Fort Financial Services Limited, abbreviated as FortFS, rolled out on June 9th, 2010, under the wings of the international financial holding company, One Vector Group Inc. It started operations as TradeFort with the vision of providing world-class brokerage services in the forex, CFD, and futures markets. Over time it expanded its services and rebranded into FortFS. The broker now operates as an International Business Company (IBC), offering customers access to diverse trading markets. Both newbies and veteran traders buy and sell FX pairs, CFDs, commodities, and cryptocurrencies.

Pros

- No commissions on FX trading.

- Deposit amount — low $5.

- No commissions on deposit and withdrawal for domestic channels like local Indonesian banks.

- It provides a 10% discount on newbie accounts.

- Possibility to trade unlimited leverages and nominal leverages of up to 1:1000.

- Offers 10% discount on newbie accounts.

- Incentives like rebates, bonuses on deposit, and a welcome compensation of $35 are available.

- Managed accounts — available.

- Internationally established broker with more than 20 awards.

- Social/copy trading — available.

- Diverse payment methods, including its payment MasterCard.

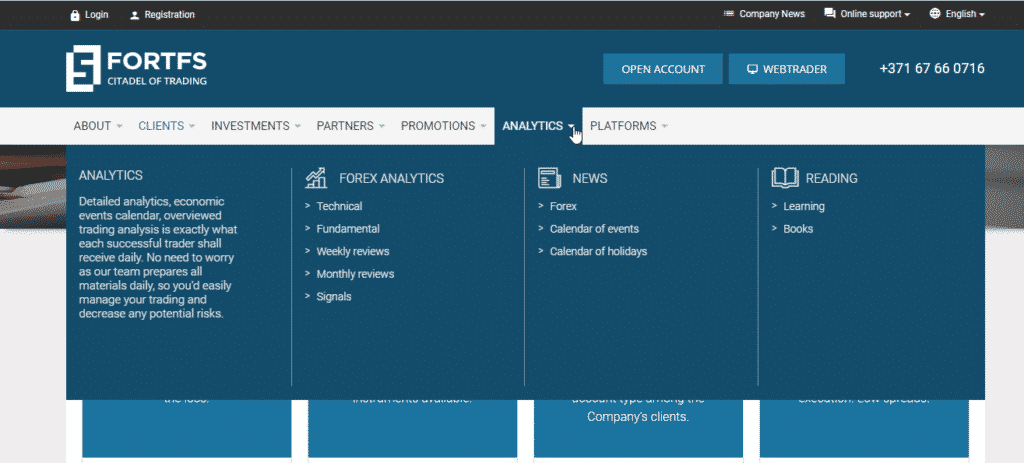

- Offers FX analytics like technical analysis and news.

- Offers Short Term Revenue Accounts (STAR) supervised by an investment manager.

- Diverse trading instruments, including cryptocurrencies.

- Available in many languages.

- Exécution type — STP/ECN.

Cons

- Trading conditions may vary depending on the account type. Newbies, PRO, and STAR accounts do not qualify for the unlimited leverage incentive for starters.

- Deposit and withdrawal commissions impose on international methods like web money.

- Deposits vary depending on the account type. Newbies expect a $5 minimum deposit while PRO traders face a $500 minimum deposit.

- Max leverages, floating spreads, and execution speeds fluctuate from one account type to the other.

- For forex, the floating spread is high for Fort account traders — starting from 2 pips.

- Swaps are imposed on some accounts.

- The CQG trading platform comes with some trading fees.

- The minimum deposit is high on some platforms. For example, the minimum deposit for NinjaTrading and CQG QTrader is $25,000 and $15,000, respectively.

As briefly introduced, The Fort Financial Services Limited (FortFS) launched in 2010 geared by the international holding company, One vector group. The parent company aimed to establish a broker offering quality brokerage services and contest for the Forex and CFDs trading market share in Europe, Asia, Latin America, among other regions around the globe.

The subsidiary broker rolled out its services under the trademark TradeFort in St. Vincent and the Grenadines (headquarters) with an international business license, but later the broker rebranded into FortFS. It holds a global financial brokerage license, IFSC/60/256/TS/17 from the IFSC of Belize, and is registered as an international business firm in St. Vincent & the Grenadines 25307 BC 2019.

Through time, as FortFS expanded its services, it achieved several milestones. The broker cites having attained over 20 awards in the trading industry.

- In fact, in 2019, the independent resource FXdailyinfo.com credited FortFS as the best forex broker. The award preceded several other milestones.

- In January, the same year, FortFS won the crown as the best newbie account broker of 2018.

