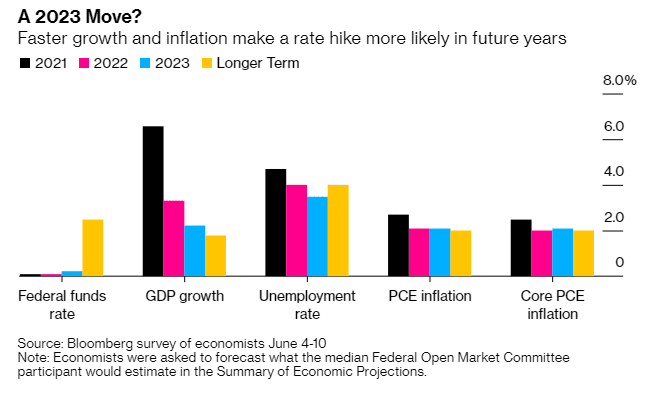

(Bloomberg) More than 50% of economists in a survey predict the Fed will increase interest rates in 2023 despite an uptick in inflation and a rebounding economy. The economists do not expect bond tapering until August or September.

Some economists do not see a liftoff of rates from near zero until 2024, in line with Fed’s March forecast.

Surveyed economists say the Fed will be in no rush to withdraw monetary stimulus.

40% of the poll respondents expect the Fed to initiate tapering of the monthly $120 billion bond purchases in late August.

Investors are keen on Wednesday’s policy statement on Wednesday in which the Fed is expected to reaffirm plans to adjust bond purchases once economic and inflation goals are met.

Analysts expect the Fed to raise this year’s growth outlook to 6.6%, with inflation of 2.7% and 2.1% in 2021 and 2022, respectively.

Survey respondents project a 4.7% unemployment rate in the fourth quarter

SPY is up +0.026% on premarket, QQQ is down -0.026% on premarket, EURUSD is down -0.09%