FXCIPHER is an expert advisor that is 100% automated and works on the MT4 and MT5 trading platforms. It has two distinct present settings you can choose from, and according to the vendor the system has high potential profitability. Of course, we need to verify this independently by conducting a thorough analysis of the various performance factors.

You can purchase this robot for the price of $295. This will give you access to a single license for all types of accounts. You will also get separate EA versions for MT4 and MT5, along with a user manual. The vendor offers technical support and free updates. However, they provide a refund only if your drawdown is more than 35% even after using the recommended settings.

FXCIPHER trading strategy

This is an expert advisor that is compatible with FIFO brokers and those are regulated by NFA. The vendor mentions that it uses two trading strategies, but they don’t explain either of them. In certain circumstances, the EA will switch between strategies in an attempt to minimize the risk.

The lack of strategy insight for FXCIPHER is quite disappointing. We don’t know what indicators it uses for spotting profitable trading opportunities, and it is unknown whether it trades with the trend or against it. As such, it is difficult to determine the profitability of the system. This will discourage many Forex traders from spending money on this robot.

FXCIPHER features

You can select one of the two preset settings installed in this robot. One of them has been optimized since 2010 and uses a conservative approach, while the other has been optimized since 2017 and provides a high win rate and requires you to invest a smaller amount.

According to the vendor, FXCIPHER has a unique drawdown limiting feature that limits the loss on your account based on the EA settings. It monitors the drawdown and uses stop loss as a risk-management technique. In case the loss exceeds the specified value, it can close the trades at the market value.

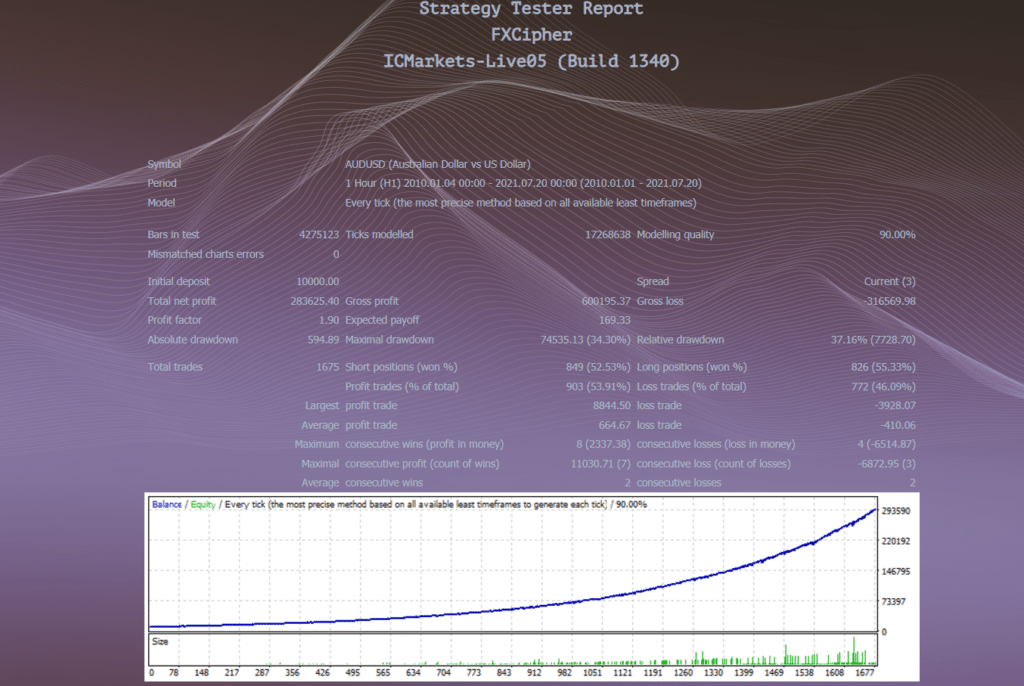

FXCIPHER backtesting results

Here we have the results for a backtest conducted between 2010 and 2021 on the AUD/USD pair. The EA used the H1 timeframe for this backtest, and a modeling quality of 90%. It placed 1675 trades, winning 52.53% of them. Compared to other robots, the win rate is pretty low.

Here, we can see that the drawdown is quite high at 37.16%. Thus, it is clear that FXCIPHER is following a high-risk trading strategy that can drain your account in no time. There were 8 consecutive wins during this backtest and 4 consecutive losses.

