For decades, traders have been going down rabbit holes to find strategies to extract money from the financial markets with the least risk and effort. Among these is the tried-and-tested grid trading, which was popularized in forex.

Naturally, most techniques that work in one market can be applied equally well in another. Therefore, grid trading is something also used by countless crypto traders. Moreover, people have become increasingly curious about automation, leading to an interest in creating robots or bots for this technique.

Before we dive into building a crypto bot for this particular strategy, let’s learn more about grid trading and its pros and cons.

Firstly, what is grid trading?

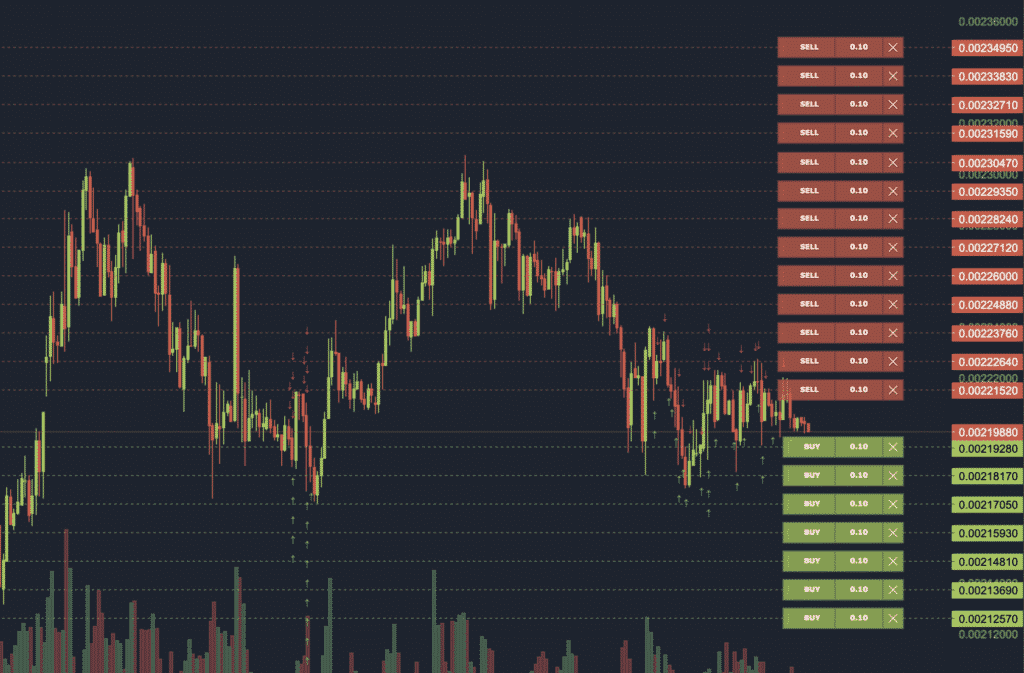

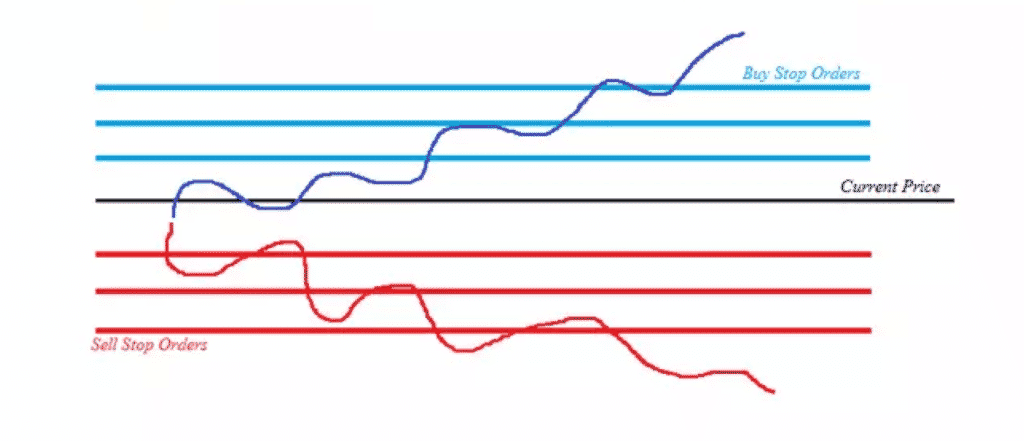

Grid trading is a strategy where traders place multiple orders in a set number of increments above and below a specified price level. Such orders appear like gridlines on a chart, hence the name. Traders pre-configure the price range of their grid before placing the pending orders.

