(GoldHub) Global central banks’ appetite for gold rose in 2021, with total accumulations jumping by 82% from the prior year to 463 tonnes. The fourth quarter saw central bank gold shrink by 22%.

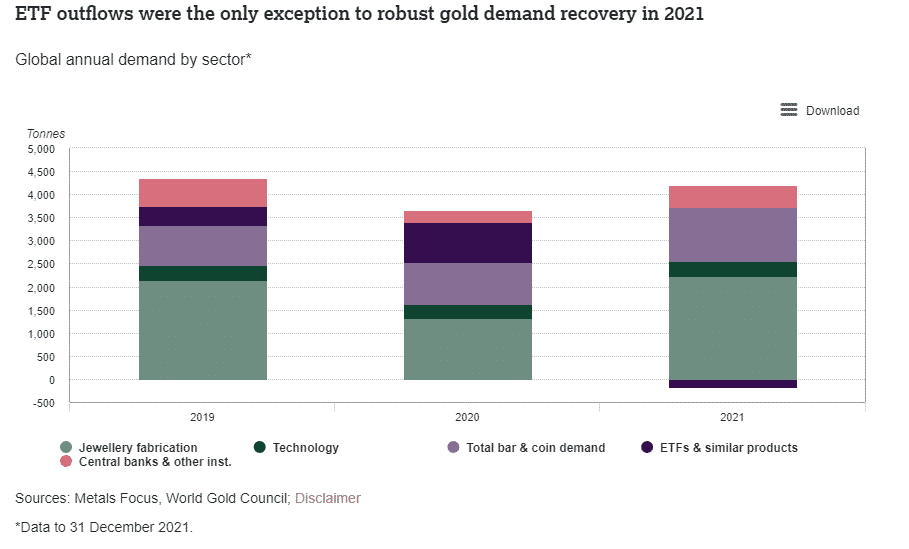

Overall demand for gold rose by 10% to 4,021 tonnes in 2021, with almost all sectors recording recoveries except ETFs.

In the last quarter of the year, gold demand soared almost 50% to hit a 10-quarter record high.

Jewellery fabrication posted a 67% expansion in gold demand which hit 2,221 tonnes in 2021. Jewellery consumer demand was up by 52% to 2,124 tonness, equivalent to the 2019 total.

Another area to post gains was gold applied in technology, which surged by 9% in 2021 to a three-year record of 330 tonnes. In the fourth quarter, growth slowed to 2%.

Holdings of gold ETFs declined by 173 tonnes in 2021, compared to a record gain of 874 tonnes in 2020. The fourth quarter saw 18 tonnes of outflows.

Gold price in terms of the US dollar eased by 4% in 2021, although its average price of US$1,799/oz was 2% higher than 2020. The total supply fell 1% at 4,666 tonnes, the lowest since 2017.

XAUUSD is down -0.37%.