Pros

- Low trading fees

- Regulated by multiple authorities

- Provides segregated accounts for each client

- Lots of trading instruments

Cons

- Slow account verification

- Fees on stock CFDs are often high

- Lack of some popular asset classes, like funds and real stocks

Forex.com is a trading name of GAIN Global Markets Inc. It is authorized and regulated by the Cayman Islands Monetary Authority under the Securities Investment Business Law of the Cayman Islands (as revised) with license number 25033.

Forex.com provides forex, stocks, indices, commodities and cryptocurrency trading, and CFDs to the people who are under the regulating authorities. This financial service provider has multiple regulations, while some services may change with the change in regulation. However, the primary service remains almost the same for all investors.

Forex.com provides all payment processing services through StoneX Financial Ltd. Overall, GAIN Global Markets Inc. is a part of GAIN Capital Holdings Inc. At the same time, all are affiliates of StoneX Group Inc.

Regulation

Based on our review, we have found Forex.com as a strongly regulated broker. Moreover, all broker funds are fully segregated from brokers’ funds in separate bank accounts with top-tier banks. The broker provides service to millions of clients in more than 140 countries where traders are eligible for the Financial Services Compensation Scheme.

The following authorities regulate Forex.com:

- Financial Conduct Authority (FCA) in the UK.

- Cayman Islands Monetary Authority (CIMA).

- Financial Services Authority (FSA) in Japan.

- Commodity Futures Trading Commission (CFTC) is a member of the National Futures Association (NFA) in the US.

- Investment Industry Regulatory Organization of Canada (IIROC).

- Australian Services and Investments Commission (ASIC).

StoneX Group has a total equity capital of $800 million with total customer assets of $5 billion. The details of the financial statements and investors’ relations are available here.

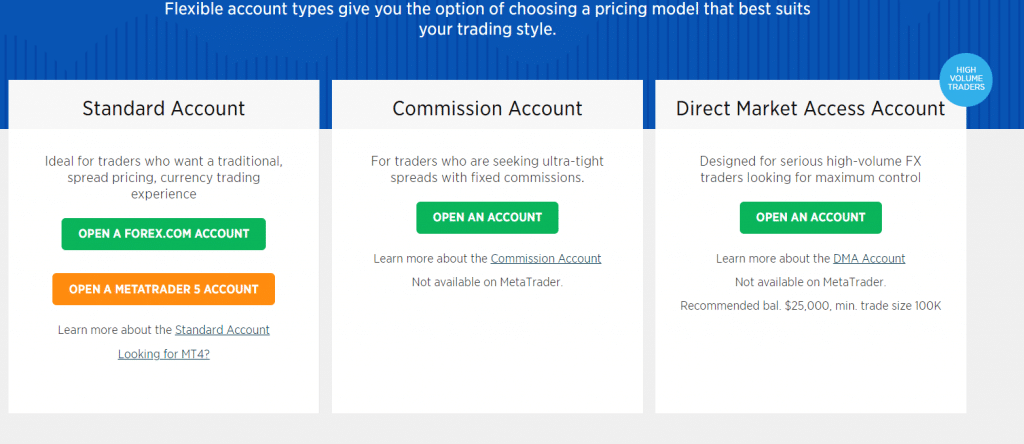

Account Types

Generally, brokers with maximum available account types can attract many traders, but the service quality is another factor investors should consider.

We have found three account types in Forex.com during our review where traders can start trading with a recommended $1000 deposit.

The summary of the account types is mentioned below.

Standard account

- Trading platform: Web Trading, MetaTrader 4, MetaTrader 5

- Trading assets: 80+ forex pairs, 4 crypto assets, 4500+ stocks, 15+ indices and 12+ commodities

- Pricing: spread only

- API trading: yes

- Recommended deposit: $1000

Commission account

- Trading platform: Web Trading, mobile, desktop

- Trading assets: 80+ forex pairs, 4 crypto assets, 4500+ stocks, 15+ indices and 12+ commodities

- Pricing: spread & commission

- API trading: yes

- Recommended deposit: $1000

DMA account

- Trading platform: Web Trading, mobile, desktop

- Trading assets: 58 FX pairs plus spot gold & silver

- Pricing: commission only

- API trading: no

- STP model: yes

- Recommended deposit: $25000

The type of account in Forex.com is perfect for those who are ready to take trading as a profession. Moreover, it allows traders to diversify the portfolio into multiple trading assets. However, the recommended deposit amount is $1000, which is relatively high for a new trader for a start. Furthermore, the leverage is a maximum of 50:1 for all account types, which is not user-friendly compared to other brokers.

