FXOpen is a fast-growing forex brokerage established in 2005 by dedicated traders to offer professional and secure financial exchange services. Over the 15 years of operation, FXOpen has completed major milestones as an FX broker and introduced innovative features like ECN trading to lower trading costs. Overall, the broker is considered trader-oriented and, therefore, suitable for both new and experienced traders.

Pros

- Competitive spreads starting from 0 pips

- Low trading costs on ECN accounts

- Minimum deposit of $1

- Multiple trading accounts

Cons

- Limited range of trading assets

- Insufficient educational resources

FXOpen was a financial school before several traders came together and launched it as a broker in 2005. The introduction of trading services was fueled by a growing desire to practice the technical analysis techniques taught in the center in an easily accessible platform.

The student traders could enjoy constant support from the financial experts at the center and practice their trading knowledge first-hand. The broker is designed with the young traders in mind, therefore offering favorable trading conditions for all the traders.

Over the years, the broker has maintained quality services for its clients and continued to grow in its quest to be among the best FX brokers globally. It offers multiple accounts on different trading platforms where its clients can trade in their preferred trading environment.

Regulation

The broker is registered as part of the FXOpen Markets Limited in Charlestown, Nevis. The registration number is C 42235.

The broker also has registered membership with The Financial Commission to protect its customers’ interests and maintain its reputation as a safe broker.

The FXOpen Ltd UK is regulated and authorized by the Financial Conduct Authority (FCA) in the UK, under Ref. No. 579202. The FCA Client Asset Rules demand client fund segregation and holding in separate bank accounts.

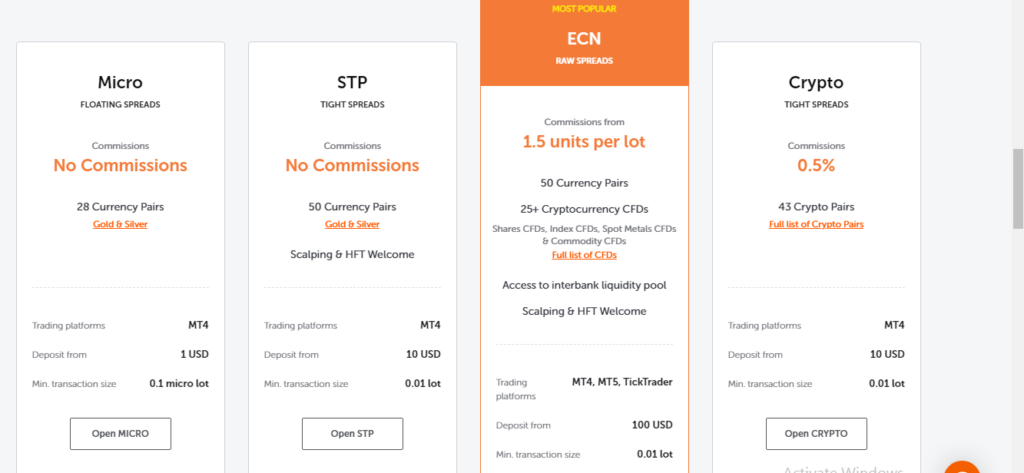

Account Types

Whether you’re a novice trader or an advanced trader, the broker has an account type that suits your level. These accounts include ECN, STP, crypto, and micro-accounts.

