FxPro Group Limited operates as a No Dealing Desk (NDD) Broker offering CFD trading on 400+ instruments. The multinational broker serves traders from over 170 countries across the globe with its four offices. It also notes having 12+ liquidity providers, 200+ employees, and more than 85 industrial awards.

Pros

- Highly regulated broker

- No deposit/ withdrawal fees

- Registered International trade supplier of “Invest in Great Britain and North Ireland”

- Deep liquidity

- Ultra-fast order execution

- Over 400+ instruments

- 24/7 CFD trading on cryptocurrencies

- No trading commissions

- True no dealing desk broker

- Wide range of trading tools

- Over 85 awards since its debut

- Offers diverse payment methods

- Offers copy trading

- Leverage of up to 1:500

- Over 2400 orders executed under one second

- Tight security of clients’ funds through segregation

Cons

- High deposit amount as compared to other brokers. Its minimum is capped at $1000 or its equivalent

- Charges $15 fee for account maintenance once after account creation

- Charges $5 fee every month after six months of account inactivity

- Some banks charges deposit and withdrawal fees on transactions made to FxPro

- Spreads fluctuate depending on the current market from 0.6 pips to an average of 1.7 for forex

FxPro Group Limited owns several brokerage offices situated in different locations around the world. Its head office, FxPro UK Limited is based in London, United Kingdom. Collectively, the FxPro conglomerate provides CFD trading on six asset classes to both retail and institutional traders.

This results from the fact that FxPro operates as a true No Dealing Desk (NDD) broker. It serves clients from more than 170 nations worldwide with the best available bid and asks prices of assets by providing direct access to deep liquidity. It provides ultra-fast trade executions in under 14 milliseconds and claims to execute more than 2400 trades in less than one second.

FxPro traders experience deep liquidity as the broker claims to provide access to the best bid and ask prices of assets and instant order execution in under 14 milliseconds. Nonetheless, FxPro holds trading licenses from four reputable regulatory agencies led by the FCA.

The broker made its debut in 2006, aiming to offer NDD services in the CFD trading industry. Over the last couple of years, FxPro Group Ltd diversified its markets and extended its services, opening four global offices. Currently, it offers more than 400 instruments from its range of assets.

FxPro asset classes include:

- Forex pairs

- Commodities such as metals & energies

- Indices

- Futures

- Shares

- Cryptocurrencies

Through the past 15+ years in the trading industry, the broker claims to have filled its trophy cabinet with more than 85 awards. Its recent award joining the portfolio came this year (2021) from the ‘Ultimate fintech Awards’. FxPro won the award as the ‘Best broker in 2021’.

Financial pundits deem FxPro’s services as the key contributor to its milestone of awards. Besides it being an NDD and offering instant order executions, the broker prides itself on solid money security as it segregates clients’ funds from its operating capital. Despite that, it holds several trading licenses from top-tier and two-tier regulatory bodies.

Such as:

