(Bloomberg) Fed’s Chair Jerome Powell expects the central bank to achieve the 2% inflation target once supply constraints subside.

Powell acknowledges the uptick in inflation in recent months, a factor he attributes to rises in oil prices and economic rebound.

The Fed chair sees the supply constraints as transitory, allowing the central bank to hit the inflation target once the effects subside.

Powell also expects recoveries in employment in the coming months as more people get vaccinated and the economy sheds off pandemic dust.

Investors are now keen on Powell’s statement before the House Select Subcommittee on the Coronavirus Crisis on Tuesday for potential monetary policy direction.

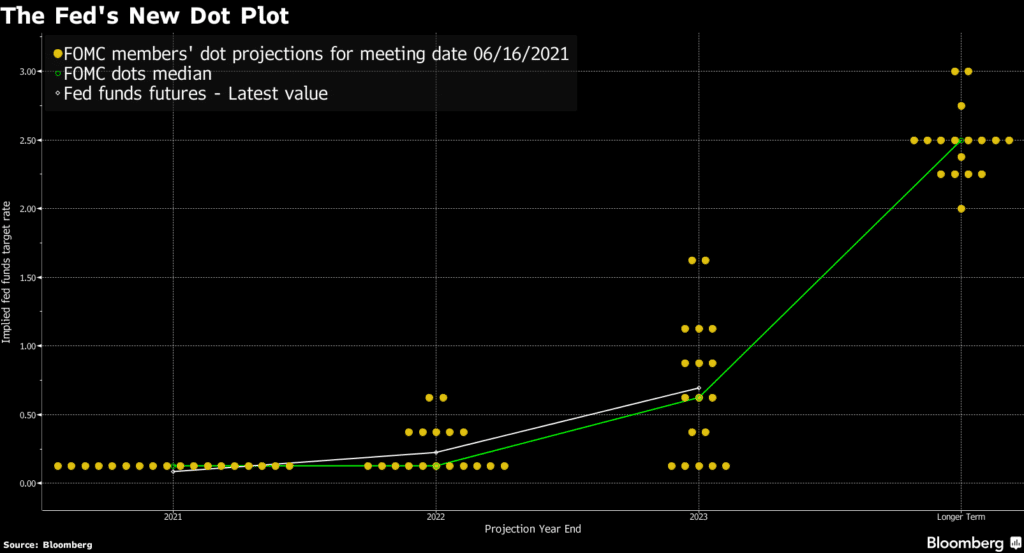

Some Fed officials have in the past hinted at tightening of policy earlier than expected even as the central bank said it would hike rates two times towards the end of 2023.

SPY is down -0.13% on premarket, QQQ is down -0.26% on premarket, DXY is up +0.23%.