ECN trading account

- Min. deposit – $100

- Tradable assets – FX Spot CFDs, Shares CFDs, Spot Metals CFDs, Index CFDs, Crypto CFDs, Commodity CFDs

- Floating spread from 0.0 pips

- The commission per lot – $15

- Max. leverage — 1:500

- Margin call – 100%

- Market depth (level II quotes)

- Market execution

- Min. lot size — 0.01 lots

STP trading account

- Min. deposit – $10

- Tradable assets – gold, silver, 50+ currency pairs

- Floating spread

- The commission per lot — $0

- Max. leverage — 1:500

- Margin call — 50%

- Market depth (level II quotes)

- Market execution

- Min. lot size — 0.01 lots

Crypto trading account

- Min. deposit — $10

- Tradable assets — BTC, DASH, PPC, LTC, EMC, EOS

- Floating spread

- The commission per lot — 0.5% trade volume turn round

- Max. leverage — 1:3

- Margin call — 30%

- Market depth (level II quotes)

- Market execution

- Min. lot size — 0.01 lots

Micro trading account

- Min. deposit — $100

- Tradable assets — gold, silver, 28 currency pairs

- Floating spread

- The commission per lot — $0

- Max. leverage — 1:500

- Margin call — 20%

- Market depth (level II quotes)

- Instant execution

- Min. lot size — 0.01 lots

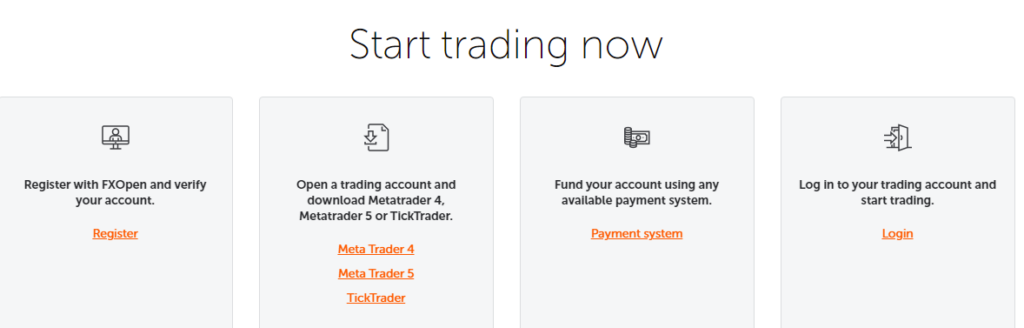

How to open an FXOpen trading account

Unlike other FX brokers, FXOpen requires that you open an e-Wallet first, which you’ll use to manage funds in your trading accounts. Then go to My FXOpen Area and log in using your e-Wallet details.

While in the My FXOpen personal area, choose the account type you want to open and accept the terms and conditions. You can now fill out the account application form and complete the process.

You’ll need to deposit funds using the available deposit options at the My FXOpen area to start trading in your account.

Fees and Commissions

The broker charges fees depending on your account type. For example, a micro account incurs $0 commissions, while an ECN account incurs a commission of $15 per lot.

In STP accounts, the commission is added to the spread. In crypto accounts, the commission is charged as 0.5% per size.

All account types charge a floating spread that fluctuates depending on the market’s volatility. However, the spreads start from 0.0 pips.

All accounts allow traders to use leverage up to 1:500, except crypto accounts which allow maximum leverage of 1:3.

Other fees

- Withdrawal fees — commissions are charged depending on the withdrawal method used

- Deposit fee — $0

- Swap — it’s charged on all positions held for more than a day

- Inactivity fee — $10/month

Payment options

FXOpen accepts funds from a long list of payment methods for both deposits and withdrawals.

Deposit

Deposit options include Debit/Credit cards, China Union Pay, Paypaid, SEPA, Local Deposit, Boleto, Airtm, Epay, Rapipago, WebMoney, FasaPay, CashU, Advcash, Bitcoin, BitcoinCash, Litecoin, Ethereum, Tether, AstroPay, Redeem, and Bank Transfer.

Deposits are free on FXOpen.

Withdrawals

They are facilitated to the following methods: Sorex, China Union Pay, Paypaid, SEPA, Local Deposit, Airtm, Epay, WebMoney, FasaPay, CashU, Advcash, Bitcoin, BitcoinCash, Litecoin, Ethereum, Tether, AstroPay, Redeem, Perfect Money, and Bank Transfer.

