo Trader Pro trades on the EURUSD pair and comes with multiple settings that can be tweaked. The robot is available on the MQL 5 marketplace, where the developer constantly updates it to adapt to the current market conditions. We will review its trend following strategy in our article and look at the backtesting and live records for performance analysis.

Hippo Trader Pro trading strategy

As mentioned before, the EA trades on EURUSD. The algorithm determines the trend using the relative vigor index oscillator and speculates the market at the Asian and European sessions. Traders can run it with a minimum deposit of $1000 with a starting lot size of 0.01.

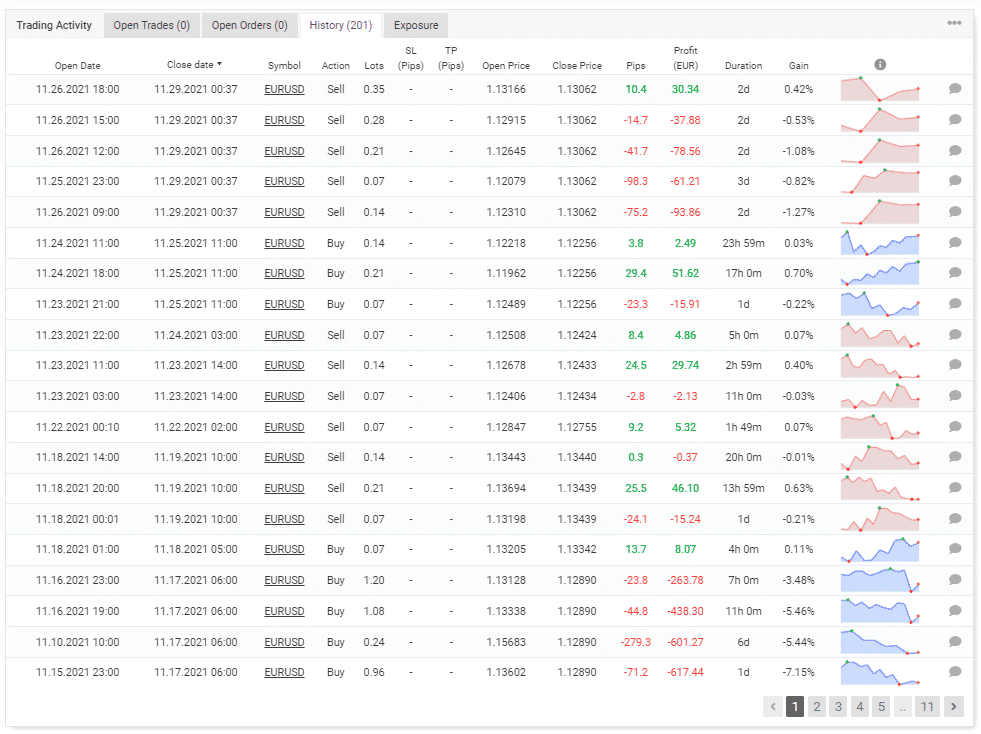

From the history present on Myfxbook records, we observe the methodology of the robot. We observe that it uses martingale and grid to trade with an average holding duration of 2 days. The developer does not state this within the MQL 5 marketplace.

Hippo Trader Pro features

The robot has the following features:

- It comes with both backtesting and live records.

- The developer constantly updates the system.

- Traders can use auto money management.

- The exit points of each position can be entered manually.

- It is possible to set the trading hours.

Price

The software comes with a one-time payment of $299, and there is no money-back guarantee. It is also possible to rent it for one and three months at $199 and $269.