The platform welcomes newbies with a $35 bonus and offers a 10% discount on the newbie’s lost amount. In addition, FortFS offers a 50% bonus on deposit and a 100% bonus on any amount above $100.

The broker operates as an STP/ECN broker offering traders execution speeds from 0.3 seconds. However, execution speeds depend on the account type of the trader. For example, pro account traders experience speeds from 0.1 seconds.

FortFS accounts include:

- Newbie

- Fort

- Flex

- Pro

- Investment account dubbed STAR

The accounts also contribute to different stake amounts. PRO account traders face a $500 minimum deposit while the rest of the account traders enjoy a $5 minimum deposit. Traders using some of its trading platforms like NinjaTrader and CQG QTrader incur fees and large deposit sizes.

However, as the broker legally offers services around the globe, clients have multiple deposit methods to choose from. It accepts funds internationally through WebMoney, E-wallets, domestic banks, among other techniques.

International methods include:

- WebMoney

- Perfect money

- E-wallets like Skrill and Neteller

- FasaPay

Depositing through the above channels includes a percentage commission depending on the channel except for skrill.

Generally, all protocols involved in depositing funds apply when making withdrawals at FortFS. However, local deposit methods include no commissions. They constitute selected domestic banks in Indonesia, Thailand, Malaysia, and Vietnam.

The broker offers diverse trading instruments. Its asset bracket consists of more forex pairs traded on swap-free accounts, including major currency pairs such as the USD, GBP, and EUR, major US stocks like FB, Amazon, Netflix, Google, eBay, Apple, among others, commodities such as precious metals and energies and significant cryptocurrencies.

Regulation

FortFS obtained international business company status in 2010 under the surveillance of the global business companies’ act of the revised laws of Saint Vincent and Grenadines.

This renders the broker abiding by all laws set for international companies. In addition, it holds an international business license number IFSC/60/256/TS/17 issued in 2013 by the IFSC of Belize. Lastly, in 2019, it achieved the international registration number 25307 BC 2019.

Pros

- Regulated internationally by the IFSC of Belize

- Holds an international registration number

Cons

- Not regulated by top-tier or two-tier agencies

- Based in offshore regions and not available in the United States

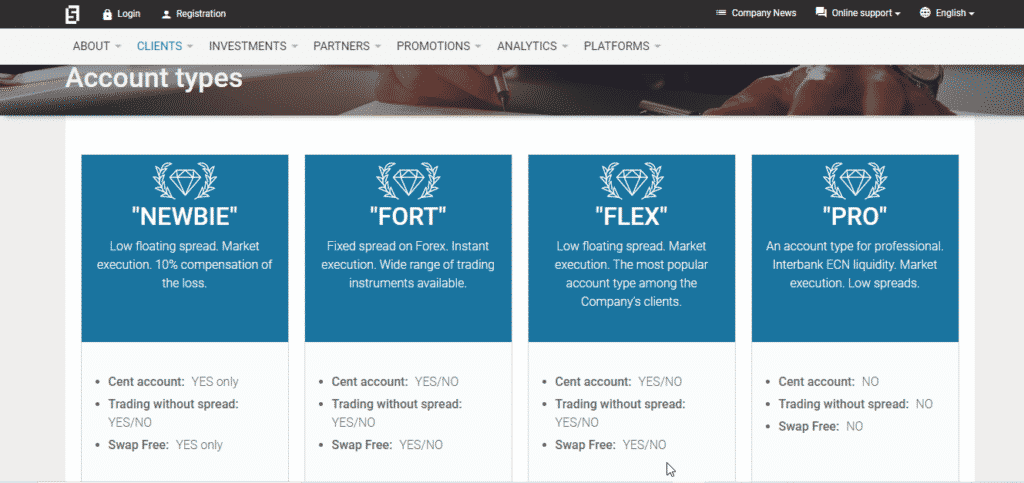

Account Types

FortFS offers four types of trading accounts to clients. The type of account you choose depends on your understanding of the market and the minimum deposit.

