International online brokerage company FBS alleges to operate as a true No Dealing Desk broker (NDD), offering millions of clients market and STP order executions in a wide range of assets. The broker claims to execute 95% of these orders in 0.4 seconds with meager floating and fixed spreads starting from 0.0 pips.

It also notes falling under a stringent regulation backed by the IFSC, giving it the much-needed momentum to operate worldwide. FBS is known to have won clients’ trust in over 150 countries around the globe.

Pros

- Tight spreads starting from 0 pip

- Low minimum deposit capped at — $1

- Well-established broker with over ten years of experience

- Regulated internationally by the IFSC

- No hidden fees

- 24/7 multilingual customer support

- Convenient trading tools like — FX calculators

- Negative balance protection — yes

- Inactivity fees — no

- Excellent education resources

- Social trading available — yes

- An array of payment options

Cons

- Some deposit and withdrawal methods charge fees

- Some trading conditions favor a peculiar type of clients depending on the account type.

- Does not accept clients from the USA, UK, and other nations

- Not regulated by top-tier agencies such as the FCA

Limassol-headquartered brokerage company FBS pioneered in the financial trading space in 2009, aiming to serve financial markets’ traders with speedy executions and tight spreads across its asset classes. Through time, the broker expanded after receiving the green light from the International Financial Services Commission (IFSC) of Belize and now claims to serve over 17 million active traders in 150+ countries worldwide.

It prides itself on being a true NDD leveraging both STP and ECN technology to offer market order executions with spreads starting from as low as 0 pip and a leverage of up to 1:3000. These, coupled with other advantages such as incentives like — 100% deposit bonus, fuel the company on achieving its milestones. Currently, FBS confirms holding more than 30 industrial awards in its trophy cabinet.

The broker allows its array of customers access to the forex, CFDs, and the cryptocurrency markets aided by profitable trading tools such as economic calendars, forex calculators, currency converters, and many more. Nonetheless, it provides 24/7 multilingual customer support, ensuring the clients have the best services when exploiting its assets.

The broker offers the following asset classes

- FX pairs — with both majors and exotics

- Commodities such as metals and energies traded as CFDs

- Indices and stocks traded as CFDs

- Cryptocurrencies — traded as CFDs

Speculating FBS’ assets as CFDs allows clients to diversify their portfolios as the broker will enable them to go long and short, thus benefiting even when the markets go down. But, customers must fund their accounts with a set monetary size depending on the account type to start trading. The minimum deposit for some FBS accounts is capped at $1, while the amount stretches up to $1000 on other accounts.

Clients have access to these payment options

- E-wallets like Skrill and Neteller

- Bank cards like Visa

- Wire transfers

- Perfect Money

Amid funding the FBS account with the required amount, clients explore the broker’s wide range of instruments through its trading platforms designed to offer a good trading environment. The broker provides the world’s popular platforms — the MT4 and MT5 across all interfaces. Lately, it launched its proprietary trading platform dumbed FBS Trader available on both android and IOS operating systems.

Wrapping up, FBS boasts of providing honest services and credible security to clients as it holds trading licenses from reputable bodies such as the IFSC of Belize. The international regulatory body is cushioned by the CySEC and ASIC, making sure FBS conducts transparent activities across Europe, Australia, and internationally.

Regulation

- Legally authorized as an international financial conglomerate by the International Financial Services Commission of Belize.

- Regulated by the Cyprus Securities and Exchange Commission (CySEC) in Europe.

- Also surveyed by the Australian Securities and Investment Commission (ASIC).

