Foreximba is an expert advisor that works on AUDUSD and EURUSD currency pairs. The vendor claims that the robot is suitable for all kinds of traders. It is supported by real-money trading accounts and has shown excellent performance in historical tests.

The current price of this robot is $194.99. Compared to other EAs on the market, it’s quite cheap. This package comes with a single lifetime license for a real account and three lifetime licenses for demo accounts. Every user gets access to a user manual and friendly support. The user also offers a 30-day money-back guarantee for this package.

Foreximba trading strategy

This is a robot that trades with a fixed lot size. It does not use risky strategies like martingale. The vendor has not clearly explained the trading strategy employed by this EA. We don’t know what indicators the robot uses or how it identifies lucrative trades. As such, we cannot determine whether the strategy is best suited to a particular trading style.

Foreximba features

This is a robot that works on EUR/USD and AUD/USD currency pairs. To get started, you need to deposit at least $60 in your account. Most robots require a much higher starting balance. According to the developer, the EA is easy to install.

Foreximba has a drawdown control feature, but we are not sure how it works. The vendor has not shared the details about the features of the robot. It is compatible with all brokers, which means its performance is not dependent on broker conditions.

Foreximba backtesting results

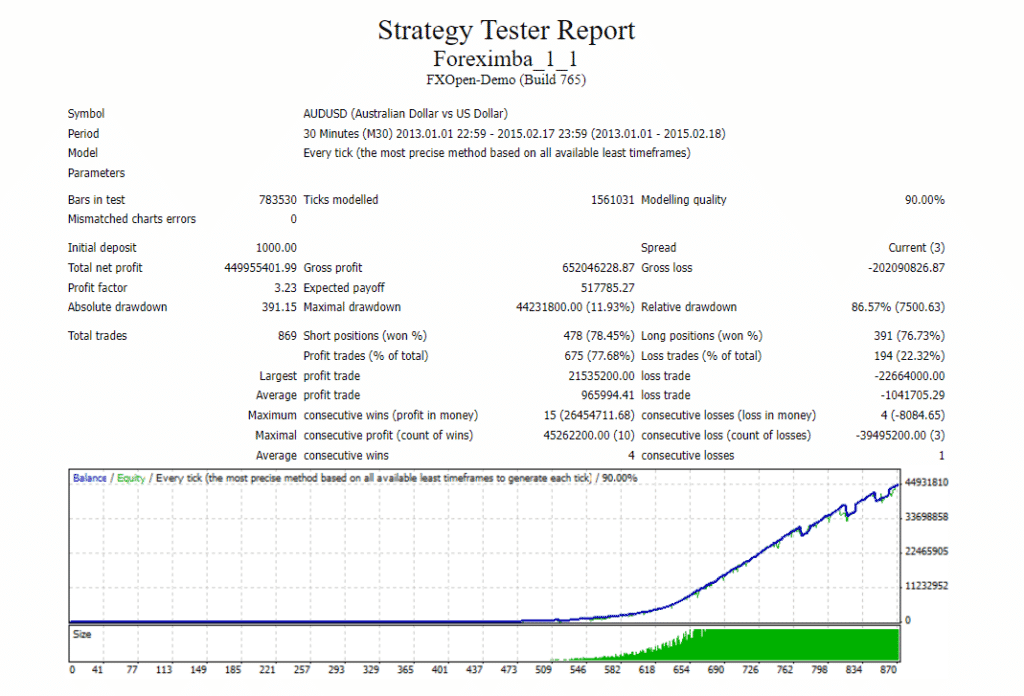

Here we have the results of a backtest performed on the AUD/USD pair. This test was carried out for the M30 timeframe from 2013 to 2015 with an every tick model. The EA started out with an initial deposit of $1000, conducting a total of 869 trades and winning 77.68% of them. This resulted in a total profit of $449955401.99.

During the testing period, the profit factor was 3.23 which is much higher than other EAs. There were 15 maximum consecutive wins and 4 maximum consecutive losses for this test. The relative drawdown was incredibly high at 86.57%. This tells us that the robot was following a high-risk strategy.