- The FCA

- The CySEC

- The FSCA

- The SCB

- And EEA registrations like BaFin

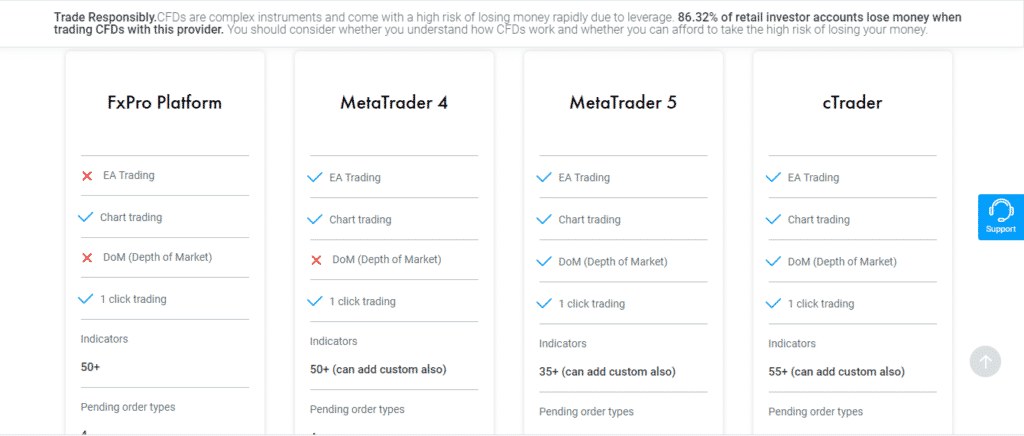

Its trading platforms and tools also give traction to the broker’s milestone of success. FxPro provides traders with four trading platforms integrated with sophisticated tools and plugins for effective trading. Its array of trading platforms consists of the world’s known platforms MT4 &5, a copy trading platform dubbed FxPro CTrader, and its proprietary trading platform, the FxPro Edge.

Integrated tools include:

- Economic and earning calendars

- Trading calculators

- Daily market reviews

- Educational resources

- VPS

Traders access these tools after creating a FxPro account. The broker offers both a demo account and a live account to traders. However, the live account applicable to a trader depends on the trading platform the trader selects. And the trading conditions also vary depending on the trading platform. For example, cTraders incur few trading commissions while MetaTrader and FxPro platform mostly incur fees only on the markup spread.

Although, FxPro neutralizes the account funding and withdrawal conditions on all its traders irrespective of the account type, but offers a minimum deposit of $1000. The broker charges no deposit nor withdrawal fees, but some bank transactions may encounter fees added by the bank institutions.

The available payment methods at FxPro include:

- Bank wire transfers

- Debit/ credit cards

- Skrill

- Neteller

- UnionPay

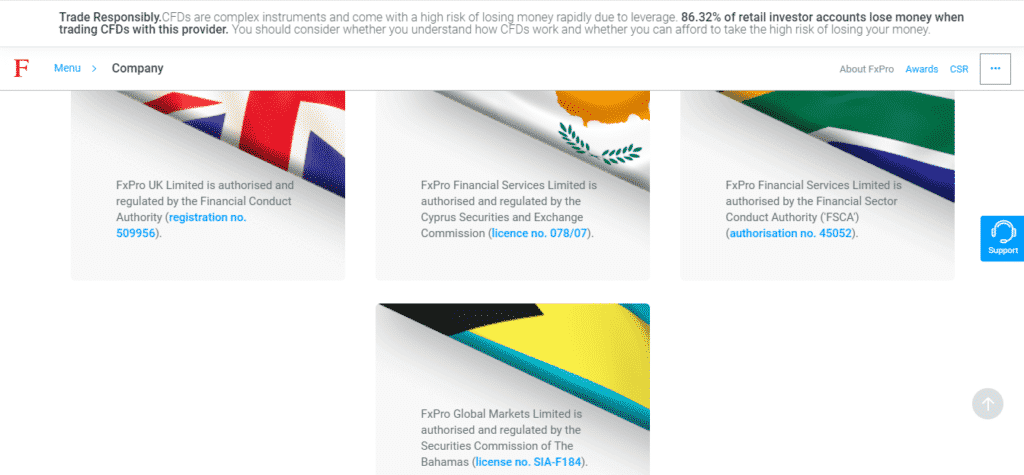

Regulation

FXPro asserts having an excellent imprint of regulation. It holds registration credentials as an international trade supplier of Invest In Great Britain and Northern Ireland, granted by the Department For International Trade. Besides, the broker indicates to have EEA registration licenses from BaFin, ACPR, and CNMV. However, its regulation tunnel shines brighter as it holds the following trading licenses:

- FxPro UK Limited holds license number 509956 from the Financial Conduct Authority (FCA).

- FxPro Financial Services Ltd holds license number 078/07 from the Cyprus Securities and Exchange Commission (CySEC).

- FxPro Financial Services Ltd holds license number 45052 from the Financial Sector Conduct Authority (FSCA).