Newbie account

- Preferred deposit currency — USD

- Price accuracy — five digits

- Floating spread from — 0.3 pips

- Execution from — 0.3 seconds

- Max leverage — 1:1000

- Commission on FX no but from $10 for CFDs

- Minimum deposit — $5

- Margin call/stop out — 50%/25%

- Lot size up to —10 lots

- Welcome bonus — yes

- Bonus on deposit — no

- Dividends — no

Fort account

- Preferred deposit currency — USD/EUR

- Price accuracy — four digits

- floating spread from — two pips

- Execution from — 0.3 seconds

- Max leverage — 1:1000

- Commission on FX no but from $10 for CFDs

- Minimum deposit — $5

- Margin call/stop out — 50%/30%

- Lot size up to — 100 lots

- Welcome bonus — yes

- Bonus on deposit — up to 50%

- Dividends — up to 5%

Flex account

- Preferred deposit currency — USD/EUR

- Price accuracy — five digits

- floating spread from—0.3 pips

- Execution from — 0.3 seconds

- Max leverage — 1:1000

- Commission on FX no but from $10 for CFDs

- Minimum deposit — $5

- Margin call/stop out — 50%/30%

- Lot size up to —100 lots

- Welcome bonus — yes

- Bonus on deposit — up to 50%

- Dividends — up to 5%

PRO account

- Preferred deposit currency — USD

- Price accuracy — five digits

- Floating spread from — 0.1 pips

- Execution from — 0.1 seconds

- Max leverage — 1:100

- $9 on FX and CFDs

- Minimum deposit — $500

- Margin call/stop out — 80%/40%

- Lot size up to — 100 lots

- Welcome bonus — yes

- Bonus on deposit — no

- Dividends — no

How to open a FortFS account?

Step 1. Log into their website at FortFS.com and click the open account button

Step 2. Choose the account you prefer

Step 3. Fill the online forms and provide personal information and KYC documents if required

Step 4. Receive login credentials for the traders portal and sign in

Step 5. Set deposit and withdrawal methods

Step 6. Select the trading platform you prefer

Step 7. Make the first deposit depending on the account type and trading platform

Step 8. Start trading

Fees and Commissions

FortFS hikes commissions on CFD trading, international deposit methods, and on the NinjaTrader platform. Traders using the Fort account also experience fees on the markup spread. The floating spread starts from 2 pips. The commission for CFD trading is $10 for all accounts, excluding the pro account. Pro account traders face a $9 commission on all instruments. Deposit commissions depend on the channel used. For some methods, a 2% commission incurs.

Payment options

The broker offers diverse payment options to traders. The payment platform depends on the geographical location of the trader. Some serve clients internationally, while others only serve domestic traders around the Asian region.

For example, WebMoney, E-wallets such as Skrill and Neteller, Fasapay, and PerfectMoney, serve clients worldwide, including in Africa. Domestic payment methods occur through local banks in Indonesia, Malaysia, Vietnam, and other Asian regions. The minimum withdrawal starts from $1 or $15, according to the channel used.

Pros

- Multiple payment options

- Deposit and withdrawal are free for domestic traders

Cons

- Commission on withdrawal and deposit to international traders

- Expensive to use trading platforms like NinjaTrader and CQG QTrader

Deposit

FortFS accepts deposits from these methods:

- Bank Cards like Visa, Mastercard for domestic clients

- E-Wallet transfers like Skrill and Neteller

- WebMoney, FasaPay, Perfect Money for international traders

Withdrawals

They occur through the following:

- Bank Cards like Visa, Mastercard for domestic clients

- E-Wallet transfers like Skrill and Neteller

- WebMoney, FasaPay, Perfect Money for international traders

International withdrawals execute instantly, while domestic payment methods take up to 48 hours.

Available Markets

FortFS allows clients access to several trading instruments. Its market bracket holds FX pairs, indices, commodities, cryptocurrencies, and maybe ETFs.

Forex

FortFS imposes zero commission on forex trading. The platform allows traders to buy and sell currency pairs 24 hours from Monday through Friday on swap-free accounts. However, FX pairs such as HKD, MXN, TRY, ZAR don’t trade on the swap-free account. The maximum leverage varies between accounts but clients trade nominal leverage of 1:1000 with the floating spread starting from 0.3pips and STP/ECN executions of 0.3 seconds.

Indices & stocks

Clients trade major global indices and stocks of US conglomerates and other companies with leverages of 1:1000 and floating spread from 0.3 pips.

Indices include; Brent, WTI, and Stoxx50, while the shares available on the broker range from Yandex, Xerox, Visa, Toyota. etc. However, these assets have an imposed commission of 0.1% per contract. Traders also can switch to swap-free accounts.

Commodities

The commodities offered at FortFS include precious metals like gold and energies such as crude oil. Traders buy and sell these instruments against the USD or the EUR. However, the actual spread varies depending on the pair and sometimes starts from 0.036, and commissions could incur commodities.

Cryptocurrencies

Cryptocurrencies trade on FortFS with lot sizes starting from 0.01 for some assets and 0.1 digital assets such as Ethereum.