You have to move to the “open an account” tab from the website’s top to open an account. Later on, you have to select the account types you are looking to extend and input all required information.

Fees and Commissions

Forex.com trading fees are low compared to the industry average. During our review, we have found both trading and non-trading prices are tolerable by most of the traders:

Non-trading fees

Forex.com’s non-trading fees are satisfactory and below the industry average. However, you have to pay a $15 or equivalent monthly fee after one year of inactivity. Besides the inactivity fee, there are no deposit or withdrawal fees required by Forex.com.

Trading fees

Trading fees include all direct payments related to taking trades where trading fees on the stock market are lower than the other trading instruments. The average trading fees on EURUSD is $6 approximately, considering 1:20 leverage and one week of holding the trade. In a similar condition, the trading cost for GBPUSD would be $5.3.

Coming to the CFD fees, if you hold a trade for more than a week, you have to incur the trading fee as below:

- S&P 500 — $1.4

- Stoxx 50 — $1.8

- Apple CFD — $21.3

Lastly, you have to incur $0.018 per share for the US Stocks and $0.8% on the trade value.

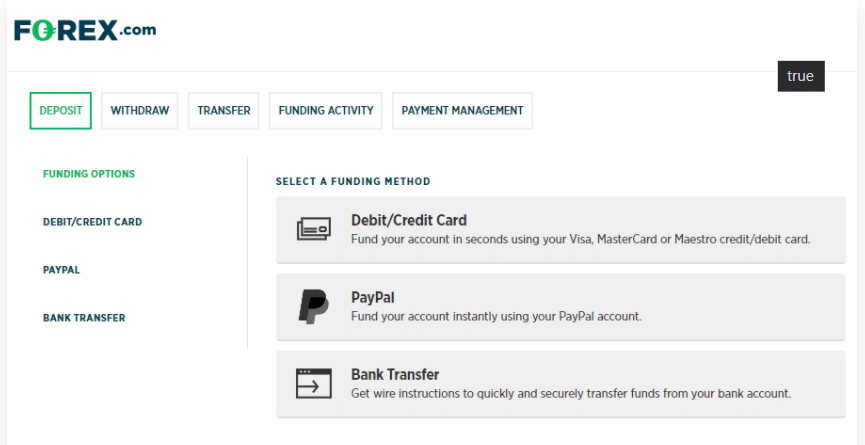

Payment Options

Forex.com has both instant and time-consuming payment methods to cover all types of traders. If you want to trade with a more considerable volume, you can pay with a bank transfer, while for instant payment, you can choose a credit card.

Forex.com deposit option

There are three ways to deposit in Forex.com, as mentioned below:

- Bank transfer

- Credit card

- Electronic wallet

Bank transfer requires almost 6 to 10 working days to process, and it is suitable for a more significant volume of transactions. On the other hand, credit card and electronic wallet transactions will be deposited immediately.

Forex.com withdrawal option

While making a withdrawal, the bank transfer takes a minimum of 2-5 business days. However, withdrawal requests from a debit/credit card may require longer, usually five days.

How to withdraw from Forex.com?

At first, you have to log into “my accounts”, click on “funding”, and select “withdraw.” Later on, input the withdrawal amount and click on “withdraw now.”