- FxPro Global Markets Limited holds license number SIA-F184 from the Securities Commission of The Bahamas (SCB).

Pros

- It’s registered as an international trade supplier

- Well authorized broker by legitimate agencies

- Holds a portfolio of licenses

Cons

- Doesn’t offer CFD trading services to clients in the USA, Iran, Canada, among other nations of certain jurisdictions

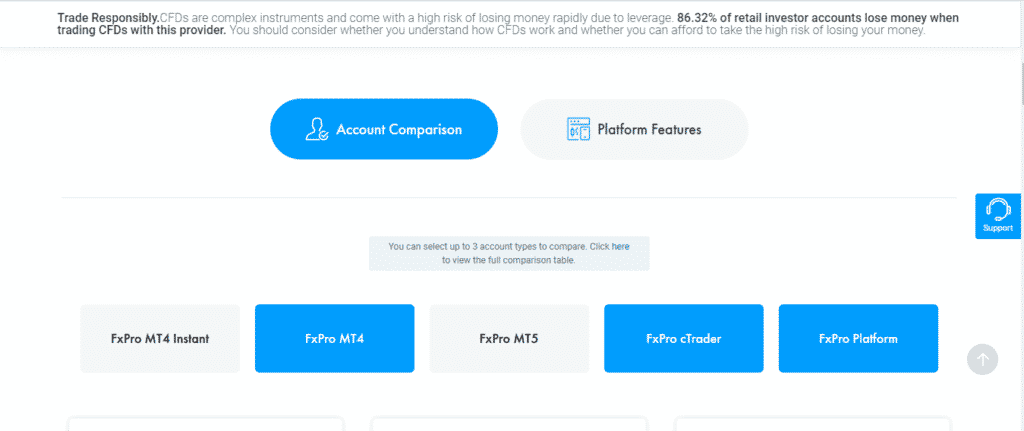

Account Types

As briefly explained in this review, FxPro offers both a demo account and a live account. However, the live account depends on the trading platform the trader chooses. And the demo account serves as a learning tool for traders on improving their trading skills.

The live accounts include:

- FxPro MT4 instant

- FxPro MT4

- FxPro MT5

- CTrader

- FxPro Platform

N/B: trading conditions for the FxPro MT4 instant account and the FxPro MT4 account are the same. For the FxPro Instant account, fixed spreads apply to seven major currencies while the broker obliterates the condition at the FxPro account. And no cryptocurrencies for the instant account.

Analysis of the accounts

FxPro MT4 account

- CFD traded instruments — all

- MT4 platform offered — on the web, desktop, Android, and IOS

- Trade sizes — from 0.01 micro-lots and 1 for shares only

- Trading costs — spread only (no commissions)

- Swaps and rollovers — yes (on overnight trading)

- Min stop levels — 1 pip (depending on market entry price) for significant assets

- Execution type — tiered liquidity (VWAP)

- Netting/hedging by default — hedging

- Trading times — FX trading 24/5, crypto trading 24/7

- Execution model — no dealing desk

- Stop out — 50% (all entities)

FxPro MT5 account

- CFD traded instruments — all

- MT5 platform offered — on the web, desktop, Android, and IOS

- Trade sizes — from 0.01 micro-lots and no shares.

- Trading costs — spread only (no commissions)

- Swaps and rollovers — yes (on overnight trading)

- Min Stop Levels — one pip (depending on market entry price) for significant assets

- Execution type — tiered liquidity (VWAP)

- Netting/hedging by default — netting (hedging available on requests)

- Trading times — FX trading 24/5, crypto trading 24/7

- Execution model — no dealing desk

- Stop out — 50% (all entities)

CTrader account

- CFD traded instruments — FX, metals, indices, energies

- CTrader platform offered — on the web, desktop, Android, and IOS

- Trade sizes — from 0.01 micro-lots and no cryptos and shares.