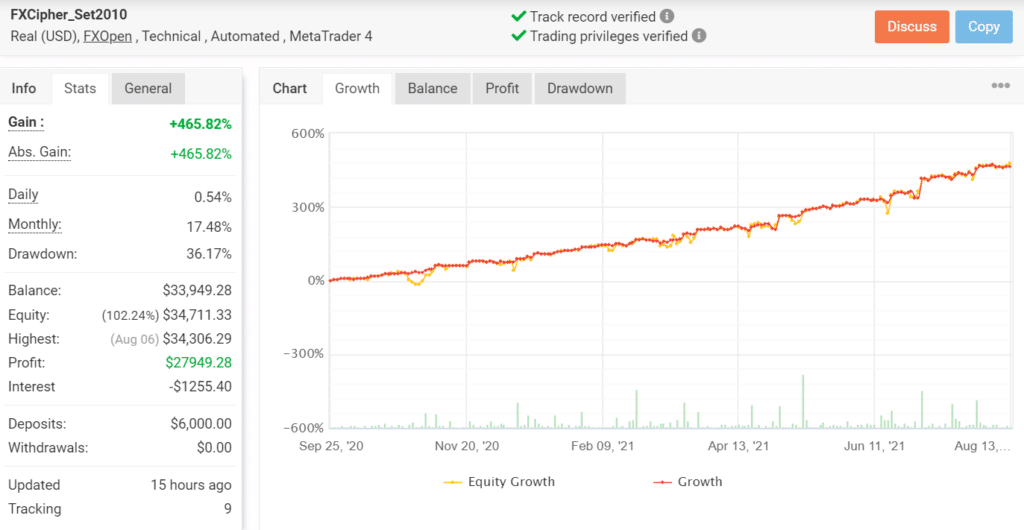

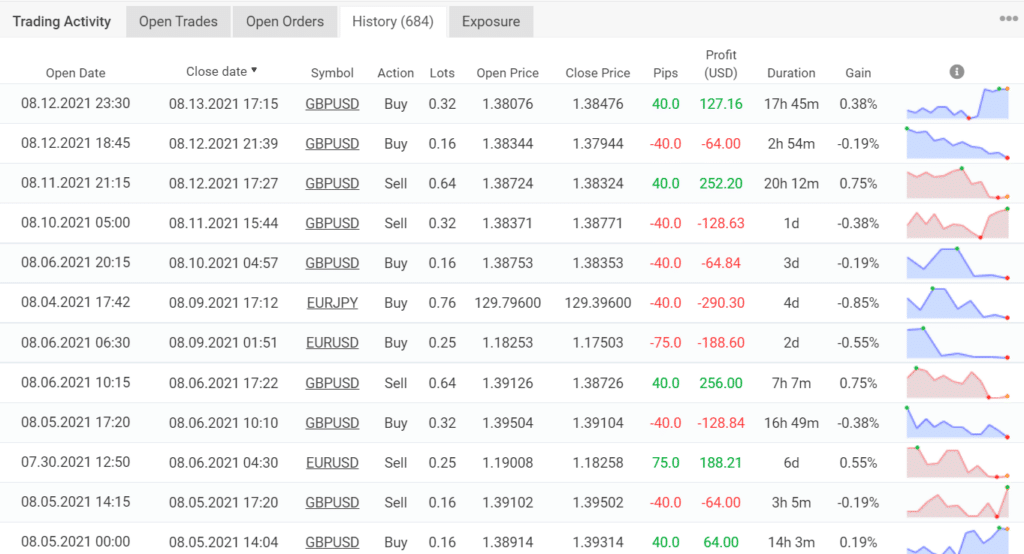

FXCIPHER live trading results

Launched on September 25, 2020, this live trading account has generated a profit of $27949.28 to date. The robot has placed a total of 783 trades through this account, winning only 49% of them. Thus, the profitability is even lower compared to the backtesting data. Currently, the daily and monthly profits for this account are 0.54% and 17.48%, respectively.

The average win and loss for this trading account are 50.18 pips /$223.22 and -46.75 pips/-$132.53, respectively. It has a profit factor of 1.60 and a sharpe ratio of 0.14.

Here also, a high drawdown can be seen. It is 36.17% for this live account, which is slightly less than what we saw in the backtesting results. Nevertheless, it implies a high-risk strategy, and we can confirm this by looking at the recent results where the robot has suffered several losses back to back.

FXCIPHER reputation

The vendor has not provided any information on the parent company. We don’t know whether the company is located or when it was founded. Since the identities of the team members are not known, we don’t if the robot has been developed by experienced individuals.

As far as we can understand, the developer has no reputation whatsoever. We couldn’t find any user reviews on third-party websites, which means not enough people know about this EA or don’t feel confident about using it for live trading.

FXCIPHER review summary

- Strategy – 3/10

- Functionality & Features – 3/10

- Trading Results – 2/10

- Reliability – 3/10

- Pricing – 3/10

Conclusion

FXCIPHER is not a system you can trust. It is sold by an unknown developer who has no reputation whatsoever. The live trading performance of this robot is not at all impressive, and there is a general lack of information surrounding it. Thus, you’d be better off purchasing a system developed by a reputable company that has a long and successful track record.