First Prudential Markets, commonly referred to as FP Markets, is a No-Dealing Desk brokerage company headquartered in Sydney, Australia. It utilizes ECN and STP models to facilitate fast, and no requotes forex and CFDs order execution. Forex trading is available in over 60 currency pairs with major pairs like GBP/USD, EUR/USD, among others. While CFDs are traded in more than 10,000 shares in global exchanges, 19 major global indices like Australian index Cash, US 30 Index Cash, Euro 50 Index Cash, etc., and the world’s braced commodities like precious metals-gold and silver, oil, and natural gas.

Pros

- Over 60 currency pairs can be traded.

- It is a trustworthy ECN broker that links you directly to the liquidity market.

- There are no account charges when depositing, withdrawing, or even when the account is inactive.

- It is regulated by top-tier agencies in Australia and the European Union.

- It offers tight raw spreads from 0.0 pips and has no requotes for forex traders.

- The minimum deposit is low.

- Execution is fast and efficient due to the Equinix server plugin.

Cons

- Trading conditions may vary according to geographical location. Australian traders are allowed the leverage of 1:500, while European traders can access the lower leverage of 1:30.

- High stocks trading spread for share traders.

- Offers the Iress trading platforms are restricted for trading.

- Its crypto instruments are few.

FP Markets started brokerage operations in 2005 led by Matthew Murphie. The company launched after it received an Australian Financial License from the Australian Securities and Investments Commission (ASIC). The broker enlarged its imprint as a broker and serves more than 12,000 clients around the globe. Its client base is from 80+ countries and offers maximum leverage of 30:1 and 500:1 for retail and professional account forex traders.

It has several trading platforms that come to the aid of a client when executing an order. They include MT4, MT5, WebTrader, and Iress platforms. They integrate with more than 12 plugins like Equinix servers that enable fast execution speeds and mitigate requests.

FP Markets also offers tight raw spreads starting from 0.0 pips that curb high volume traders from incurring many costs during trading. In the last 15+ years since it started, the company witnessed several success milestones.

It has been credited as the most satisfying client-broker six times and four times as the best execution broker. The success trajectory ends with a two-times winner for the best customer education and a 1-time winner for best client service. In 2019, it was awarded the best Global Forex Value Broker Award.

Besides, FP Markets has also tapped into the cryptocurrency market and allows traders to sell and buy top digital coins like Bitcoin, Bitcoin Cash, Ethereum, and Litecoin against limited fiat currencies.

In addition, the brokerage account opening is swift and digitized. It takes a few steps and only requires a minimum deposit of 100 Australian Dollars or its equivalent. Once a client’s account opens, the broker does not charge deposit, withdrawal, nor inactivity fees.

Regulation

FP Markets has been under the surveillance of an entire tier-regulatory body since it emerged. The company holds an Australian Financial Service License (AFSL) issued by the Australian Securities and Investment Commission (ASIC) more than fifteen years ago. However, it is also regulated in the European Union by CySec, ensuring that FP Markets conducts transparent operations to its European Union clientele. For example, it offers negative balance protection for clients in the EU region.

- ASIC authorizes FP Markets Australia under License No: ABN 16 112 600 281 AFS 286354.

- While in the EU, it is authorized by CySEC under License No: 371/18.

Pros

- Regulated by ASIC and CySEC

- CySEC is also compliant with the MiFID European directive

- Clients in the EU have negative balance protection

Cons

- Not regulated by many agencies

- Clients can benefit from different privacy policies and authorities depending on their region

Account Types

FP Markets allows clients to access the interbank (liquidity market) through two different accounts. The accounts might either have an STP or ECN execution model. They include the Standard and the Raw account.

The account choice depends on your trading objectives, but new traders benefit from the Raw account. They incur low costs at the Raw account as compared to the standard account. However, clients who prefer the IRESS platforms can be proposed for an IRESS account.

| Standard account | Raw account |

| Minimum opening balance — 100 AUD or its equivalent Spreads start from 1.0 pips Instruments include 60+ FX pairs, metals, indices, and commodities Maximum leverage is 500:1 (for non-EU traders) ECN exécution The commission per lot — zero Minimum trade size 0.01 lot Expert advisors — yes Mobile app — yes VPS available — yes | Minimum opening balance — 100 AUD or its equivalent Spreads start from 0.0 pips Instruments include 60+ FX pairs, metals, indices, and commodities Maximum leverage is 500:1 (for non-EU traders) ECN exécution The commission per lot — $3 per 100,000 Minimum trade size — 0.01 lot Expert advisors — yes Mobile app — yes VPS available — yes |

How to open an FP Market account?