- Trading costs — FX & metals (reduced spreads plus $45 per one million traded)

Indices & Energies (spread only and no commissions) - Swaps and rollovers — yes (on overnight trading)

- Min stop levels — no minimum

- Execution type — tiered liquidity (VWAP)

- Netting/hedging by default — hedging

- Trading times — FX trading 24/5

- Execution model — no dealing desk

- Stop out — 50% (all entities)

FxPro Platform account

- CFD traded instruments — all

- FxPro Edge platform offered — on the web, desktop, Android, and IOS. Also MT4 platform ranges

- Trade sizes — from 0.01 and one for shares only

- Trading costs — spread only (no commissions)

- Swapps and rollovers — yes (on overnight trading)

- Min stop levels — one pip (depending on market entry price) for significant assets

- Execution type — tiered liquidity (VWAP)

- Netting/hedging by default — hedging

- Trading times — FX trading 24/5, crypto trading 24/7

- Execution model — no dealing desk

- Stop out — 50% (all entities)

How to open a FxPro account?

Account opening involves the following easy steps:

Step 1. Log into their official website and click the ‘register button’

Step 2. Fill the form that pops-up

Step 3. Receive a confirmation email from the broker

Step 4. Verify your email and receive login credentials

Step 5. Log in and choose the account type

Step 6. Fund account and start trading

Fees and Commissions

Having gone through FxPro’s accounts, it’s right to believe we’ve noticed the broker waives all trading commissions and fees except for the CTrader account traders. These clients trade with reduced spreads and incur $45 commissions on one million (volume) trades.

However, the broker induces fees on the markup spread and some overnight fees on swaps and rollovers on all accounts. It also charges a one-time $15 fee for account management and a $5 inactivity fee every month after six months of account dormancy.

Payment options

FxPro offers clients multiple payment methods to choose from, waiving all deposit and withdrawal fees. However, clients incur charges on deposits made through some banks.

Its payment methods include:

- Bank transfers

- Debit/ Credit cards like Maestro, Visa, and MasterCard

- E-wallets like Skrill, Netteler, and China’s UnionPay

Pros

- Offers segregation of funds

- Multiple payment options

- No deposit/ withdrawal fees

Cons

- Clients incur fees through banks

Deposit

Deposit channels include the following:

- Bank wire transfers

- E-Wallet transfers

- Credit/ debit cards such as Visa, Mastercard, Maestro

Withdrawals

Clients receive payments through the same channels offered for deposits.

Available Markets

FxPro claims to offer a wide range of markets, providing clients with more than 400 instruments to trade. The array of instruments includes 70+ forex pairs, metals, energies, major global indices, among others.

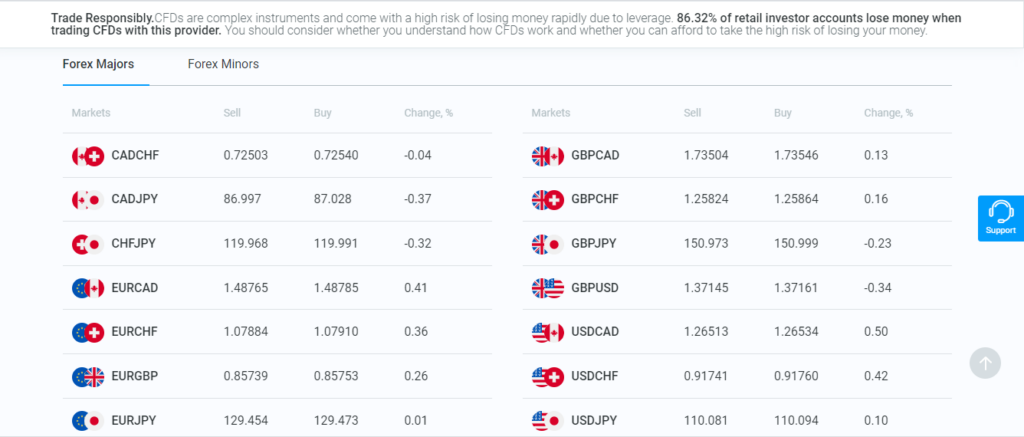

- Forex

The FX market opens 24/5, offering clients access to over 70 forex pairs from Monday to Friday. The pairs trade with ultra-fast executions and tight spreads as the broker notes that most orders execute under 14 milliseconds, and about 7,000 orders execute in one second.