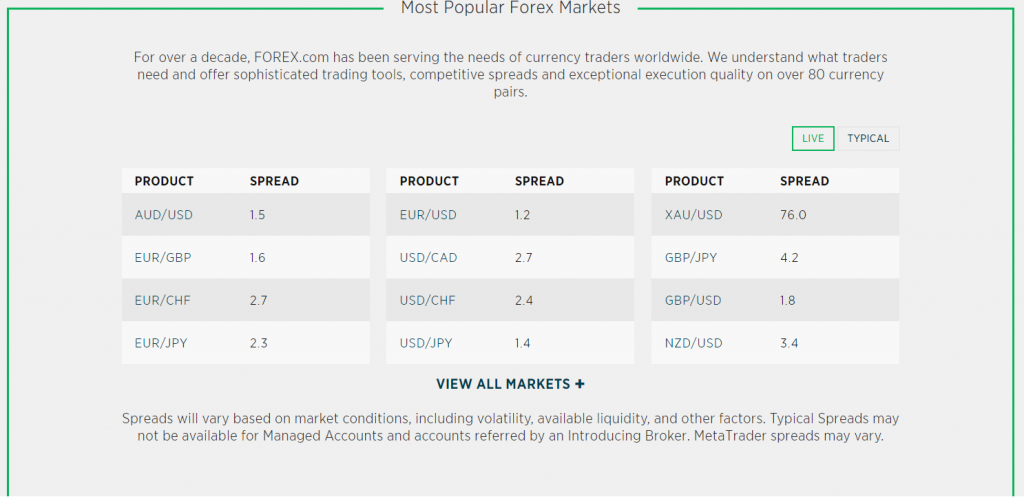

Available Markets

Let’s look at the list of available markets on the Forex.com platform, which is suitable for diversifying the portfolio as it has countless numbers of trading assets available. Simultaneously, there is a lack of some popular asset classes on the platform, like funds and like real stocks.

Forex

- You can trade more than 80 currency pairs with the Forex.com platform with a competitive spread as low as 0.8 pips for EURUSD.

- The trading opportunity is available in multiple platforms like MT4, MT5, DMA, and forex.com platform.

- You can trade for multiple account types to cover the traders’ requirements.

- There is an opportunity for a monthly rebate of up to $10 per million dollars trader within the active trader program.

Indices

- Forex.com provides more than 15 world’s top indices.

- UK 100 and Germany 30 are available to trade from 1 pt.

- Forex.com allows trading in indices with a fixed spread during market hours.

- Trade sector-themed US indices, including ESG, green, Trump 30, and Biden 30.

Stock market

- Opportunity to trade more than 4500 popular stocks.

- You can trade with a 1.8 cents commission on US Stocks.

- Moreover, Forex.com allows short selling on top companies.

Commodities

- Trade UK crude oil on fixed spreads, 1% margin.

- Among other assets, there are coffee, corn, cotton, heating oil, etc.

- You can go both long as short on US and UK crude oils.

Cryptocurrencies

- Crypto assets are available to trade, including Bitcoin, Ethereum, Litecoin, etc.

- A cost-efficient environment for crypto trading.

- You can go both short and long from 10p a point.

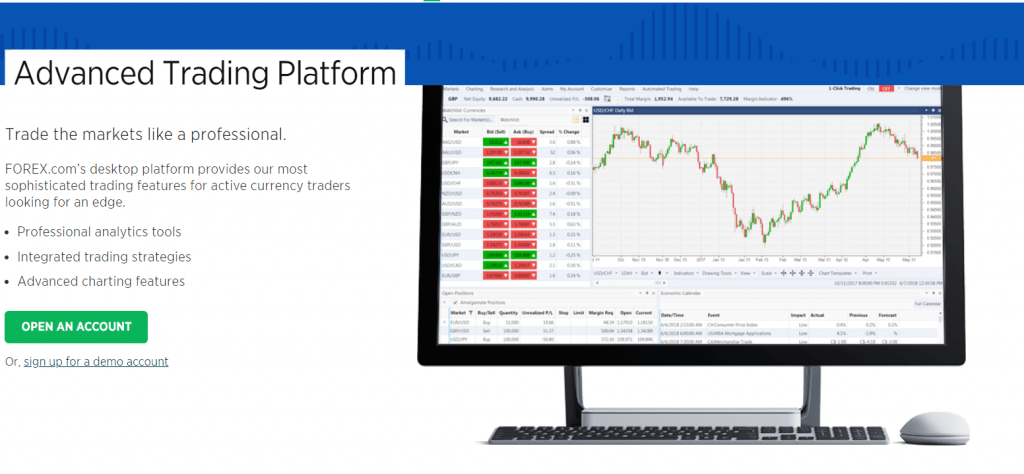

Trading Platforms

Forex.com provides MetaTrader 5, MetaTrader 4, and Its proprietary trading platform to cover all traders’ trading needs.

Forex.com desktop platform

- Forex.com trading platform has a customizable dashboard with more than 80 trading indicators and lots of trading tools to cover all traders’ requirements.

- Integrated trading strategies are available to cover analysis support.

- More than 100 predetermined templates for traders.