The account opening process is efficient but can sometimes take 24 hours or lag to a maximum of two days. This happens as the broker is verifying the trading account. Here are the steps to follow upon opening your preferred account at FP Markets.

Step 1. Fill an online form that requires your name, email, and country.

Step 2. Provide KYC documents like national ID, proof of address, among others.

Step 3. Select your account type and trading platform.

Step 4. Fill another online questionnaire to prove your financial experience.Step 5. Once the account is verified, deposit any amount from 100 AUD and start trading.

Fees and Commissions

FP Markets’ fees depend on the account type. For example, the IRESS account charges are based on a specific commission plus percentage and vary depending on the instrument. However, for the Standard and raw account, clients incur fees through the following:

- Some withdrawal methods may add a processing fee.

- The spread attaches commission such that the only fee you pay is a markup on the spread. So this applies to standard account users and depends on the no-dealing desk model fused with your account. For example, for an STP model account, the floating spread for EUR/USD could be averaged 0.7 pips and, at the same time, averaged 0.1 pips for an ECN model account.

Pros

- Free deposits

- No withdrawal fees charged

Cons

- Few withdrawal methods may charge a processing fee

- Standard account users may incur markup spread costs of 0.1 pips

Payment options

There are a plethora of payment methods at FP Markets for depositing funds and withdrawing. Some of the channels are free, while others may hike in some fees. Always ensure you have the channel that is best satisfying your trading goals. Here are several methods of depositing and withdrawing funds from FP Markets.

Deposit

FP Markets accepts deposits from these methods:

- Debit/credit cards

- Wire transfer

- Bank transfer

- E-wallets (Skrill and Neteller)

Although depositing is free, some fees may be charged for any transaction made as a transfer from a bank or another broker to your FP Markets account. Also, there is an included fee for international transactions of up to $50 for any amount above $10,000.

Withdrawals

They are made through the following:

- Debit/debit card

- Bank wire transfer

- E-wallets (Skrill and Neteller)

So the withdrawals made via Visa cards, whether debit or credit card and domestic bank wire transfers are waived off fees. However, International bank wire withdrawals meet an imposed fee of up to 10 Australian dollars.

E-wallets’ fees like Skrill and Netteler are imposed. For starters, clients using Neteller can endure a withdrawal fee of about 2% of any amount lower than $45,000 and $30 for any monetary size exceeding that amount.

On the other side of the camp, Skrill clients face a 1% fee of their total amount. Sometimes an additional fee depending on the country of location.

Available Markets

By this time, you might have caught the wind of the markets offered by FP Markets. Currently, clients can trade its diversified markets extending from FX pairs, CFDs in indices, shares, commodities like metals and energy, and cryptocurrencies.

- Forex

The broker allows clients to trade 60+ FX pairs with major pairs like; GBP/USD, EUR/USD, and USD/JPY starting from 0.0 pips with a maximum leverage of 500:1 for Australian traders and 30:1 non-Australian traders. The company’s forex trading markets are open 24/5 (that is, Monday to Friday).

- Indices

The broker paves the way for you to participate in the global stock market. It allows clients to trade 19 major indices through Index CFDs on its platforms. The margins start at 1%. For example, AUS 200 cash indices trade at AU$1 per point.

- Commodities

Trading commodities with this broker means you have access to commodity prices worldwide with high execution speeds, low spillage, deep liquidity, and tight spreads. You can trade crude oil, natural gas, and metals like gold and silver. Some of the products include West Texas intermediate crude oil and brent crude oil cash.

- Precious metals

Popular metals on FP Markets are gold, silver, platinum, palladium, and copper. They are traded against the US the Australian Dollar as a currency pair on 500:1 leverage. The perfect platform that offers efficient trading of metals is the MT4.

- Bitcoin

FP Markets offers cryptocurrency CFD trading in some of the renowned digital currencies. These crypto-assets are traded against standard currency pairs like the USD and GBP and include Bitcoin, Ethereum, Ripple, BTC Cash, and Litecoin.

