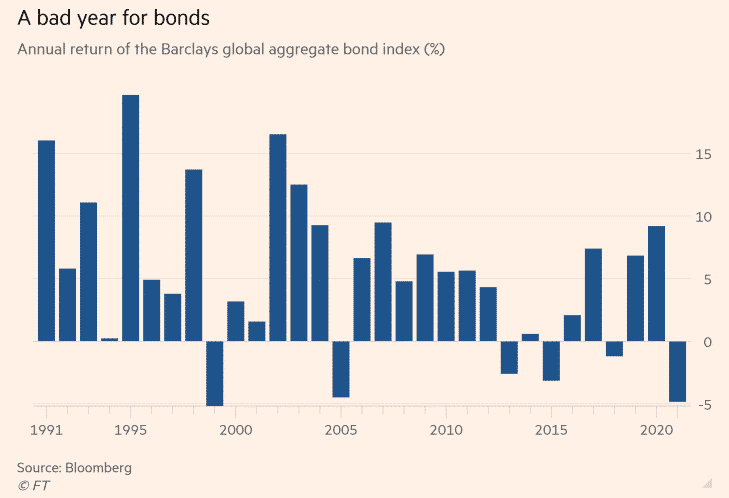

(FT) The $68 trillion global sovereign and corporate bond market returned negative 4.8% in 2021, marking its worst performance since 1999.

The negative returns, measured by the Barclays global aggregate bond index, reflects a surge in inflation, with the asset class highly affected by rising prices

Heavy selling of government debts contributed to falling bond returns as investors placed bets on economic recovery by dumping the “reflation trade” asset class. Central banks hint, in the autumn, of actions to tame rising inflation by raising rates also hit the short-term bonds.

Aberdeen Standard Investment portfolio manager James Athey says bonds are likely to underperform in a high inflation environment. He cautions that next year will be tricky if central banks act faster than expected.

Some investors are still positive on bond markets, saying that it is premature to judge the fixed income sector.

Axa Investment’s portfolio manager Nick Hayes says the recent gains in long-dated debt signal that central banks could stall economic recovery which could dampen stocks. He says a negative year is followed by a positive one, although he cautions against expecting double-digit returns in 2022.

Bond markets have yielded positive returns, with few negatives since 1999 when losses of 5.2% were experienced as investors abandoned bond markets in preference for the stock market in the dot-com era.

US 10 Year Treasury Note yield is currently 1.484%.