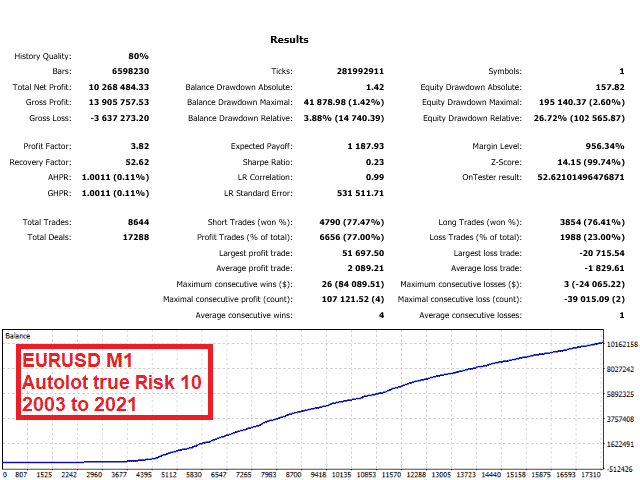

Hippo Trader Pro backtesting results

Backtesting results are available for the EURUSD M1 chart. The duration of the test is 19 years. The developer presents backtesting results by showing multiple images with no detailed statement.

For the period, the robot had a maximum drawdown of 26.72% and turned an unknown initial deposit into $10268484.33. It had a winning rate of 77% with a profit factor of 3.82. The average amount of profitable trades was $2089.21, while the average amount of losing deals was -$1829.61 in a total of 8644 executions. The modeling quality of the test is 80%, with a total of 6598230 bars under observation.

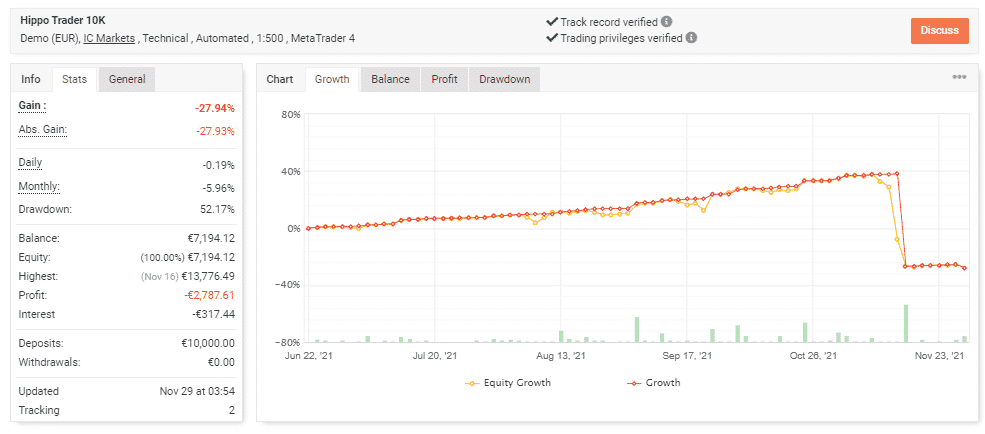

Hippo Trader Pro live trading results

We have live records on Myfxbook that show us information about the product’s performance from June 22, 2021, until November 29, 2021. The system made a total growth of -5.96 %, with a drawdown of 52.17%.

The winning rate stood at 63%, with a profit factor of 0.71. The average profitable trade was €52.52, while the worst was -€128.52 in a total of 202 trades. The records are on a demo account which does not take real market liquidity and slippage into account.

The risk of ruin is high here, where there is a chance to lose 50% of the account’s value within 28 trades. After the substantial loss on the portfolio, the developer stops updating the records.

Hippo Trader Pro reputation

Traders on MQL 5 community are mainly testing out the product on the live account after using it on a backtest. One of the customers is not pleased with the algorithm and gives it a one-star rating.

Hippo Trader Pro review summary

| Strategy | 3/10 |

| Functionality and features | 4/10 |

| Trading results | 4/10 |

| Reliability | 5/10 |

| Pricing | 3/10 |

Hippo Trader Pro has a significant drawdown on the live records where it loses most of the accounts’ value within a few trades. The algorithm is currently standing at a negative gain with no further updates. There are also no reviews from customers who have tested the product for a long time. We can not get an idea on their viewpoint.