FxPro allows clients to trade CFDs on these assets with deep liquidity and the best prices available during market entry. Some clients experience fixed spreads on several pairs, but the broker offers variable spreads starting from 0.7 pips to an average of one pip and a leverage of up to 500:1 on significant currency pairs. Its pairs trade against eight base currencies made up of both popular and minor currencies.

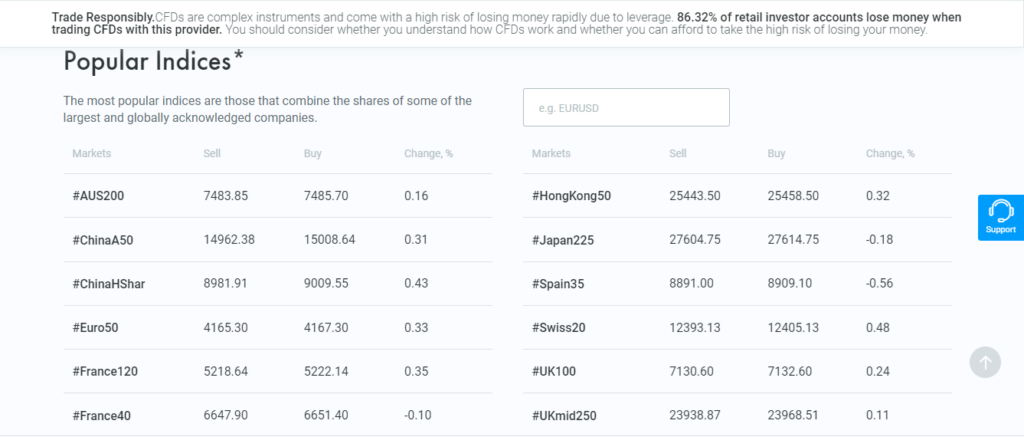

- Indices

FxPro offers clients access to major global indices with ultra-fast executions and tight spreads. Trade buy and sell CFDs on these instruments 24/5 on the broker’s trading platforms. Some of these assets available at FxPro include AUS200, China250, Euro50, among others.