Pros

- Internationally legalized broker

- Regulated by two-tier agencies, making it a relatively safe broker

Cons

- Fails to offer its services in the USA, UK, and other nations

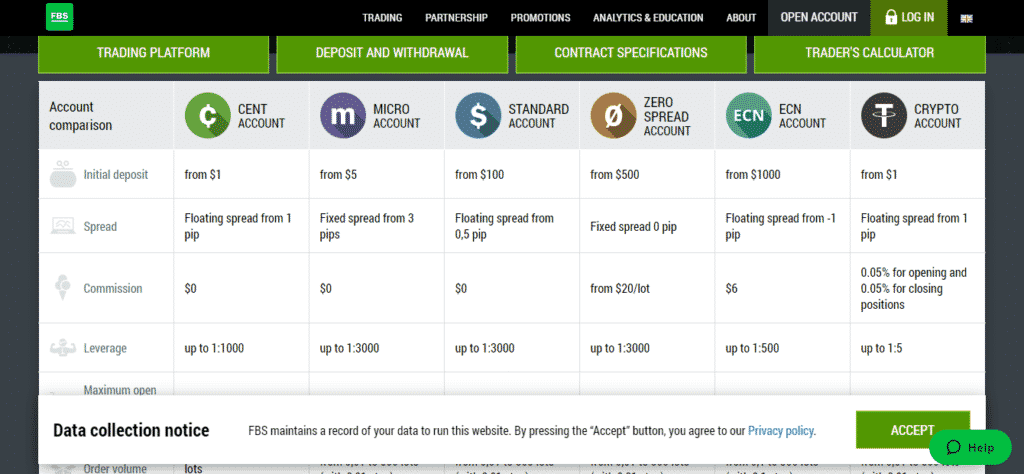

Account Types

FBS offers several account types tailored to serve special types of clients. The account types include the following:

- Standard account

- Cent account

- Micro account

- Zero spread account

- ECN account

- Crypto account

Analysis of the accounts

Standard account

- Maximum open position and pending order — 200

- Min. deposit — $100

- Min. trade size — 0.01 lot

- Leverage — up to 1:3000

- Floating spread from — 0.5 pips

- Commission — $0

- Market execution — 0.3 seconds, STP

Cent account

- Min. deposit — $1

- Min. trade size — 0.01 lot

- Leverage — up to 1:1000

- Floating spreads from — 1 pip

- Commission — $0

- Maximum open position and pending order — 200

- Market execution — 0.3 seconds, STP

- Order volume — from 0.01 to 1000 cent lots(with step 0.01)

Micro account

- Min. deposit — $5

- Min. trade size — 0.01 lot

- Leverage — up to 1:3000

- Fixed spreads from —3 pips

- Commission — $0

- Maximum open position and pending order — 200

- Order volume — from 0.01 to 500 lots (with step 0.01)

- Market execution — from 0.3 seconds, STP

Zero spread account

- Min. deposit — $500

- Min. trade size — 0.01 lot

- Leverage — up to 1:3000

- Fixed spreads from — 0 pips

- Commission — $20/lot

- Maximum open position and pending order — 200

- Order volume —from 0.01 to 500 lots (with step 0.01)

- Market execution — 0.3 seconds, STP

ECN account

- Min. deposit — $1000

- Min. trade size — 0.01 lot

- Leverage — up to 1:3000

- Floating spreads from — -1 pip

- Commission — $6

- Maximum open position and pending order — no trading limits

- Order volume from — 0.1 to 500 lots(with 0.1 step)

- Market execution — ECN

Crypto account

- Min. deposit — $1

- Min. trade size — 0.01 lot

- Leverage — up to 1:5

- Floating spread from — 1 pip

- Commission — 0.05% for opening and 0.5% for closing positions

- Maximum open position and pending order — 200

- Market execution — 0.3 seconds, STP

- Order volume — from 0.01 to 500 lots(with 0.01 step)

How to open an FBS account?

The account opening process takes less than five minutes and involves the following steps.

Step 1. Log into the broker’s official website and press the “open account button.”

Step 2. Fill in the required details on the form that pops up.

Step 3. Choose the trading account type.

Step 4. Verify your email and required documents.

Step 5. Fund your account.

Step 6. Start trading.

Fees and Commissions

As noted, FBS operates as a true NDD offering market executions leveraging both STP and ECN technology as depicted across its accounts. It also offers either floating or fixed spreads that determine the commissions applicable to a spectrum of traders. The Micro and the Zero spread accounts leverage fixed spreads capped at three pips and 0 pip, respectively.

Meaning, Micro account traders incur fees and commissions added on the markup spread while Zero spread account traders face commissions capped at $20 per lot. Nonetheless, the floating spread accounts, such as the Crypto account traders, face 0.05% and 0.5% (for opening and closing positions) while the ECN account traders incur a commission of 6$. Other fees and commissions are due to the markup spread for the Cent and the Standard account traders.