The crypto-assets available include:

- BTC

- ETH

- BTC Cash

- Ripple

- Litecoin

Traders access this market daily from Monday to Friday. Its commission hovers around 1.5% per contract.

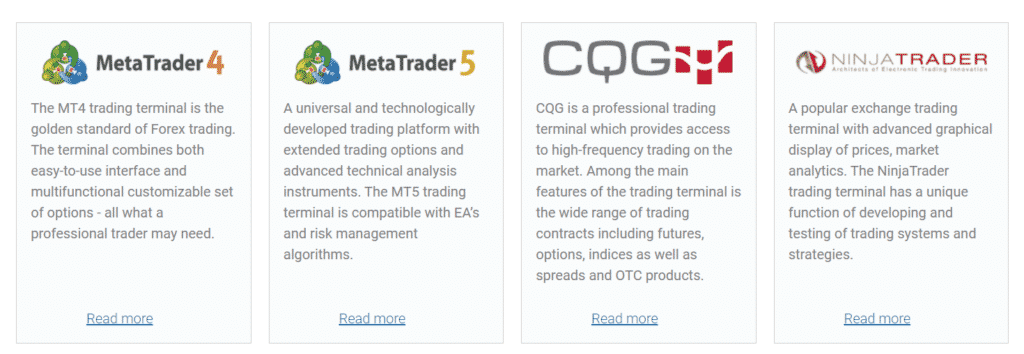

Trading Platforms

MT4

The MT4 platform is available on the web, mobile in Android and IOS, and desktop versions for easy accessibility in Windows and Mac OS. It rolls out robust trading technology that paves the way for the following:

- Autotrading — yes

- Minimum deposit — $5

- Indicators/EA — yes

- Advanced testing — yes

- Able to cancel orders — no

- Micro-lot account available — yes

- Chart trading available — yes

- Allows Unlimited leverage — yes

- Offers Forex and CFDs trading — yes

- It is free

MT5

The MT5 platform is a predecessor of the MT4 and allows clients to experience next-generation trading because of its advanced tools and top-notch trading capabilities. It is also available in Windows and Mac OS, Android and IOS, and on the Web.

- Autotrading — yes

- Minimum deposit — $5

- Indicators/EA — yes

- Advanced testing — yes

- Able to Cancel orders — no

- Micro-lot account available — yes

- Chart trading available — yes

- Offers Forex and CFDs trading — yes

- It is free

NinjaTrader

Offers advanced graphical display of prices, market analytics and helps develop and test trading systems and strategies.

- Autotrading — yes

- Minimum deposit — $25000

- Indicators/EA — yes

- Advanced testing — yes

- Cancels orders — yes

- Micro-lot account available — no

- Chart trading available — yes

- Not available for Mobile and Web

- It offers futures trading

- It is free

CQG QTrader

It provides access to high-frequency trading on the market. The terminal is available on the web, desktop, mobile, and CQG QTrader, which costs $40 per month.

- Autotrading — yes

- Minimum deposit — $15000

- Advanced testing — yes

- Able to Cancel orders — yes

- Micro-lot account available — no

- Chart trading available — yes

- Offers futures and options trading

- Webtrader and Mobile CQG — provided free

Features

FortFS features generally include:

Trading tools

- Expert advisors

- Trading calculator

- Profit calculator

- Charting tools

Analytical tools

- Market watch information tools

- Technical analysis tools.

- Indicators

- Signals

Education

FortFS helps traders boost their trading knowledge by offering several tutorial programs. The broker holds seminars to educate clients about the FX and CFD markets. It claims to have saved more than 100 seminars in the Asian region.

Besides, clients can also access its glossary resources on the web and learn trading terminologies. It also offers a Q&A section that answers the most frequently asked questions raised by traders.

Customer Support

The broker allows clients and anyone else access to a 24/5 customer support portal on its website. The portal offers an online chat section where traders and people seeking inquiries can contact FortFS’s customer care. In addition, the broker includes an efficient “contact us” section giving clients real-time customer care services.

Review Summary

Fort Financial Services prides itself with over 20 awards in the trading industry and the ability to extend roots to every corner of the globe as it holds an IFSC business license. The broker serves millions of traders globally, offering them access to its diverse markets. However, it’s yet to make an entry into the US financial market.

FortFS allows clients to access the trading markets using several accounts and platforms. The trading conditions differ depending on the account, and the minimum deposit varies on some platforms. It targets newbies, intermediate, and professional traders. Its pool of accounts serves all these criteria of traders with incentives like bonuses, unlimited leverages, and discounts on the newbie account. It’s an excellent broker to acquit with as a newbie or an experienced trader.