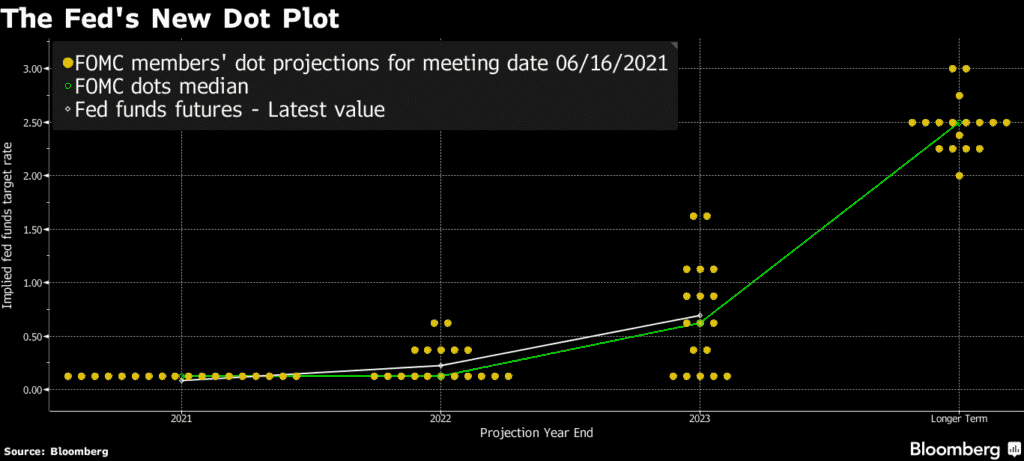

(Federal Reserve) The Federal Reserve projects two rate hikes by the end of 2023 even as officials plan to hold discussions to scale back bond purchases.

Fed Chair Jerome Powell says the economy has made progress that necessitates scaling back bond purchases.

The Fed maintained its benchmark policy rate at 0-0.25%, the same as previous and also left the $120 billion monthly bond purchases unchanged.

Analysts saw a hawkish surprise from the Fed in statement, which saw the dollar and Treasuries rise as the stocks traded lower.

The central bank sees inflation rising by 3.4% this year, up from an initial projection of 2.4%, before cooling to 2.1% in 2022, up from previous projection of 2%.

Fed also raised estimates of 2023 inflation to 2.2% from 2.1%.

Unemployment rate in Q4 2021 was left unchanged at 4.5%, while that of the comparable quarter of 2022 was reduced from 3.9% to 3.8%, with the 2023 forecast set at 3.5%.

The Fed expects the gross domestic product to grow by 7% this year, up from a previous forecast of 6.5%, with 2022 and 2023 growth set at 3.3% and 2.4% respectively.

SPY is down -0.33% on premarket, DXY is up +0.72%.