The broker also charges fees on deposits and withdrawals depending on the method used. However, FBS reiterates to offer negative balance protection and waives the aspect of inactivity fees giving clients the ability to trade without going negative even after major losses and escaping charges after an account dormancy.

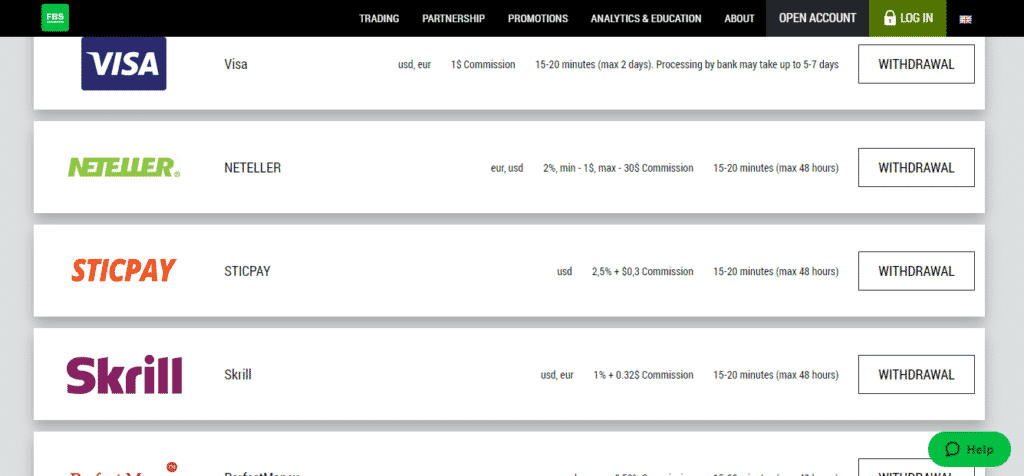

Payment options

With its imprint as an international broker, it strives to provide multiple payment systems to serve the global clientele. It accepts a spectrum of currencies as deposits allowing customers easy funding of accounts in different regions. As pinpointed in this review, the minimum deposit amount depends on the account type, and some methods charge fees on deposits and withdrawals.

Pros

- Multiple payment options and accepts a variety of currencies for deposits.

Cons

- Some payment options charge fees.

Deposits

The broker accepts deposits from these methods:

- Bank cards like Visa

- STICPAY

- Wire transfers

- E-wallet transfers like Skrill and Neteller

- PerfectMoney

Withdrawals

Deposit methods also apply to withdrawals.

Available Markets

FBS claims to offer an array of instruments trading in the FX, CFDs, and crypto markets backed by 24/7 expert customer support and cutting-edge platforms. The FX market holds about 35+ FX pairs encompassing both majors and exotics, while the CFDs marketplace holds a stream of assets like commodities, stocks, and indices. Lastly, the cryptocurrency space brings onboard instruments such as BTC that clients speculate on as CFDs against the significant fiat currencies.

