(Bloomberg) Grayscale Investments LLC and the New York Stock Exchange have filed to convert its $40 billion Bitcoin fund into an ETF.

Grayscale’s CEO Michael Sonnenshein, reiterates the firm’s commitment to turn the Grayscale Bitcoin Trust into an ETF as soon as the approval is received.

The application coincided with the launch of ProShares Bitcoin Strategy ETF, the first exchange-traded fund in the US after the Securities Exchange Commission approved it.

Grayscale’s application now awaits SEC’s approval even as Sonnenshein maintains optimism that the BITO’s latest launch will pave the way for physical Bitcoin ETF.

Sonnenshein said that the regulator should allow Bitcoin futures ETF and spot ETF in the market since the two are related.

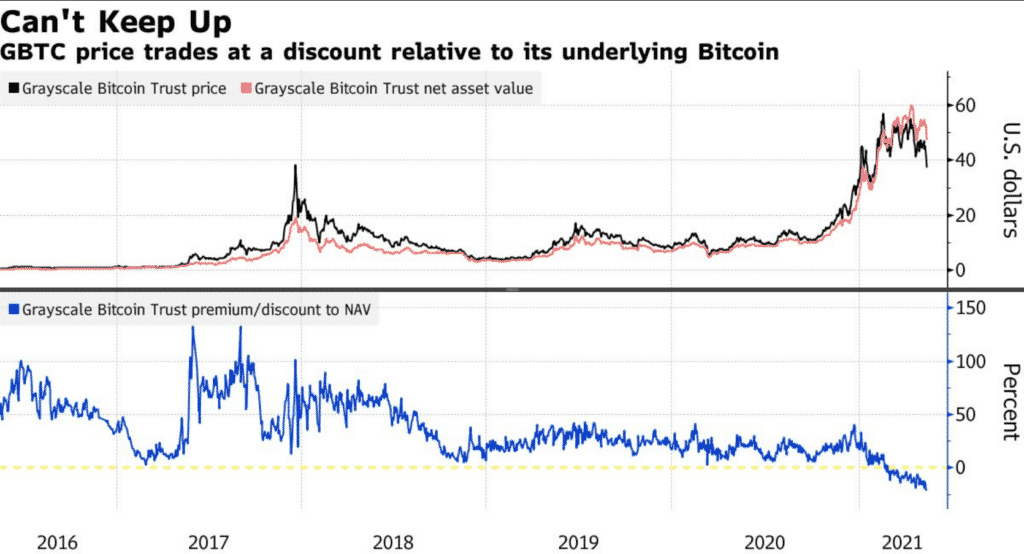

The ability to convert the fund will solve Grayscale’s problem, where the fund’s price has been trading below the Bitcoin holdings since the shares cannot be destroyed,fund’sGrayscale’sBITO’sSEC’sGrayscale’s similar to an ETF.

Grayscale Bitcoin Trust is the largest Bitcoin fund globally.

BTCUSD is up +0.92%.