Withdrawals are subject to commissions depending on the withdrawal method.

Available Markets

The broker allows its customers to trade FX, Indices, commodities, shares, and cryptocurrencies in its different account types.

Forex

Trade 50+ currency pairs in the FX Market (including major, minor, and emerging pairs), with low spreads from 0.0 pips. The FX market is open from Sunday through to Friday night.

Indices

Global indices on FXOpen markets include UK100, US SPX 500, and Wall Street 30. Traders can choose from over 10 indices available and trade with low commissions and flexible contract sizes.

Commodities

The commodities market experiences deep liquidity on energy and metal products. FXOpen offers over five commodities for trading in the markets.

Shares

The broker allows you to buy shares from global giants like Amazon, Apple, Netflix, etc., at competitive commissions.

Cryptocurrencies

The crypto available on the platforms are paired with other financial assets like fiat currencies to create 40+ pairs for CFD trading. Crypto trading is available on the crypto account and to professional traders.

Trading Platforms

The broker has launched different platforms to ease trading and lower trading costs for investors. The TickTrader platform is the most recently launched trading platform with comprehensive functionality for every trader’s needs. The desktop, mobile, and web terminals are available for all trading platforms.

TickTrader trading platform

- Highly customizable workstation

- One-click/double-click trade executions

- Level II pricing

- State-of-the-art technical analysis tools

- Comprehensive charting system

- Back-testing strategies

- Customizable alert system

- ECN accounts

MetaTrader 4

- Interactive charts

- 50+ built-in and third-party indicators

- User-friendly and highly customizable interface

- Expert advisors

- Automated trading

- One-click trading

- ECN and crypto accounts

MetaTrader 5

- Accessible 24/7

- Automated trading

- Expert advisors

- Stop limit orders with no slippage

- 80+ technical indicators

- Open up to 100 charts at a time

- 21-time frames

- ECN accounts

- Trading signals

Features

- Virtual Private Server (VPS) Hosting — the broker offers VPS hosting services upon request to investors trading in an STP, ECN, or crypto account.

- Myfxbook — it’s an auto trading platform that ensures error-free trade executions for higher profits.

- Percentage Allocation Master Module (PAMM) — a master-follower technology for copy trading, where the master’s trading strategies are automatically replicated into the follower’s trading account. This technology applies to all accounts.

- ZuluTrade — an auto-trader that reproduces signals from professional traders into the trader’s account.

- Economic calendar — it shows upcoming events in the financial markets and how they’re likely to affect the market conditions.

- Market news — the broker has a news section to keep investors informed on the different market conditions.

Education

Unfortunately, FXOpen has limited educational resources for its clients. However, there are a few blogs that teach CFD trading, ECN trading, and FX trading.

The demo accounts are also crucial for training new traders or those using FXOpen for the first time. They are loaded with virtual cash and simulate the live markets so that clients can have a complete market experience.

Customer Support

The help center under the tab ‘help’ on the platform was unavailable. However, clients can chat with FXOpen representatives on social media platforms like Facebook Messenger, WhatsApp, Telegram, Twitter, Viber, Skype, and Line.

The links to the chat rooms are all available on the broker’s official platform. The response time varies depending on the media you use.

The email service is available for non-FXOpen clients, and the phone service is available for New Zealand clients.

Another way to get help is to submit a ticket from the Customer Support Portal. You’ll need to sign in first to send the ticket.

Review Summary

FXOpen’s popularity rose following the introduction of the unique ECN trading platform, allowing traders to take full advantage of the market opportunities at low trading costs. It also has auto-trading features as well as PAMM accounts for non-UK clients, which allow copy-trading.

Overall, the broker is a suitable broker for both active and passive traders at all levels of trading experience. The different accounts make it easy to trade-in preferred market conditions.

On the flip side, FXOpen lacks enough educational materials for its customers. That means that they have to find their information elsewhere and apply it on the FXOpen platforms.