The U.S is recovering faster from the economic shocks of coronavirus than countries in the European Union, according to CNBC. Fiscal stimulus in the U.S has been a critical driver in the faster rebound of America.

Silvia Dall’Angelo, a senior economist at Federated Hermes, cites “Institutional problem” as one of the main issues hindering a recovery in the EU.

Although the EU approved a fiscal stimulus plan that included borrowing 750 billion euros or $892 billion from public markets in July 2020, the money is not yet available in 27 member states.

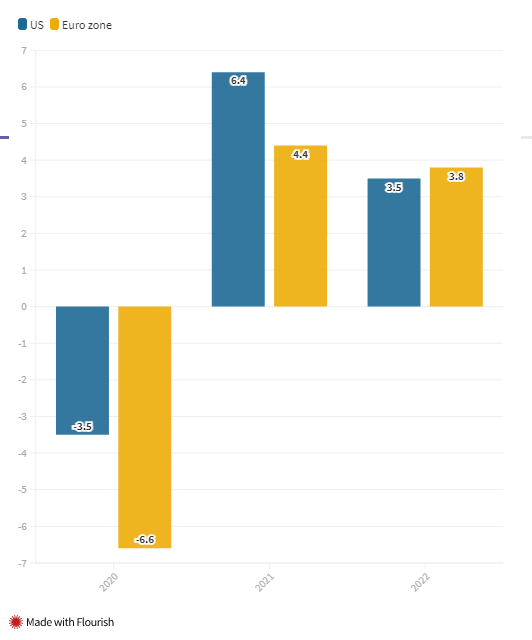

Whereas the U.S economy contracted by 3.5% last year, the eurozone economy shrunk by almost twice as much.

Eurozone economies are expected to struggle to recover this year from the deep shock of 2020, with growth expected to expand by 4.4% against the U.S’s 6.4%.

50% of the U.S population has received at least one dose of Covid-19 vaccine, while only 20% of the EU counterparts have had their first shot

At the end of the third quarter of 2020, the average personal savings rate in the U.S was 15.7%, less than household savings of 17.3% in the euro area to suggest that the consumption boom is more limited in the latter.

Unemployment in the U.S is set to fall to 5.8% this year, whereas it is seen slightly rising in the euro area to 8.7% from 7.9% in 2020.

U.S and European stocks are currently gaining. The dollar is strengthening against the euro. SPY is up 0.12% on premarket, Euro Stoxx 600 is up 0.073%, EURUSUD is down 0.17%