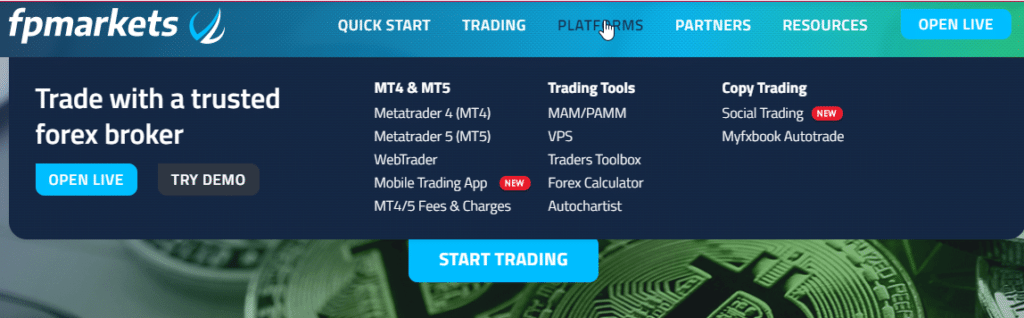

Trading Platforms

The broker offers its clients access to three leading trading platforms. However, the company has recently launched a mobile trading app. Its platforms include the renowned MT4 and its predecessor MT5 and a Web-based trading platform dubbed WebTrader. They are innovated with plugins to offer interactive interfaces and fast-speed trade executions. Besides, the broker is also introducing a social trading platform.

| MetaTrader 4 (MT4) | MetaTrader 5 (MT5) |

| The MT4 platform is available on the web, mobile in Android and IOS, and desktop versions for easy accessibility in both Windows and Mac OS. The desktop platform has many plugins for easy layout customization. Other features include: Customizable interface, including colors of technical indicators One-click trading MarketWatch tool Live price streaming on live accounts and demo accounts with 128-bits encryption for secure trading Expert Advisors Customizable alerts Access to MetaTrader market and MQL4 community | The MT5 platform is a predecessor of the MT4 and allows clients to experience next-generation trading because of its advanced tools and top-notch trading capabilities. It is also available in Windows and Mac OS, Android and IOS, and on the Web. Other features include: Allows you to trade FX, indices, commodities, shares, and crypto Spreads start from 0.0 pips and leverage up to 500:1 Extreme market display and technical indicators More pending stock orders, including the buy, stop limit and sell stop limit 21-time frames and eight order types Forex signals and copy trading An In-built market of trading systems and apps. Improved precision in forex and CFD trading through integrated trading robots for scalpers |

These platforms are all accessible on the web, desktop, and mobile platforms. Each of these platforms allows traders to experience the market through their available features.

WebTrader platform

- Easy to trade as it’s online

- One-click trading

- Multiple order types and execution modes

- Real-time price quotes

- 24hr online support from Monday to Friday

- Multiple language support

- Real-time price quotes

Mobile platform (launched recently)

- Available on both android and IOS

- A customizable interface that saves you time when searching for your preferred pair

- You can build your favorite trading menu

Features

In general, the FP Markets’ features are as follows:

- Innovative trading technology with fast execution of orders

- Low-cost ECN pricing

- leverage of up to 500:1

- Tight spreads are as low as 0.0 pips

- Several trading platforms, including IRESS

- Diversified instruments

Education

FP Markets braces education as a vital tool in harnessing forex and derivatives trading knowledge. The broker offers tutorials about FX and derivatives through webinars, ebooks, videos, trading glossaries, and newsletters.

Through those study portholes, whether experienced or entering the FX market with this broker, you acquire enough skills to excel when trading.

Customer Support

FP Markets’ customer support offers via its platforms and its website at the help center section. It is made up of an FAQ part, call back, traders hub blog, live support, and contact us.

The FAQ tries to answer all the most realistic questions a client might have, like, which account type do you provide?

If a client is not satisfied with the FAQ questions, he/she can fill a form that renders them to leave their phone number at the end, and FP Market can get back at them via a call. While the traders’ hub blog allows clients access to trending articles about the FX market.

Lastly, FP Market has a live support part that runs 24/5 and allows clients to send messages to the company’s customer care team instantly. The last part of the help center is the “contact us” part that will enable clients to contact FP Markets. Either through email, chat, phone calls, among others.

Review Summary

FP Markets is a well-established FX broker, suitable for both amateur and experienced traders. It is secure as top-tier agencies regulate it, and it’s easy to trade. The powerful MT4, MT5, and WebTrader offer unique features that give traction to your trading targets and a good experience. In addition, it also provides FX and derivative trading tutorials to help you revamp your trading skills.

However, the platform is not available in the US, Japan among other nations. Its roots penetrate deep in Australia and the European Union currently but are extending to other countries.