Below is a simple illustration of grid trading.

Such a technique is pretty clever as it capitalizes on price movements regardless of the market direction. The hope is that when one of the initial orders is triggered, the price will travel enough distance to activate all the other orders sequentially.

The floating profit on the first execution will essentially compensate for all the others in the grid. Since multiple orders are placed, your total position additively increases in size, resulting in potentially greater profits once you close all of them.

While you can implement grid trading in both trending or range-bound conditions, it works better in the former. Furthermore, most traders using this technique are scalpers since they don’t hold their positions for very long.

However, if the price moves favorably and speedily, the hope is to hold on for more profits if the market remains on the grid. A grid trading crypto bot is simply an automated program executing a particular grid strategy.

The benefits of grid trading crypto bots

The advantages of grid trading bots are similar when you automate virtually any manual strategy. The main drawcard of robots or mechanical systems is removing emotion and discretion.

One common problem with manually executing a grid strategy is religiously sticking to a set number of pips between each order. While this isn’t impossible, humans are naturally fickle.

Automation allows you to execute a defined set of rules without deviation and subjectivity. Grid trading crypto bots rely on programmed logic where all actions are pre-defined by the creator regardless of their emotions or the present market behavior.

This also eliminates FOMO (fear of missing out), meaning that you will never miss any opportunity. Assuming the bot has been well-programmed according to your defined conditions, it will automatically look for grid trading opportunities even when you’re not near your computer.

The other massive benefit to grid trading robots is how they save you time and manual effort, increasing efficiency. When you ordinarily use this strategy, it requires continuous monitoring and sometimes micro-managing.

Due to the volatile nature of most financial markets like cryptocurrencies, this can be time-consuming and lead to unnecessary mistakes.

The risks of grid trading crypto bots

Unfortunately, grid trading crypto bots are anything but foolproof, a sentiment that applies to pretty much any automated strategy. While adding multiple positions increases your profit potential, it also equally amplifies the potential for losing money, which would be more substantial than placing a single order.

Volatile markets like cryptocurrencies can produce fast-moving grids that work for and against you. One likely scenario could be where all your orders are triggered, but the price never reaches the desired take-profit levels. This would leave you with floating losses if the market quickly went in the other direction.

We had spoken of discretion being a downer of manual strategies. Yet, a lack of it is also a massive downside with bots. While such software operates on well-defined rules, it is not dynamic enough for the ever-changing market conditions, which can be better discerned with an experienced human eye.

How to build your own grid trading crypto bot

Now for the not-so-fun part; building your very own grid trading crypto. Of course, there isn’t a one-size-fits-all approach to doing this, as there are countless grid strategies already.

Yet, the principles of creating any bot in crypto remain relatively the same. While programming experience (particularly Python knowledge) isn’t necessarily required, it is advantageous given some of the complexity involved.

Generally, you have two options: going the ‘DIY from scratch’ route (more complicated) or building your bot on dedicated platforms like Trality, Quadency, Bitsgap, 3Commas CryptoHopper, TradeSanta, etc.

Such services already have many templates to form the foundation of your bot, and while they usually come at some cost, it is warranted. We’ll cover the creation process in a few main steps:

- It goes without saying that you first need an existing and profitable grid trading strategy. However, the most critical aspect is accumulating enough historical data for backtesting, which is used to simulate the viability of that strategy.

- You should ideally perform backtesting on the platform creating the bot for consistency.

The primary elements to harness at this stage include setting the maximum price range for each grid, the indicators (if any), trading pair, the volumes of each order, setting stop loss and take profit levels, and risk allocation.

Most traders may spend several weeks, months, or longer fine-tuning every detail, paying attention to achieving consistent profits with relatively little risk.

- By now, you will have already decided on the exchange (Binance, KuCoin, etc.) to implement your bot with real money. The platform in which you created the system will have a few compatible exchanges that can process all the key requests of the strategy to ensure functionality.

Curtain thoughts

Many computer experts suggest much of the internet traffic nowadays is driven by artificial intelligence and algorithms interacting with users (for instance, with live chat customer support), scanning content, and performing an increasing number of naturally human-driven tasks.

It is no surprise then that many traders also believe bots used by so-called institutional investors carry out most trading in markets like cryptocurrencies.

Although automation is prevalent and beneficial in many financial securities, we shouldn’t consider automating any manual system as a piece of cake. Perfect the foundation of grid trading by forming a solid strategy until it becomes second nature before adding bots into the mix.