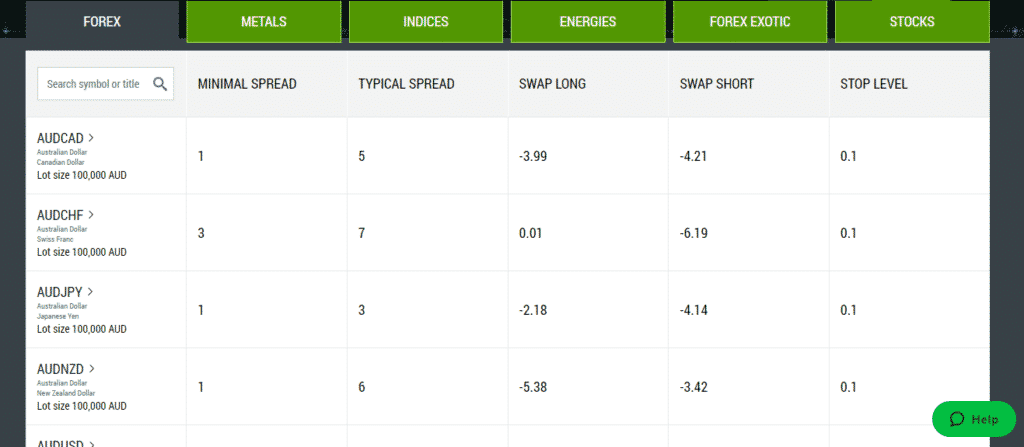

Forex

FBS links traders to the FX liquidity market, holding 35+ currency pairs to buy and sell from Monday through Friday, aided by real-time customer support. These instruments trade with market order executions, low spreads start from 0.0 pips, and leverage of up to 1:3000. However, the minimum and type of spread depend on the account type. Some accounts leverage floating spreads, while other accounts offer fixed spreads.

The min spread is also capped at 0 pip for some accounts and fixed as high as three pips on other accounts. The type of FX pair also affects the minimum spread as it starts from 1 pip for EUR/GBP and seven pips for pairs like EUR/AUD.

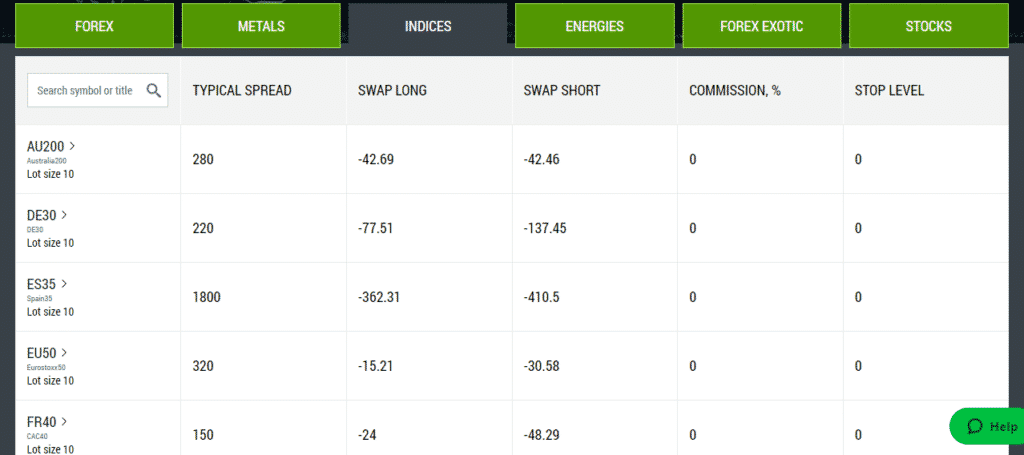

Indices

The indices marketplace at FBS trades on weekdays fueled by a 24hr customer support and holds instruments such as AU200, US100, US500, and many more. These assets trade with zero commissions and a lot size of up to 10.

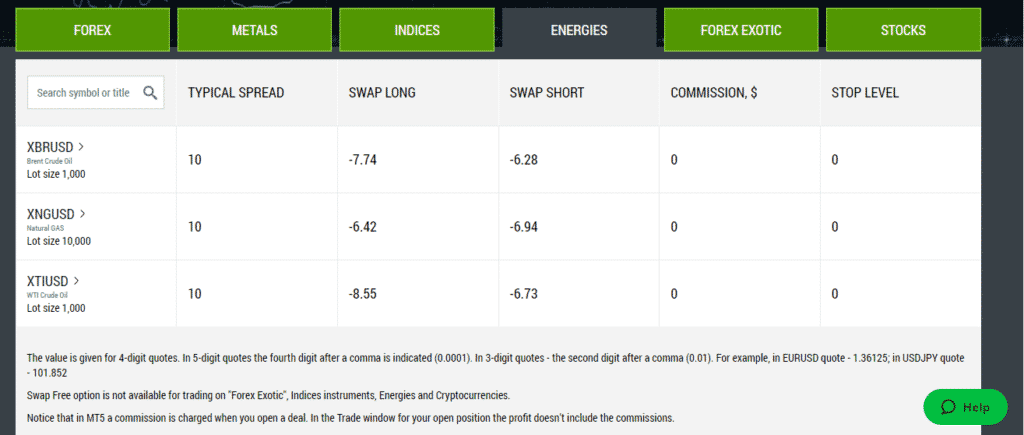

Energies

FBS energy bracket holds a few assets such as Natural gas, Brent crude oil, and WTI crude oil. These instruments trade from Monday to Friday with ultra-fast executions and zero commissions. Natural gas trades with a lot size of up to 10,000 while the other assets’ lot size scale goes up to 1000.

