Concerns about the Fed withdrawing economic support sent US stocks lower on Thursday. The fears were fueled by several economic data, including payrolls which showed that job gains in the private sector gained the most in almost 12 months.

The plunges in US equities followed previous gains after President Joe Biden’s hint he may lower the corporate tax rate to below 28% to win Republican support.

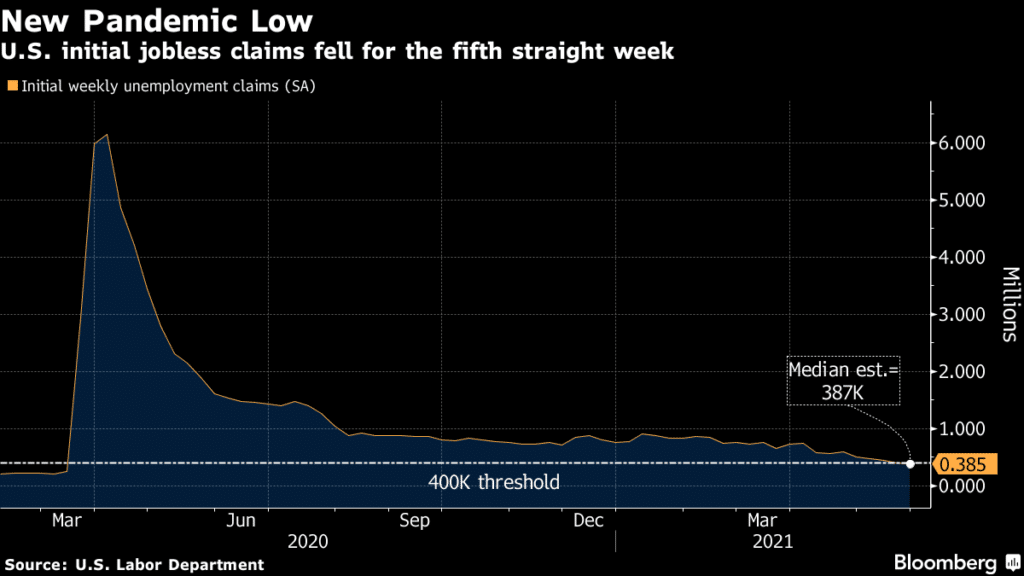

Jobless claims, which fell for the fifth consecutive time to hit a figure below 400,000, also fueled expectations of economic stimulus withdrawal by the Fed.

Investors are now looking at any signs that the Fed could taper asset purchases, with non-payroll data set to be released on Friday.

Weaknesses in US equities were also replicated in Europe and Asia on mounting geopolitical tensions.

Thursday’s concerns saw S&P 500 shed 0.4% at 4 p.m. as Nasdaq 100 declined by 1.1%.

The US dollar surged about 0.7%, the highest gain since May 12.

In bond markets, 10-year Treasuries jumped by four basis points, the highest gain since May 12.

Commodities markets saw West Texas Intermediate crude little changed as gold futures shed 1.9%

US stocks are currently mixed as the dollar loses. SPY is up 0.41% on premarket, Nasdaq 100 is down 0.11%, EURUSD is up 0.36%.