Foreximba live trading results

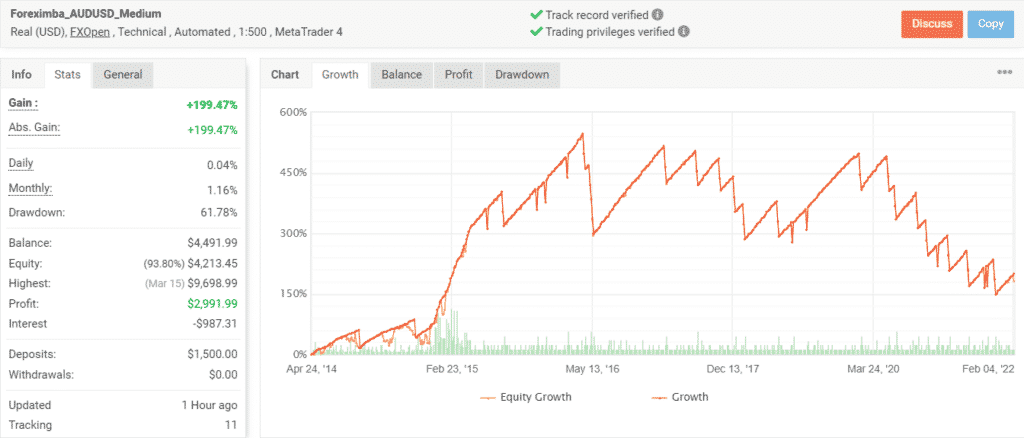

Here we have a live trading account on Myfxbook that was launched on April 24, 2014. To date, the EA has conducted 921 trades through this account, winning 664 and losing 257. Thus, it currently has a win rate of 72%, which is slightly lower compared to the backtesting data. The total profit generated through this account currently stands at $2991.99.

Currently, the daily and monthly gains for this account are 0.04% and 1.16%, respectively. The drawdown of 61.78, while being lower than the backtest, is still higher than normal. This account has a decent profit factor of 1.08.

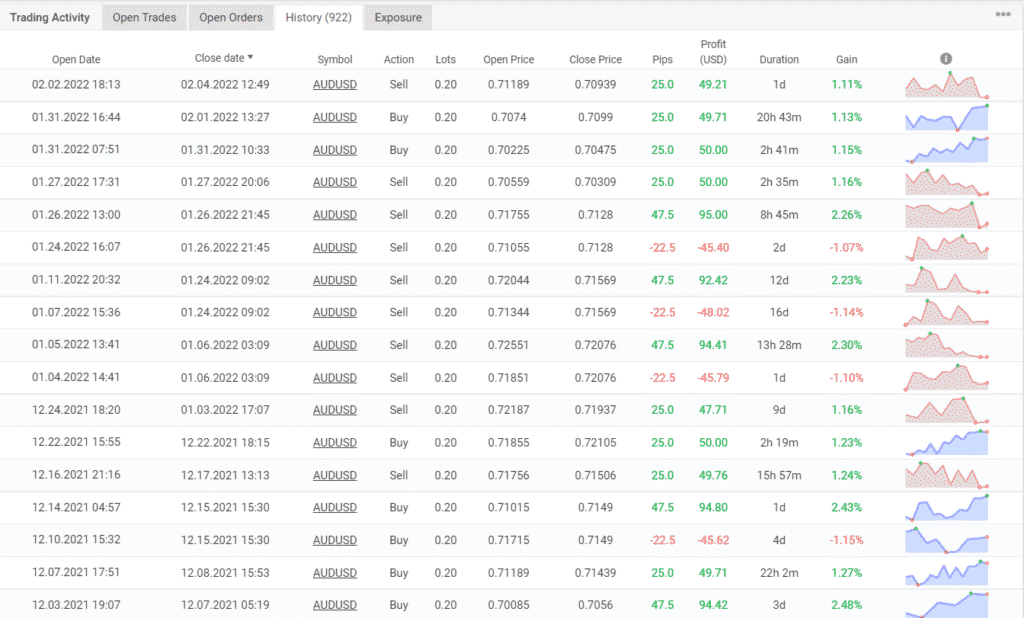

The last trade placed through this account was on 2nd February 2022. We can see that the EA conducts trades with a fixed lot of 0.20. It generates profit at a steady rate but is prone to suffering substantial losses occasionally. Also, it sometimes holds its trades for several days. The average win and loss for this account are 28.20 pips/$59.56 and -64.03 pips/-$142.24, respectively.

Foreximba reputation

Unfortunately, there is zero information on the parent company behind this EA. On the official website, the vendor has not shared any background information on the developers. We don’t know when the company was founded, or where it is located. It is unclear whether this team has built other automated trading systems in the past. There is no contact information, and the only way to get in touch with the support team is through the contact form on the website.

We were unable to find any user reviews for this EA on websites like Trustpilot, Forex Peace Army, Quora, and Myfxbook. As such, we have no idea about the experience of other customers with this expert advisor. It seems not many people are currently using this robot for conducting live trades.

Foreximba review summary

- Strategy – 4/10

- Functionality & Features – 4/10

- Trading Results – 5/10

- Reliability – 5/10

- Pricing – 6/10

Foreximba is an affordable expert advisor supported by verified statistics and backtesting results. However, it is sold by a developer whom we know nothing about. They haven’t clearly explained the trading strategy. We know it is a risky strategy since the EA exhibits a high drawdown. Also, there are no user reviews for this system written.