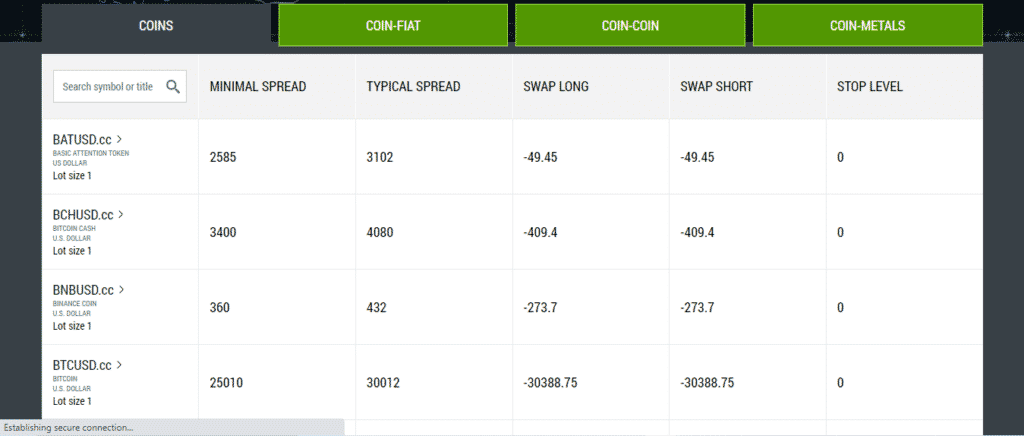

Cryptocurrencies

The crypto market at FBS consists of digital currencies such as BTC, Ethereum, Litecoin, Dash, EOS, and a few others. Due to its high volatility, clients speculate on these assets 24/7, swapping long or short with real-time customer support. The crypto coins trade against fiat currencies, precious metals, or other cryptocurrencies.

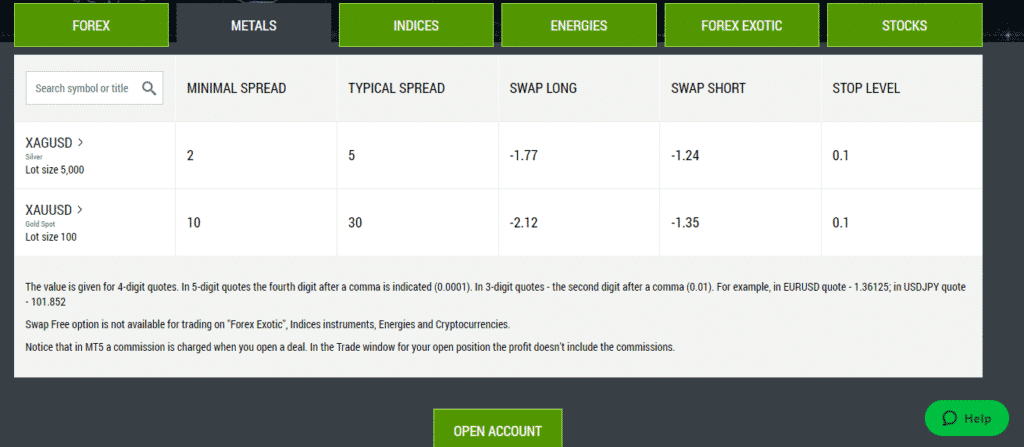

Precious metals

FBS allows clients to trade some world’s valuable metals like Gold and Silver. The market opens all through weekdays trading with fast orders and spreads starting from 2 pips for silver and ten pips for gold. Customers also can swap long and short on these assets against the US dollar.