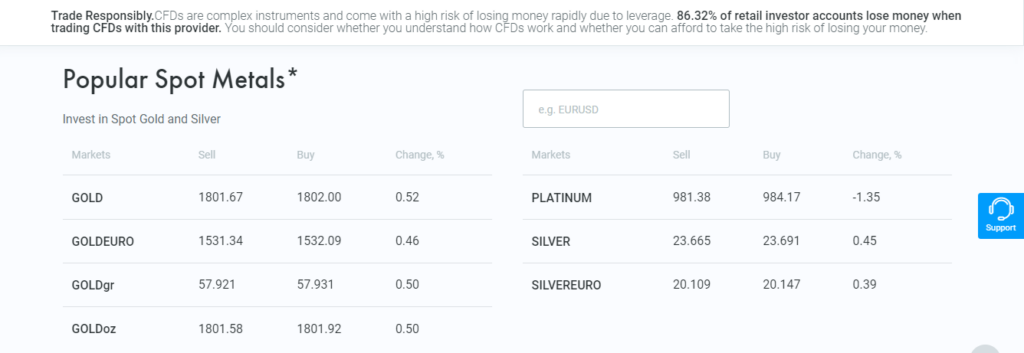

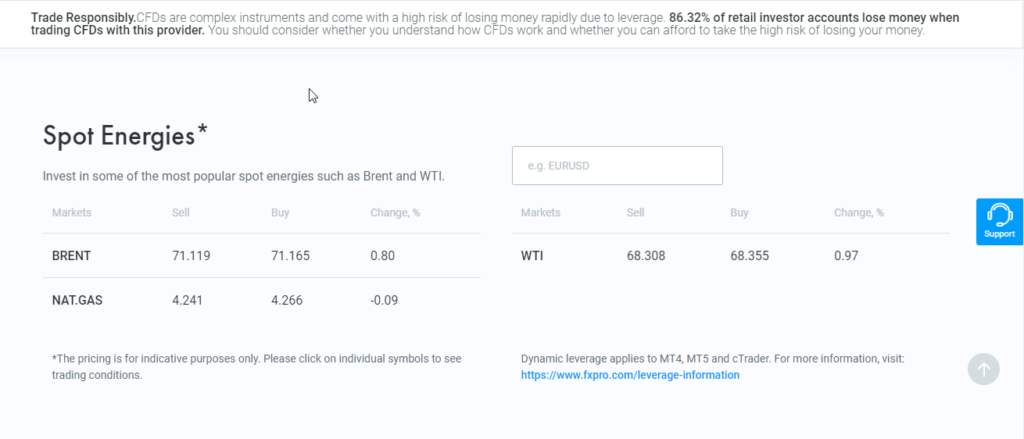

- Metals and energies

FxPro also offers the commodities asset class holding instruments like precious metals and energies. Some of the metals available include the world’s braced precious metals such as gold, silver, and platinum. Both assets trade with ultra-fast executions and best prices as the broker offers true NDD services.

FxPro also offers a subclass of commodities as energies blended with instruments such as natural gas, Brent crude oil, among others.

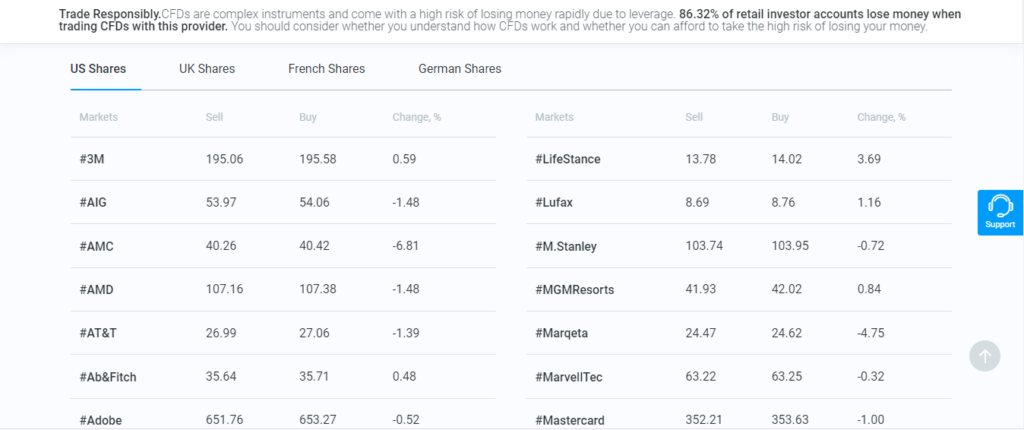

- Shares

FxPro allows clients to trade shares of world-known companies in the US, UK, France, and Germany. These instruments trade 24/5 with market entry prices, fast executions, and a minimum trade size of 1 pip. Traders experience CFD trading on global company shares such as AMD, AMC, Barclays, among others.

