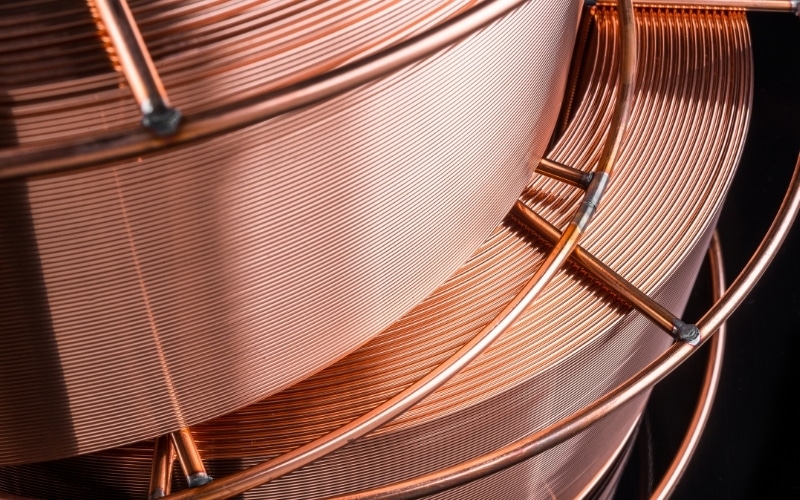

Goldman Sachs termed copper as ‘new oil’ whose low supply could drive the price from the current $9,000 a ton to $15,000 a ton by 2025, reports Markets Insider. Goldman states that copper will be crucial in decarbonization and replacing oil with renewable energy sources.

Copper is regarded as a cost-effective metal, majorly used in the process of creating, storing, and distributing clean energy.

Goldman says that discussions of peak oil demand overlook the fact that without a surge in the use of copper and other key metals, the substitution of renewables for oil will not happen.

The investment bank expects copper’s demand to significantly increase, by up to 900% to 8.7 million tons by 2030, if green technologies are adopted en masse.

If green technologies are not significantly adopted, Goldman still expects copper demand to surge to 5.4 million tons, or by almost 600% by 2030.

Goldman argues that the copper market is not prepared for the increased demand, with its price now up about 80% in the last 12 months.

The bank estimates copper’s long-term supply gap to be 8.2 million tons by 2030.

Global Data report states that global copper production will increase by 5.6% in 2021, after falling 2.6% in 2020.

Copper futures are currently gaining. HG1 is up 2.15%.