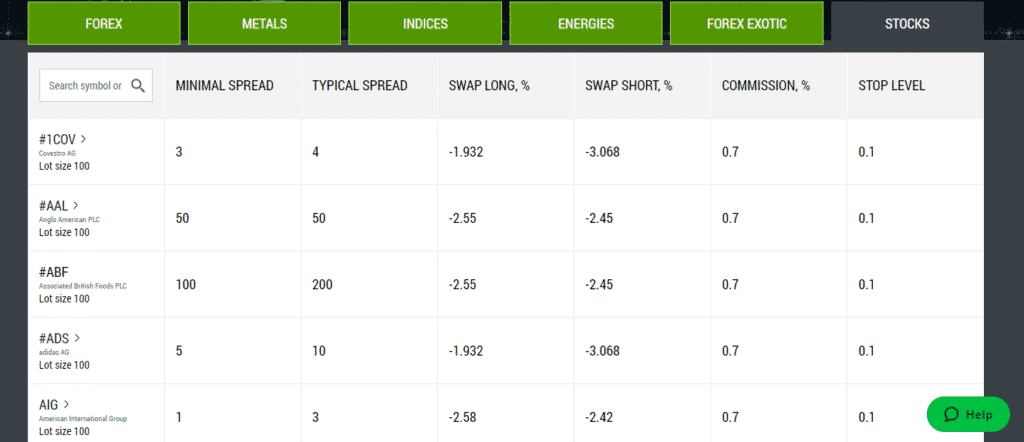

Stocks

The stock market at FBS also trades from Monday to Friday and holds stocks from major global companies such as Alibaba, Amazon, Apple, and many others. These stock instruments trade with market order executions and spread starting from as low as one pip. Customers have the chance to swap long and short and face a commission capped at 0.7% on all stock instruments.

Trading Platforms

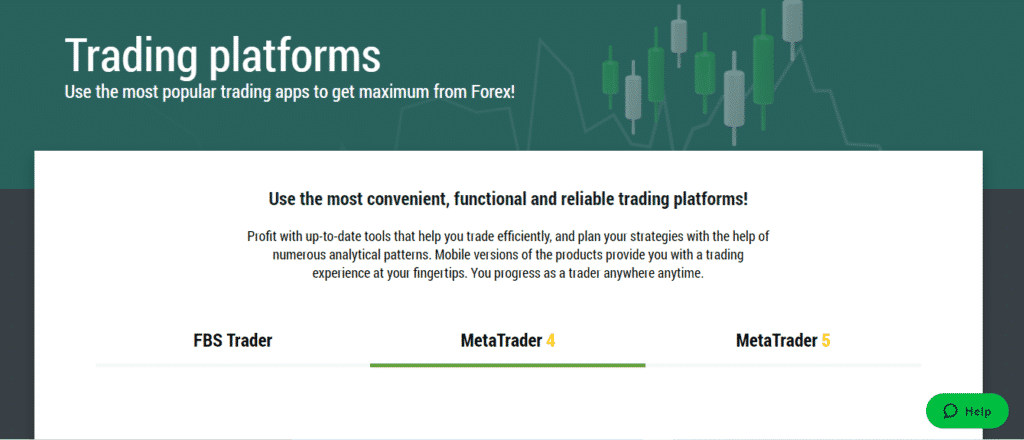

FBS provides cutting-edge trading platforms integrated with smart tools and plugins for effective trading. As indicated in this review, clients access either the world’s most popular trading platforms or its newly rolled out trading App, the FBS trader. That joins MT4 and MT5 in serving the broker’s traders.

Analysis of the platforms

MT4

- Data exchanged between the client terminal and the servers are encrypted

- Possibility to create, buy, and use EA advisors and scripts

- One-click through trading — yes

- Embedded news — yes

- Number of pending orders — 4

- VPS service support — yes

- Hedging positions — yes

- Number of indicators — 50

- Charting tools — yes

MT5

- Number of indicators — 90

- Number of pending orders — 6

- One-click trading — yes

- Embedded news — yes

- Number of timeframes — 21

- Access to the economic calendar — yes

- Charting tools — yes

- Ability to create technical indicators, trading robots, and utility applications

Features

FBS features generally include:

Trading tools

- VPS service support

- Expert advisors

- Trading calculators

- Economic calendar

Analytical tools

- Market watch information tools (embedded news) and Forex TV

- Technical analysis tools

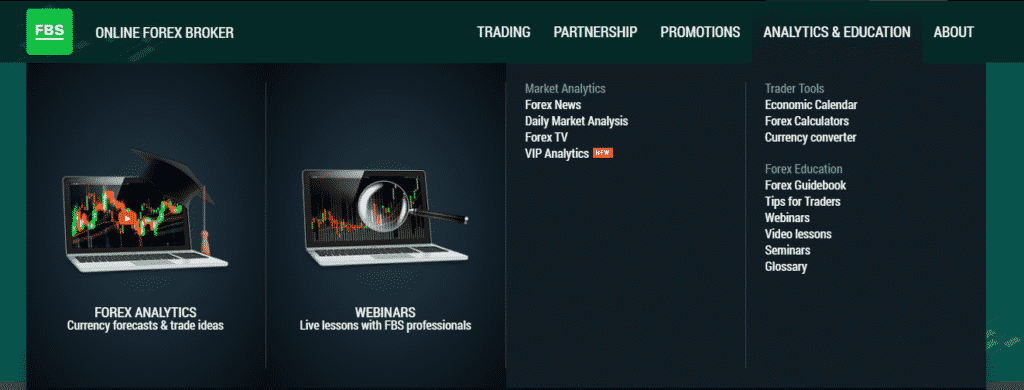

Education

FBS finds it important to have a good understanding of the financial markets as a trader or investor. As a result, the broker provides wherewithal resources that come in handy boosting clients’ skills and knowledge. Some of the available educational resources include:

- Forex guidebook

- Trading Tips

- Videos tutorials

- Glossary materials

- Seminars & webinars

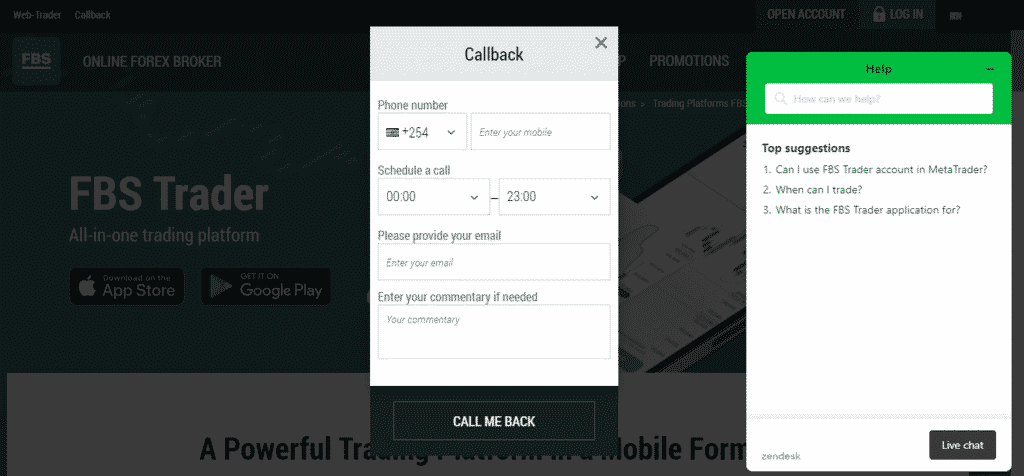

Customer Support

FBS claims to offer 24/7 multilingual customer support dedicated to serving its clients. The customer support portal provided on its official websites consists of a live chat and callback section that clients click to schedule a call with the FBS support team. On the other hand, the live chat links clients directly with the help team to converse their queries.

Review Summary

FBS prides itself on over ten years of experience in the financial trading industry, which offers fast execution of orders and meager spreads starting from 0.0 pips. The broker holds an international license from the IFSC of Belize, giving it traction to expand globally and now cities to offer its services in 150+ countries worldwide. It also alleges to be a true NDD leveraging on both STP and ECN for market order executions.

However, although it provides ultra-fast executions across its account types, traders experience high fixed spreads on some of the accounts starting from three pips, while in other accounts, it starts from as low as 0 pip. The broker’s commissions are a bit high compared to other brokers as well.