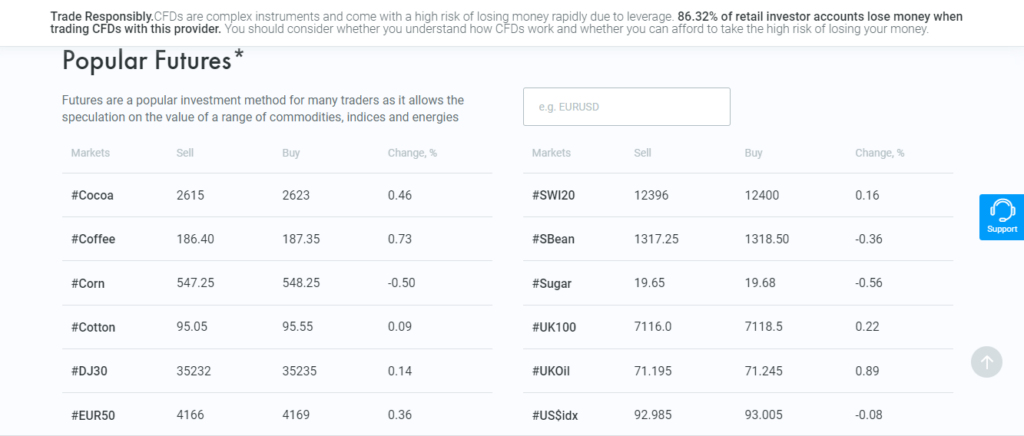

- Futures

FxPro allows clients to speculate CFDs on the value of a range of commodities, indices, and energies. The market trades 24/5, offering clients access to a portfolio of assets compiled from three major asset classes. Some of the futures instruments trading on the broker include Cocoa, EUR50, NGas, among others.

Trading Platforms

As briefly introduced in this review, FxPro offers clients several platforms to choose from depending on the trading conditions best fit to a client. The platform the client selects determines the trading conditions applicable to him.

However, despite the trading platform the trader chooses, FxPro offers the platforms on all interfaces to serve an array of traders on the web, android, IOS, and desktop. Its platforms include:

- MT4 and 5

- CTrader

- FxPro trading platform (FxPro Edge)

Analysis of the platforms

FxPro Platform (FxPro Edge)

- EA trading — no

- Chart trading — yes

- Depth of market — no

- 1 click trading — yes

- Indicators — 50+

- Pending order types — 4

- Trailing stop — no

- Price alerts — sound

- Chart types — line, bar, candlesticks, Heiken, Ashi, HLC & dots

- Chart time frames — 15

- Trading central integration — no

- Sentiment — only for majors

- Languages available — 1

- Coding language — N/A

- Integrated economic calendar — yes

- Detachable charts — yes

MetaTrader 4

- EA trading — yes

- Chart trading — yes

- Depth of market — no

- 1 click trading — yes

- Indicators — 50+ (can add custom also)

- Pending order types — 4

- Trailing stop — yes

- Price alerts — sound, email, notification

- Chart types — line, bar, candlesticks

- Chart time frames — 9

- Trading central integration — yes, with a plugin

- Sentiment — no

- Languages available — 37

- Coding language — MQL4

- Integrated economic calendar — no

- Detachable charts — no

MetaTrader 5

- EA trading — yes

- Chart trading — yes

- Depth of market — yes

- 1 click trading — yes

- Indicators — 35+ (can add custom also)

- Pending order types — 6

- Trailing stop — yes

- Price alerts — sound, email, notification

- Chart types — line, bar, candlesticks

- Chart time frames — 21

- Trading central integration — yes, with a plugin

- Sentiment — no

- Languages available — 49

- Coding language — MQL5

- Integrated economic calendar — yes

- Detachable charts — yes

cTrader

- EA Trading — yes

- Chart trading — yes

- Depth of market — yes

- 1 click trading — yes

- Indicators — 55+ (can add custom also)

- Pending order types — 6

- Trailing stop — yes + advanced take profit and breakeven stop loss

- Price alerts — sound, email, notification

- Chart types — line, bar, candlesticks, and dots

- Chart time frames — 26+ tick, range, and Renko

- Trading central integration — yes via chart targets

- Sentiment — yes

- Languages available — 22

- Coding language — C#

- Integrated economic calendar — yes

- Detachable charts — yes

Features

FxPro tools and features generally include:

