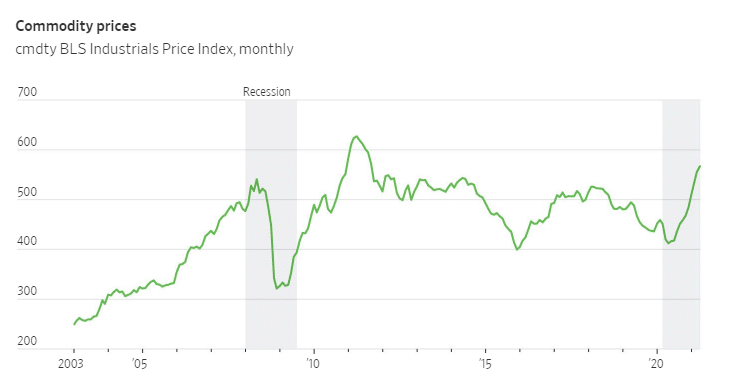

Rising material costs are likely to be reflected on the corporate bottom lines, according to the Wall Street Journal. Analysts say that higher input costs generally accompany broad economic growth, allowing companies to pass added expenses and fatten margins.

Analysts believe commodity prices and the price of manufactured goods have room to run due to governments’ fiscal and monetary stimulus.

The scarcity of raw materials has constrained supply lines, prompting purchasing managers to stockpile inputs, which adds more demand.

Analysts now say those price adjustments are more likely to be accepted in the market when industry-wide and broad-based input cost inflation occurs.

Higher input costs are reflected in the producer-price index, which rose 1% in March and ended the month up 4.2% from a year earlier, the biggest 12 month gain in a decade.