(Bloomberg) Goldman Sachs economists expect the US to grow by 1.75% this year on a fourth quarter-to-fourth quarter basis, from previous 2.0%.

The lowered growth forecasts reflect the hit caused by rising commodity prices, especially oil due to the war in Ukraine.

The economists say that the odds of the US entering into recession next year is around 20% to 35%, pointing out that the high prices will affect disposable incomes.

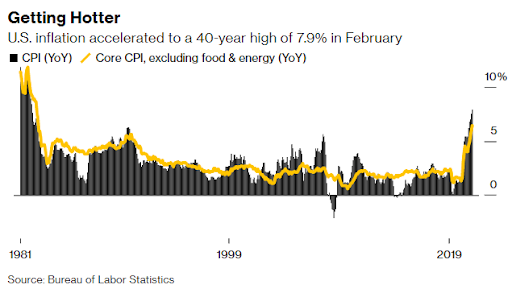

The downgrade by Goldman comes amid surging inflation, with the US consumer prices hitting a new 40-year high in February, fueled by rising gasoline, housing, and food.

The US Federal Reserve is already on course to raise the interest rates this month to curb the high inflation, although officials are adamant that the Ukrainian war means they need to move “carefully.”

The International Monetary Fund Managing Director Kristalina Georgieva also said that the global body could cut global growth this year owing to the geopolitical disruptions. In a separate lowered global growth in January due to the rising Covid-19 cases, IMF said growth would average 4.4% in 2022.SPY is down -0.040%, DXY is up +0.22%