Trading tools

- Trading widgets in one place

- Calculators

- 24/7 server for EA

- Real-time app access

News & analysis tools

- Economic calendar

- Earning calendar

- Market news

- Trading signals provider for pro clients

Education

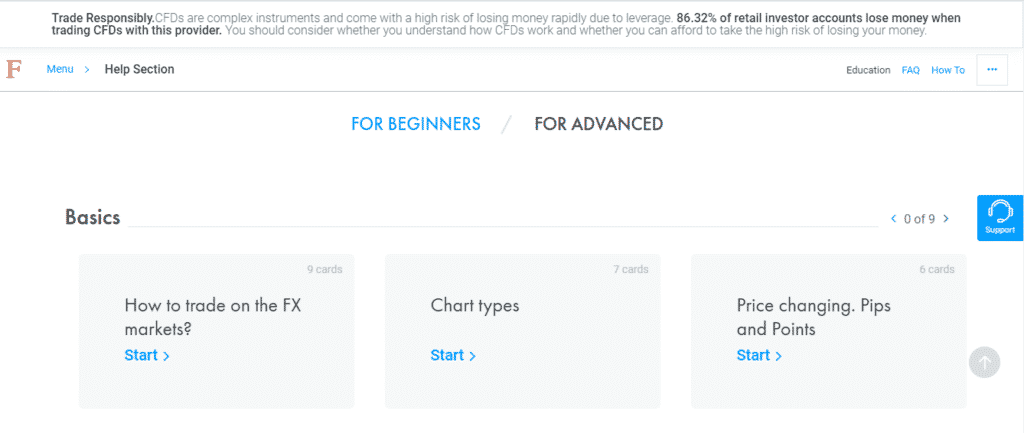

FxPro provides clients with a rich educational platform equipped with trading tutorials crafted in videos, guides, and others. Moreso, the broker’s educational resources structure begins from basics to complex trading strategies depending on the trader’s skill set. Clients access the education section on the broker’s official website.

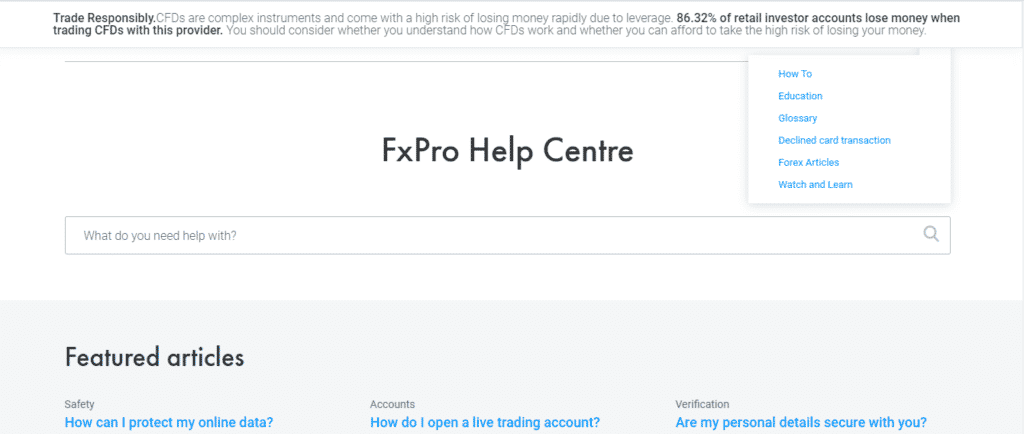

Customer Support

FxPro offers 24/5 multilingual customer support. The broker claims to have scooped an award for customer support services. Clients access the customer support section via the broker’s website and benefit from a wide range of resources such as forex articles, glossaries, How-to articles about forex, among others. Clients also contact live support through live chat, email, and phone calls.

Review Summary

FxPro prides itself with a portfolio of awards and 15 years of experience in the trading spree offering CFDs on diverse assets. Its asset basket holds six asset classes summed with both significant and minor instruments. The instruments trade 24/5 except cryptocurrencies as the broker allows clients to trade the price movement of these digital assets 24/7.

FxPro operates as a true NDD, offering ultra-fast order executions and the best available prices. It holds trading licenses from reputable regulatory agencies and serves clients with different account types, making the broker safe and acceptable for beginners and veteran traders.