Gold Eagle EA works on the MT 5 platform and uses a news filter to avoid trading during volatile conditions. The algorithm comes with a user manual that amateur and professional traders can use to tweak its settings. Let us observe all the good and bad points of the algorithm and see if it can be profitable on live accounts.

Gold Eagle trading strategy

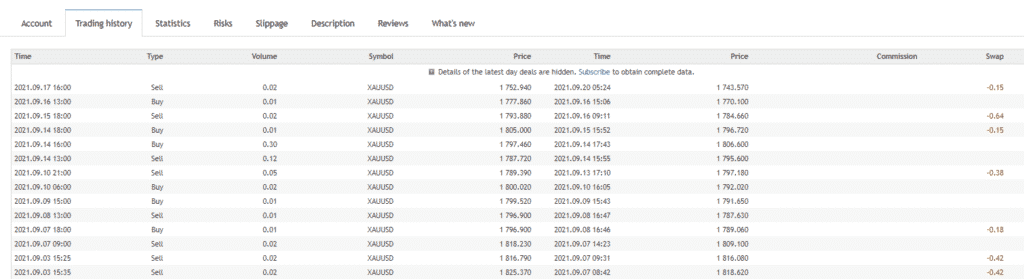

The robot uses a grid trading strategy on gold and provides a mobile trading panel from which traders can see the opened orders. The algorithm works only on a hedge account. It can also manage trades that are opened on the platform. We can see on the trading history present at the MQL 5 platform that the algorithm also employs martingale in addition to the grid. The developer hides this fact from the traders, which is a poor approach.

Gold Eagle features

The robot has the following features:

- It has a built-in news filter to avoid trading during volatile conditions.

- It comes with a user manual for teaching traders on its use.

- It can manage trades that the trader opens.

- It comes with a dedicated panel to manage orders manually.

Price

The software comes with a one-time payment of $199. There is no money-back guarantee. There are no renting options available.

Gold Eagle backtesting results

There are no backtesting results available on the website that could show us the algorithm’s performance on a historical record. This is not a good approach as traders would like to see the output of an EA that uses grid and martingale and check the drawdown. The robot would have failed during the backtest, which might be the reason why the developer failed to share any results.

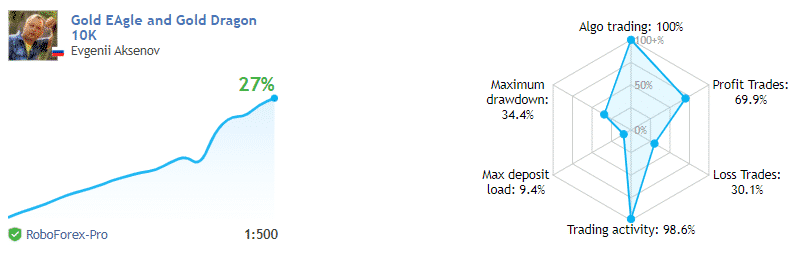

Gold Eagle live trading results

Verified trading records on MQL 5 show performance from June 03, 2021, till the current date. The results are available for combined systems of Gold Eagle and another algorithm from the developer called as the Gold Eagle. The system made an average monthly gain of 6.65% during the period, with a drawdown of 34.4%. The stated drawdown is four times the monthly output which gives us a bad risk-reward. This is due to the implementation of grid and martingale.

The winning rate stood at 69.9%, with a profit factor of 1.68. The best trade was $690.75, while the worst was -$323.52. There were a total of 551 trades. The developer made $10000 in deposits and $0 in withdrawals.

Gold Eagle reputation

Customer reviews are available on the MQL 5 marketplace. A trader states that he lost €18000 in one night using the algorithm.

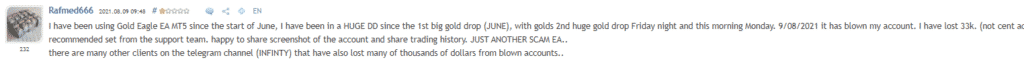

Another trader mentions that the robot is a scam and that his account has been facing huge drawdowns since he started using the algorithm. He has lost 33k using Gold Eagle.

Is Gold Eagle a good EA to invest in?

Gold Eagle uses a risky grid and martingale strategy that can cause a huge drawdown on the trading account as soon as the market trends in one direction. We can not suggest the use of the algorithm as there is a high chance that a trader can receive a margin call on his portfolio.

Gold Eagle review summary

| Strategy | 3/10 |

| Functionality and features | 6/10 |

| Trading results | 4/10 |

| Reliability | 5/10 |

| Pricing | 6/10 |

Gold Eagle can be extremely dangerous for trading in XAUUSD. The EA is not favorable for investors who desire a steady output with a stable drawdown. The developer is not transparent about backtests and the strategy, which is quite suspicious.