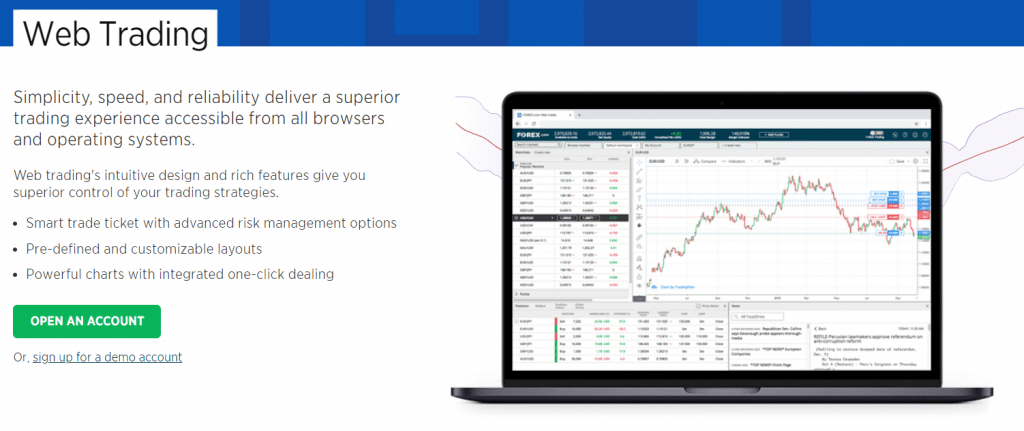

Forex.com web platform

- You can manage risks based on P&L and other methods as per the margin requirement.

- In the web trading platform, you can set the template to get the desired outlook from anywhere in the world.

MetaTrader 5 platform

- Meta Trader 5 is a sophisticated trading platform that has more than 100 trading tools & indicators.

- You can see the market from a broader view, with more than 29 available timeframes.

- Lots of automated trading tools built on MQL5 language.

Features

Besides general features, Forex.com provides more than a trader should know. Here we will see some elements that Forex.com exclusively supplies:

Market analysis

The market analysis includes the latest technical and fundamental analysis on different trading assets. During our review, we have found those analyses to be perfect. Besides analysis on a specific trading instrument, Forex.com often provides analysis on sessions so that investors can get the overall outlook of the market before any significant event appears.

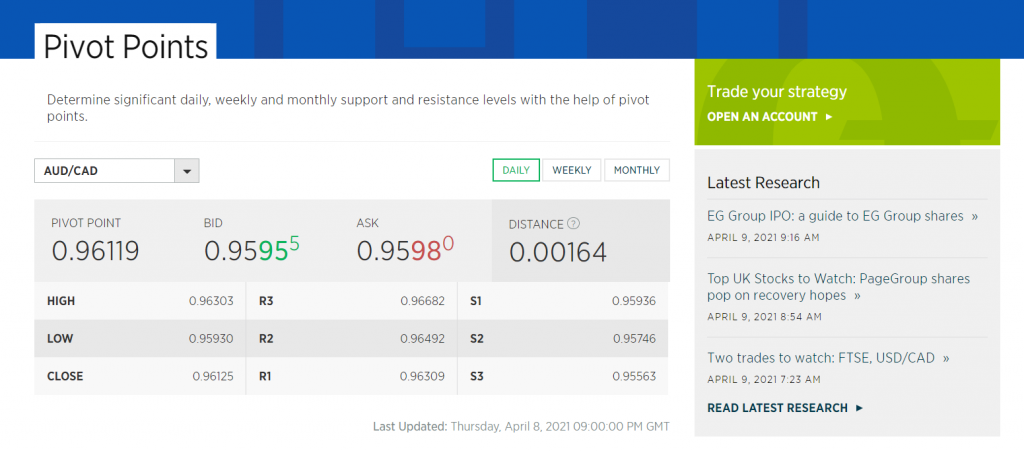

Pivot points

Forex.com provides pivot points for all trading instruments. Here you have to move to the pivot point page and select the trading instrument. Later on, you can see the exact pivot point level with multiple support and resistance levels.

Education

Forex.com emphasizes trading education as it is an essential element for being a successful trader. As a part of the education, Forex.com provides trading courses from beginners to advanced level. We have found the trading courses as resourceful and practical for traders, as most come from certified analysts. Moreover, it does not require to have an account with the broker to access all educational services. Besides the trading knowledge, Forex.com provides support on risk management as well.

Customer Support

Forex.com website is available in English and Chinese languages so that investors of most other countries can access it.

On the support page, there are several frequently asked questions covering most of the general requirements. Moreover, through the account changing form, traders can request the account type changes.

Among other customer support methods, the most effective is live chat. Here you can contact them instantly, and this method is speedy and active.

Review Summary

In summary, we can say that Forex.com is a reliable forex broker where you can invest and diversify your trading portfolio without any hesitation.

However, the forex market involves some unavoidable risks. Therefore, you have to research yourself before investing money in the Forex.com platform. In that case, you can open a demo account and practice trading for a while.